Sky Protocol, formerly known as MakerDAO, is an innovative decentralized finance (DeFi) project built on the Ethereum blockchain. Its governance token, Sky (SKY), plays a key role in enabling users to mint decentralized and trustless stablecoins such as the well-known Dai and the newly introduced USDS—both pegged to the US dollar using collateralized assets.

From MakerDAO to Sky: A Strategic Rebrand

The story of Sky Protocol began in 2015 as MakerDAO. Originally operating under the Single Collateral Dai (SAI) model, the platform evolved into a Multi-Collateral Dai (MCD) system that accepted a broader range of assets. By November 2019, MakerDAO had fully transitioned to a decentralized governance structure. In 2023, the project took a major leap by rebranding to “Sky Protocol”—a change reflecting its expanded vision, including Real World Asset (RWA) integrations beyond crypto.

Sky aims to create a secure and decentralized ecosystem where stablecoins are backed by transparent, asset-based systems integrating both DeFi and traditional finance.

How Sky Works: Collateral Vaults & Stablecoin Issuance

Sky Protocol allows users to deposit approved collateral (like ETH or RWAs) into smart contract-based Vaults to mint stablecoins (Dai or USDS). Also this process is entirely automated and transparent via smart contracts.

Key Components of Sky Protocol:

- Sky Vaults: Smart contracts that enable stablecoin minting against collateral.

- RWA Vaults: Advanced vaults that accept tokenized real-world assets (e.g., real estate, bonds), using RWA tokens and oracles for valuation.

- External Actors: Includes Keepers (for arbitrage and price stability), Oracles (price feeds), and Emergency Oracles (able to trigger shutdown).

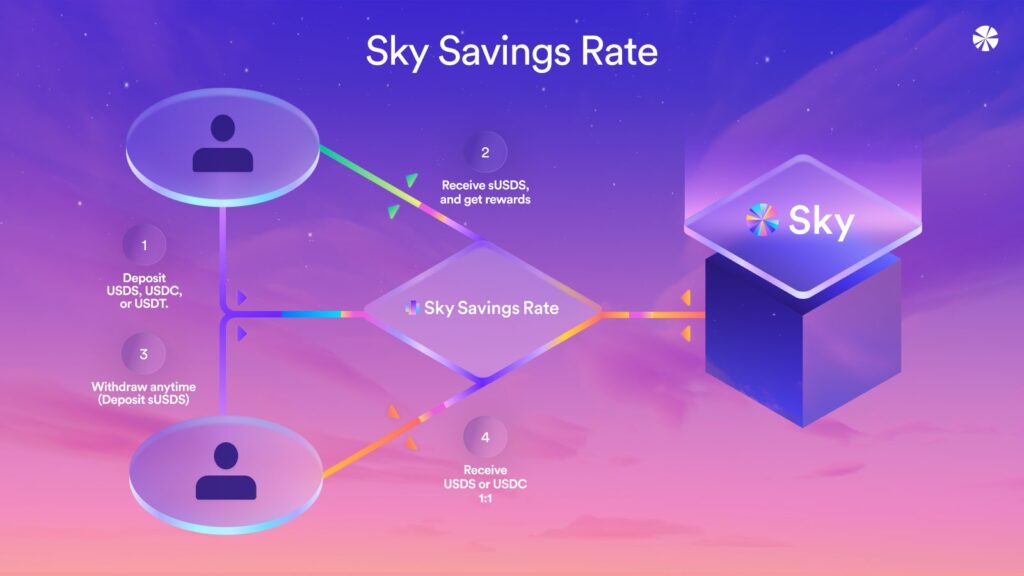

- DSR & SSR: Dai and USDS holders can earn yield by locking their tokens in savings contracts. These rates are governed by protocol governance.

- Liquidation Process: When collateral value drops below a threshold, the protocol auctions the collateral via an Automatic Liquidation Mechanism.

Key Features of Sky Protocol

Sky ensures the stability and transparency of its stablecoins through several innovations:

- Multi-Collateral Support: Accepts ETH, various ERC-20 tokens, and RWAs.

- Soft USD Peg: Dai and USDS are softly pegged to USD for a reliable store of value and medium of exchange.

- Decentralized Governance: SKY holders control protocol changes via a dual-layer system—Governance and Executive Votes.

- Transparency & Non-Custodial Vaults: All transactions are visible on Ethereum, and users retain control of their assets.

- Advanced Security Layers: Systems like the Oracle Security Module (OSM), Governance Security Module (GSM), and Emergency Shutdown protect the protocol.

Sky Ecosystem & Use Cases

Sky Protocol is not just technical infrastructure; it’s a living, modular ecosystem accessed through various decentralized frontends and applications.

Ecosystem Elements:

- Stablecoins: DAI, USDS

- Governance Token: SKY

- Community Frontends: Oasis Borrow, SummerFi, instadapp, Zerion, MyEtherWallet

- Stars: Independent teams managing RWA operations

- Sky Atlas: A governance and system architecture framework

SKY Token Utilities:

- Voting: Used for governance proposals and parameter updates

- System Backstop: Used to cover liquidation shortfalls

- Store of Value: Represents community ownership and long-term value

Team & Governance

The protocol is led by seasoned DeFi experts:

- Rune Christensen: Founder

- Mariano Conti: Head of Smart Contracts

- Gustav: Advisor

Backers & Partners: The project is developed in collaboration with the original Maker Foundation developers, independent contributors, and third-party custodians in the RWA ecosystem. Investor names are not disclosed in the whitepaper.

Tokenomics

- Total Supply: 23.46B SKY

- Circulating Supply: 21.28B SKY

Roadmap Highlights

- 2022: Launched Web3 fund platform v1.0, broker partnerships with Gate and Binance

- 2023: Reached 50K users, launched DAO, partnered with TRON and ChainGPT

- 2024 (Planned): TGE, Telegram Mini App, DEX/CEX integration, algo trading, SDK/API tools

- 2025 (Target): AI tech, NFT management, and crypto cashback features

Community & Social Channels

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.