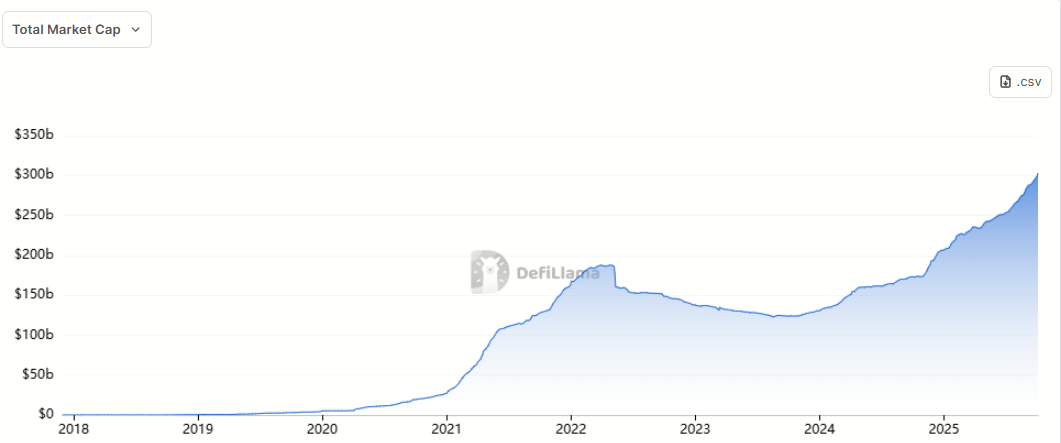

The stablecoin supply has soared to a record-breaking $300 billion, marking a significant milestone that could signal a new phase for the cryptocurrency market. This surge not only reflects growing investor confidence but also highlights the increasing integration of stablecoins into the global financial system.

Record Supply: 46.8% Growth Since the Start of the Year

At the beginning of October, the total stablecoin supply surpassed $300 billion for the first time in history. With a 46.8% year-to-date growth rate, the market is on track to outpace previous years’ expansion. The timing is particularly notable, as October has historically been one of Bitcoin’s strongest months, further fueling investor optimism for a potential rally.

Capital in Motion, Not Sitting Idle

Analysts emphasize that this record-breaking supply isn’t just capital sitting on the sidelines. On the contrary, stablecoins are actively circulating within markets. Monthly transfer volumes are reaching trillions of dollars, while velocity metrics confirm that stablecoins are being used rather than simply held.

Beyond serving as an investment vehicle, stablecoins are facilitating trade settlements, funding positions, and providing dollar access in regions where banking systems fall short.

Expanding Use Cases: From Daily Payments to Cross-Border Transfers

The rise in stablecoin supply also underscores their growing role outside of traditional investment. They are increasingly being used for everyday payments, remittances, merchant transactions, and even savings.

In countries such as Nigeria, Turkey, and Argentina, where inflationary pressures are high, residents have turned to dollar-pegged stablecoins as “everyday dollars” for routine transactions.

Institutional Integration and Financial Infrastructure

Major financial institutions are also moving to integrate stablecoins into their payment systems. For example, Visa has rolled out solutions that leverage stablecoin technology, embedding them further into mainstream financial infrastructure.

Meanwhile, blockchain data shows that $8 billion worth of USDC was minted on the Solana network in the past month alone, including $750 million in a single day. This level of activity demonstrates the strong and rising demand for stablecoins within the ecosystem.

What Does This Mean for the Crypto Market?

Experts suggest that the record-breaking stablecoin supply could act as a catalyst for the next phase of digital asset growth. Since stablecoins represent dollar-backed liquidity that can quickly flow into Bitcoin, Ethereum, or other altcoins, the $300 billion milestone may serve as “rocket fuel” for the upcoming market cycle.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.