Global financial markets have witnessed a notable shift in asset rankings. Silver has climbed past Alphabet (Google) in total market capitalization, securing its position as the world’s fourth-largest asset. This move highlights not only the renewed strength of the commodities market but also a broader change in investor preferences toward tangible, real assets.

Gold Maintains Its Dominance at the Top

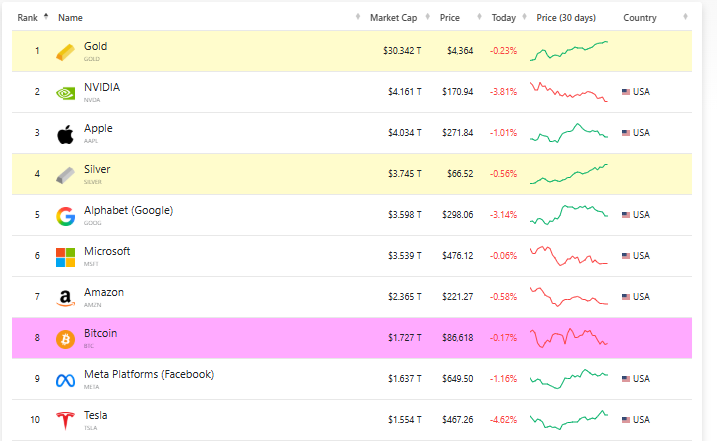

The top of the global asset hierarchy remains unchanged. Gold continues to lead by a wide margin, with a market capitalization of approximately $30.3 trillion. Trading around $4,364 per ounce, gold has seen only a modest pullback over the past 30 days, reinforcing its long-standing role as the ultimate safe-haven asset.

Following gold, technology giants still occupy prominent positions. NVIDIA, valued at roughly $4.16 trillion, holds second place, while Apple, with a market capitalization of $4.03 trillion, ranks third. Despite periodic volatility, artificial intelligence and large-cap technology stocks continue to command significant investor interest.

Silver Claims Fourth Place

The most striking development comes from the silver market. With a total market value of around $3.75 trillion, silver has overtaken Alphabet to become the fourth-largest asset globally. Currently priced at $66.52 per ounce, silver has maintained its elevated valuation despite minor short-term fluctuations.

This rise underscores silver’s evolving identity. Long regarded primarily as an industrial metal, silver is increasingly being viewed as a strategic store of value. Heightened geopolitical tensions, persistent inflation concerns, and structural constraints on supply have all contributed to its growing appeal among global investors.

Tech Giants Slip Behind Commodities

Alphabet now follows silver with a market capitalization near $3.6 trillion, while Microsoft sits just behind at approximately $3.54 trillion. This shift does not necessarily reflect a sharp deterioration in technology fundamentals, but rather the exceptional performance and re-rating of precious metals in the current macroeconomic environment.

Bitcoin Remains in the Top 10

Bitcoin continues to rank among the world’s largest assets, holding eighth place with a market capitalization of about $1.73 trillion. Trading near $86,618, Bitcoin still trails traditional stores of value such as gold and silver by a wide margin. Meta and Tesla follow closely behind in the global rankings.

What This Shift Signals

The updated asset rankings reveal a clear change in market dynamics. As uncertainty rises and investors reassess risk, real assets are regaining prominence. Silver’s move ahead of major technology companies suggests a meaningful shift in global portfolio allocation strategies. Whether this trend proves temporary or structural will largely depend on macroeconomic conditions and investor confidence in the months ahead.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.