On October 2, spot ETFs crucial for the crypto markets experienced notable activity. These funds, which make it easier for traditional market investors to access crypto assets, continue to attract institutional interest while also standing out as a safe investment alternative for retail investors.

The increase in trading volume observed particularly in ETFs based on Bitcoin and Ethereum, the two largest digital assets in the market, demonstrates that investor confidence and demand for digital assets remain strong.

Growing Interest in Bitcoin ETFs

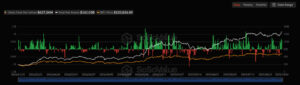

On October 2, these funds saw a net inflow of $627.24 million. With this, Bitcoin ETFs continued to be among the top investment vehicles preferred by investors for the fourth consecutive day.

Spot Bitcoin ETFs allow institutional investors to benefit from BTC price movements without directly holding the crypto asset. Especially the consecutive inflows recorded in recent days indicate strengthening investor confidence.

The inflow exceeding $627 million on October 2 highlights that liquidity and institutional demand on the BTC side continue to grow. This is seen as an important factor that could support stability in Bitcoin’s price.

Notable Surge in Ethereum ETFs

The Ethereum market also showed remarkable activity. On October 2, spot Ethereum ETFs recorded a total net inflow of $307.05 million. This development signals a critical trend not only on a daily basis but also in the broader context, as it shows that Ethereum ETFs—just like Bitcoin ETFs—have attracted strong investor interest for four consecutive days.

According to experts, the growing demand from institutional investors for Ethereum stems not only from price expectations but also from Ethereum’s central role in smart contracts and the DeFi ecosystem.

Overall Assessment

With a total fund inflow of approximately $934 million, spot ETFs have proven to be one of the most important institutional investment vehicles in the crypto markets.

According to analysts:

- The momentum in Bitcoin ETFs could create upward pressure on BTC’s price.

- The inflows into Ethereum ETFs are seen as a signal that strengthens Ethereum’s long-term ecosystem value.

- The growing interest of institutional investors in crypto assets is critically important for the sector in terms of both market confidence and liquidity.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.