TRON DAO has launched the initial minting of the USD1 stablecoin. This new digital asset was developed by World Liberty Financial (WLFI). WLFI stands out as a pioneering governance protocol in the DeFi space, inspired by the vision of Donald J. Trump.

Each unit of USD1 is 100% backed by short-term U.S. Treasury bills, U.S. dollar deposits, and other cash-equivalent assets. The goal is to provide investors with a transparent and secure stable value.

Furthermore, the minting on the TRON network aligns with the announcement made by Eric Trump at the Token2049 event held last month in Dubai. Trump, who is a co-founder of WLFI, introduced USD1 as the stablecoin to be used in MGX’s $2 billion investment on Binance. He also emphasized that the asset would be fully integrated into the TRON network.

Meanwhile, TRON’s founder Justin Sun announced the development on social media platform X with the following statement:

“A small step for stablecoins, a giant leap for financial freedom.”

Sun further commented on the process, saying:

“From launching new ideas to challenging our thoughts on money and freedom, it’s clear we’re making progress in moving the crypto industry forward. It’s been great to be a part of this process with WLFI and to see the Trump administration taking steps to create a clearer and more supportive environment for innovation.”

Why Is the TRON Chain at the Forefront of Stablecoin Development?

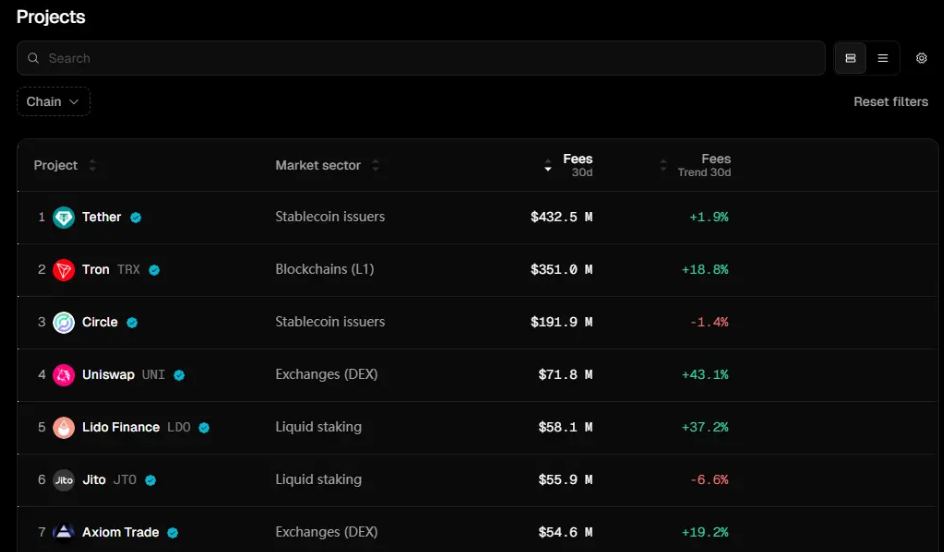

Following the news, TRX price rose by 1.51% to $0.29. Daily trading volume grew by 19%. TRON was already leading the USDT stablecoin market. According to ChainCatcher data, there are 78.7 billion USDT in circulation on the TRON network. This figure represents approximately half of the total stablecoin volume.

Similarly, DeFiLlama data shows that the total value locked (TVL) on TRON has surpassed $5 billion. On June 6, 4.5 million returning user addresses actively transacted on the network. However, whether these users will retain their assets on TRON or migrate to other chains remains uncertain.

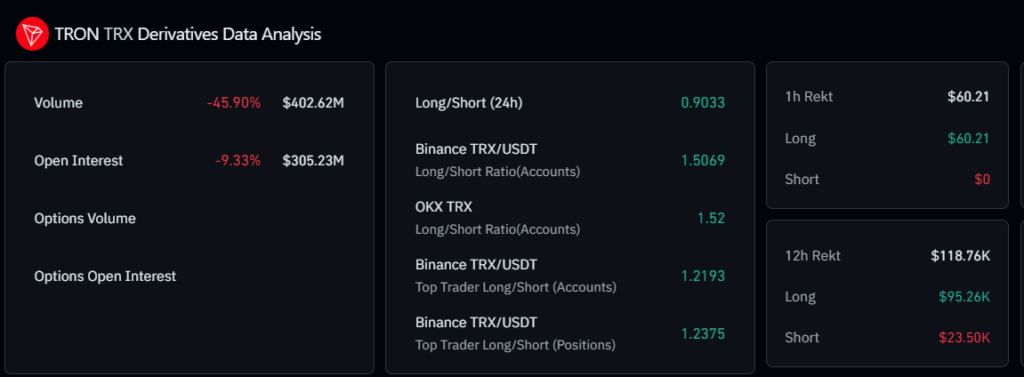

In TRX derivatives, open interest increased by 8.25% over the past 24 hours to $329 million. The weighted funding rate reached 0.0098%. This indicates bullish positions dominate. Meanwhile, short positions were liquidated during the day, and long positions were preserved nearly twice as much. This suggests weakening bearish sentiment in the market.

In conclusion, the issuance of USD1 on the TRON chain not only boosts institutional confidence but also reshapes the competition in the stablecoin arena.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.