Bitcoin, the world’s largest cryptocurrency, has recently been going through a period in which investors are struggling to find clear direction. Price action suggests the absence of a well-defined trend, while experts are offering cautious assessments about the short-term outlook. So, what can be expected from Bitcoin in the coming days, and how is the market shaping up?

Bitcoin Price Under Pressure in a Sideways Range

In recent weeks, Bitcoin has been trading within a narrow range, with downside pressure becoming more prominent. Upward attempts have failed to hold, and each rally has been met with fresh selling. Market data indicates that investors who bought near record highs in early October are using rebounds as opportunities to sell.

After reaching an all-time high near $126,000 on October 6, Bitcoin has since fallen by roughly 30%. As prices prepare to close the week in a largely sideways pattern, the market reflects a period dominated by uncertainty.

Glassnode: A Mild Downturn Phase Has Begun

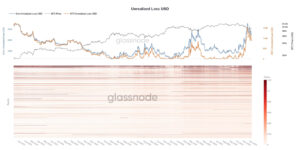

On-chain analytics firm Glassnode noted in its latest assessment that the market has entered a “mild downturn phase.” According to the firm, limited capital inflows combined with steady selling pressure from large holders are weighing on prices.

Glassnode emphasized that weak but range-bound price action is working against time, causing unrealized losses to accumulate. The relative unrealized loss ratio has risen to 4.4%, the highest level seen in the past two years. This signals a shift from an exuberant market environment to one marked by rising stress and uncertainty.

FxPro: A Bear Market May Have Started

Alex Kuptsikevich, senior analyst at FxPro, takes a more bearish stance. He argues that the crypto market has already entered a bear market. According to Kuptsikevich, any attempted rebound could attract new sellers, increasing downward pressure and reducing the likelihood that short-term rallies will be sustained.

In recent weeks, Bitcoin has declined alongside other risk assets, yet it has failed to recover when those assets rebounded. This suggests a breakdown in Bitcoin’s usual positive correlation with risk markets. Analysts note that despite interest rate cuts by the U.S. Federal Reserve, digital assets have not gained the expected momentum. Weak liquidity conditions and declining risk appetite continue to weigh on Bitcoin’s price.

Volatility Is Falling, Sideways Movement May Persist

Glassnode also highlighted a decline in implied volatility. According to the firm, following the year’s final major macro event—the FOMC meeting—volatility has historically tended to compress further.

Unless a hawkish surprise emerges, gamma sellers in the options market may become active again, potentially pushing volatility even lower toward year-end. This scenario points to a low-liquidity market structure characterized by mean reversion and prolonged sideways price action.

GSR: Macro Factors Are Becoming More Influential

Mitch Galer, a trader at GSR, noted that macroeconomic conditions are playing an increasingly significant role in crypto price movements. According to Galer, factors such as the U.S. government shutdown, uncertainty around monetary policy, and geopolitical risks have intensified the impact of trading flows on the market. He adds that this behavior is typical of bear markets, suggesting that while volatility may remain elevated in the short term, extremely negative sentiment could allow for a limited rebound toward the end of the year.

Timothy Misir, Research Director at digital asset analytics firm BRN, argues that the current price stability rests on fragile foundations. Low liquidity and mixed ETF flows indicate that the market is searching for direction rather than committing to a clear trend. As a result, sudden news events or macro developments could trigger sharper-than-expected price moves.

Overall Assessment

In the short term, uncertainty continues to dominate the Bitcoin market. Expert opinions point to weak liquidity, declining risk appetite, and mounting macroeconomic pressures, all of which support a cautious outlook. However, excessively negative market sentiment does not entirely rule out the possibility of a limited rebound toward year-end. This environment suggests that investors should remain cautious, data-driven, and risk-aware as the market navigates this uncertain phase.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.