On January 8, notable capital movements were observed in spot cryptocurrency ETFs. Daily fund flows indicated that short-term expectations in the crypto market are being reshaped. While Bitcoin and Ethereum ETFs experienced strong net outflows, Solana and XRP ETFs stood out positively with continued investor interest. This outlook suggests that institutional investors are taking a more cautious stance amid rising volatility and are rebalancing their portfolios accordingly.

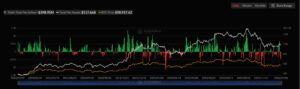

Sharp Outflows from Bitcoin ETFs

One of the most striking data points of the day was the $398.95 million net outflow recorded from spot Bitcoin ETFs. This figure ranks among the highest daily outflows seen in recent periods. Short-term price fluctuations in Bitcoin and investors’ moves toward risk reduction stand out as the primary drivers of this trend. In particular, institutional investors reducing exposure during periods of heightened volatility appears to have accelerated fund outflows from Bitcoin ETFs.

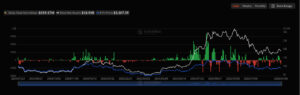

Notable Net Outflows from Ethereum ETFs

Spot Ethereum ETFs also recorded a $159.17 million net outflow, signaling weakening short-term expectations for Ethereum. Macroeconomic uncertainty, interest rate expectations, and overall market risk sentiment are cited as key factors limiting demand for Ethereum ETFs. Analysts note that these outflows may be temporary and that inflows could resume depending on broader market conditions.

The outflows from both Bitcoin and Ethereum ETFs do not necessarily paint an entirely bearish picture. According to experts, this movement may be related to profit-taking and portfolio rebalancing. Large funds often choose to temporarily reduce exposure during periods of increased volatility.

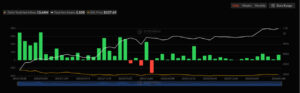

Solana ETFs Diverged Positively

Despite the cautious tone across the broader market, spot Solana ETFs recorded a $13.64 million net inflow. This indicates strengthening expectations for the Solana ecosystem. Rising network usage and increased activity in DeFi and NFT projects are among the factors supporting investor confidence. Solana’s technological infrastructure and scalability advantages continue to attract capital, particularly from funds seeking exposure to alternative crypto assets.

Limited but Positive Inflows into XRP ETFs

Spot XRP ETFs recorded a $8.72 million net inflow, showing that XRP has maintained relative strength despite broader selling pressure. This inflow reflects sustained investor confidence in XRP and supports its position within the market. Ongoing institutional adoption and closely watched regulatory developments continue to play an important role in keeping investor interest in XRP alive.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.