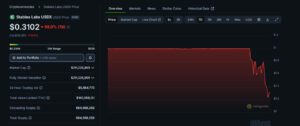

A stablecoin has once again failed to maintain its 1:1 peg with the U.S. dollar, sparking concern among investors. The synthetic stablecoin USDX, issued by Stable Labs, experienced a sharp decline today, dropping below $0.60 before partially recovering to around $0.80 at press time. This sharp drop has raised fears of a potential domino effect within the stablecoin ecosystem, prompting DeFi protocols to take swift risk-mitigation measures.

USDX Depeg Crisis: The $1 Peg Breaks

USDX was launched by Stable Labs as a synthetic stablecoin designed to maintain a 1:1 parity with the U.S. dollar. However, as of November 6, the token came under intense selling pressure, falling as low as $0.60. According to CoinMarketCap, USDX’s circulating supply has reached $683 million, increasing concerns that its depegging could trigger a broader systemic impact across the ecosystem.

The depeg event has also put USDX-backed collateral used in DeFi lending and staking platforms at risk of liquidation, leading to mounting pressure on protocols dependent on USDX as collateral.

Ecosystem on Alert: Lista DAO and PancakeSwap Issue Warnings

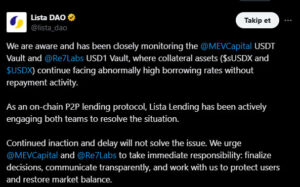

Following USDX’s sharp decline, leading DeFi platforms were quick to respond. Both Lista DAO and Binance-backed PancakeSwap announced that they are monitoring the situation closely and advised users to review their positions.

Lista DAO stated on X (formerly Twitter):

“We are closely monitoring MEVCapital’s USDT Vault and Re7Labs’ USD1 Vault. Collateral assets such as sUSDX and USDX are facing abnormally high borrowing rates with no repayment activity.”

Similarly, PancakeSwap warned users:

“We are aware of the affected vaults and are monitoring the situation. Please review your related positions on PancakeSwap. We will continue to provide updates.”

These warnings highlight the potential contagion risk a stablecoin depeg poses within the decentralized finance ecosystem.

Stable Labs Remains Silent

Despite the market turmoil, Stable Labs the issuer of USDX has yet to release an official statement. The company, which describes itself as a MiCA-compliant stablecoin and tokenization platform, previously raised $45 million from institutional investors, including NGC, BAI Capital, Generative Ventures, and UOB Venture Management. Other notable investors include Dragonfly Capital and Jeneration Capital.

Stable Labs had claimed that USDX maintained price stability through delta-neutral hedging strategies, though the current situation suggests these mechanisms may have failed.

Assessment

The loss of USDX’s dollar peg has reignited debate over the credibility and resilience of stablecoins. The event poses potential systemic risk to DeFi protocols that rely on USDX as collateral. Experts note that Stable Labs’ next steps including emergency liquidity measures and risk-management responses will be crucial in restoring confidence and calming market panic. Until an official update is issued, investors in USDX face heightened volatility and trust uncertainty.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.