The long-awaited altcoin season might finally be on the horizon as we enter Q3 of 2025. A combination of rising liquidity, increasing regulatory clarity, and growing onchain activity appears to be reigniting investor interest in alternative crypto assets beyond Bitcoin.

A Market Shift in Motion? Altcoin Season On The Way?

Earlier this year, the altcoin market faced significant pressure due to global geopolitical tensions and fiscal uncertainty in the United States. These factors triggered broad sell-offs and market hesitation. However, the tide seems to be turning.

Capital is now rotating toward projects with tangible utility and robust token models. This shift marks a renewed appetite for risk and long-term growth potential, particularly in segments of the crypto market that had been overlooked in recent months.

Another key signal is the drop in Bitcoin dominance. After reaching its highest level since 2021, Bitcoin’s share of the overall market has fallen by nearly 6%—a strong indication that altcoins are regaining traction.

Bitcoin Soars Amid Supply Crunch

Despite the focus shifting toward altcoins, Bitcoin continues to see strong bullish momentum due to ongoing supply-demand imbalances. On July 14, 2025, the leading cryptocurrency surged past $123,000, setting a new all-time high.

Spot Bitcoin ETFs have played a crucial role in this rally, with total assets under management exceeding $160 billion and over 110,000 BTC accumulated in just the last quarter.

Ethereum Reclaims Institutional Confidence

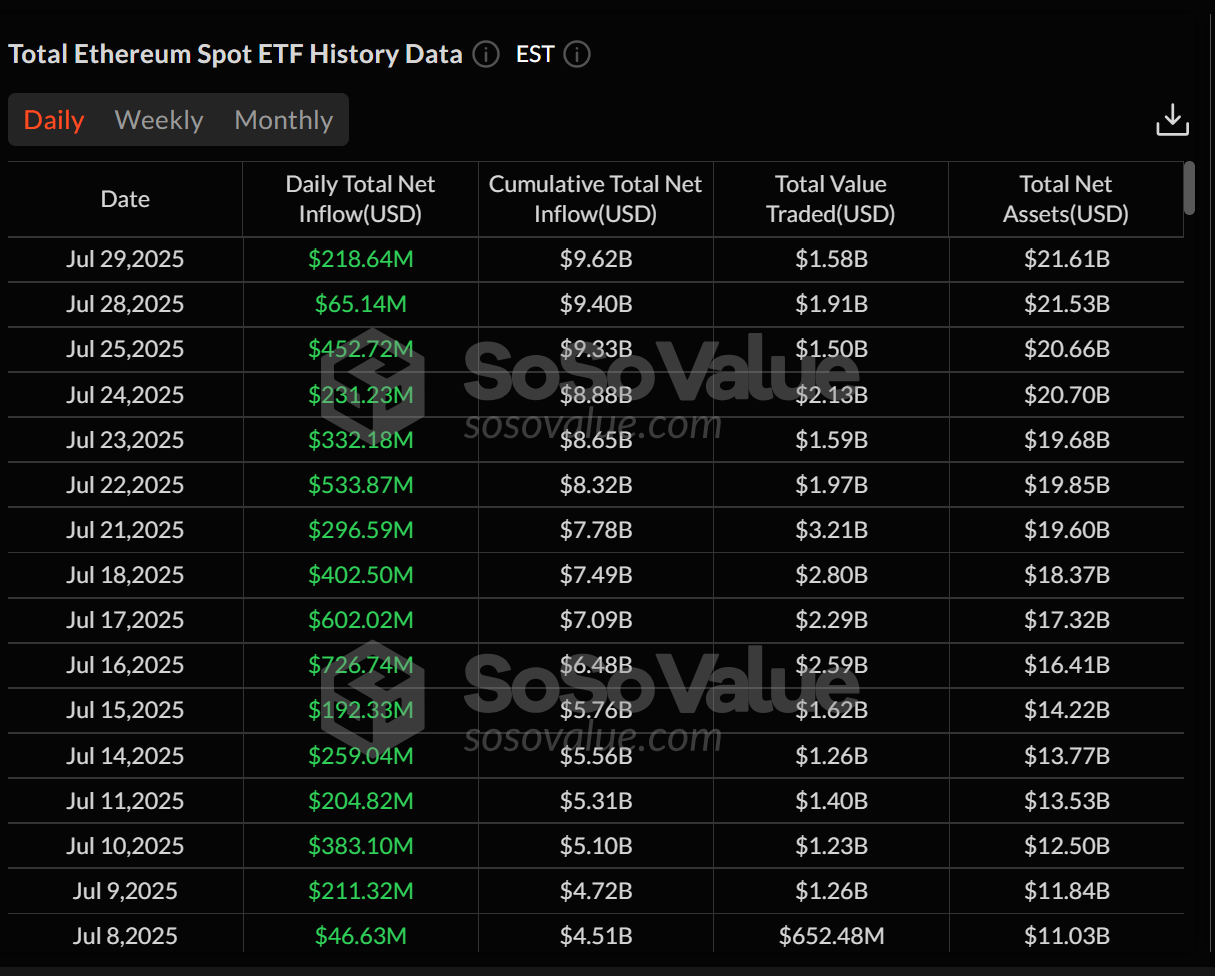

Meanwhile, Ethereum has quietly gained strength. The number of ETH on centralized exchanges has dropped significantly, ETF inflows are rising, and nearly 30% of Ethereum’s liquid supply is now staked. This might be a great sign for altcoin season.

The successful rollout of the Pectra upgrade—which raised staking caps and improved protocol efficiency—further strengthened the network’s fundamentals. Regulatory authorities in the U.S. clarified that staking activities do not fall under securities law, providing a major boost to ETH’s institutional appeal.

In fact, Ethereum has now broken out of its long-standing downtrend, supported by growing interest from major financial players. A $1 billion ETH allocation is being planned by Sharplink, and global institutions like BNY Mellon, Société Générale, and a Trump-linked USD1 stablecoin are launching initiatives on Ethereum’s infrastructure.

DeFi and DEX Sectors Hit New Milestones

Decentralized exchanges (DEXs) captured 30% of the total spot trading volume in the last quarter—setting a new industry record. Platforms like PancakeSwap on BNB Chain and PumpSwap on Solana were key contributors to this surge, fueled largely by memecoin activity.

The DeFi lending sector also reached a new high with over $70 billion in total value locked. At the same time, liquid staking surpassed 30% of the total ETH supply. This indicates increased investor appetite for leverage and yield-generating strategies, particularly on platforms built around Ethereum.

A Word of Caution: Memecoin Mania Ahead?

Despite the optimism, analysts are sounding alarms about a potential bubble forming in the memecoin space. Historically, unchecked hype and rapid inflows into speculative assets have often ended in sharp corrections.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.