STBL is a decentralized and non-custodial platform designed to redefine stablecoin usage. Its core tokens, USST and YLD, offer users passive yield without staking, no lock-up requirements, and a DeFi experience backed by real-world assets (RWA).

STBL does not aim to replace banks; instead, it seeks to deliver a transparent, cross-border, and sustainable financial infrastructure through DeFi.

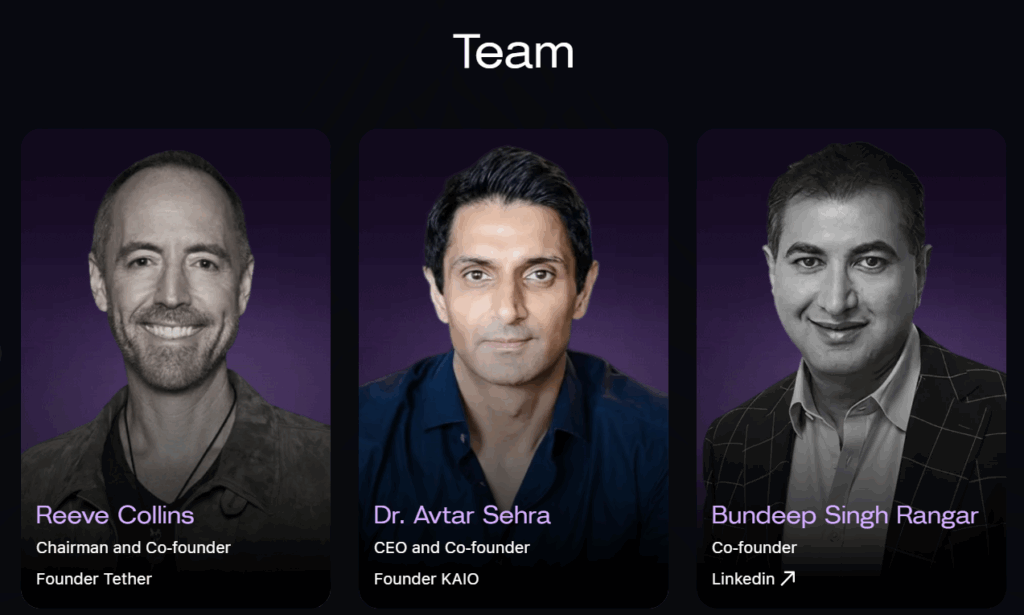

Team and Founders

STBL was developed by Reeve Collins, co-founder of Tether (USDT). The team consists of experienced professionals in blockchain, DeFi, and financial technologies. The founders have a strong background in stablecoins, tokenization, and maintain solid industry connections.

Investors and Partnerships

STBL is backed by DeFi and fintech-focused investors. Partners include financial technology firms, blockchain funds, and regulated investment institutions, adding both liquidity and credibility to the platform.

Project Idea and Mechanism

The mission of STBL is to make stablecoins secure, transparent, and yield-bearing.

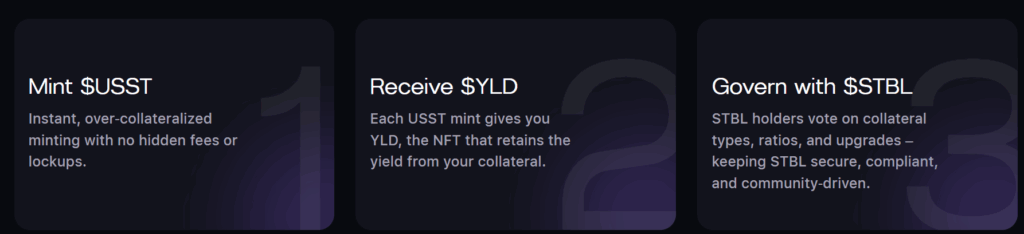

- Users mint USST or YLD tokens.

- Tokens are backed by regulated real-world assets.

- YLD tokens provide passive yield.

- Users can withdraw or reinvest tokens at any time.

Mission and Vision

Mission: To decentralize financial power within the stablecoin industry, redistributing yield back to users while ensuring fairness, transparency, and inclusivity. STBL empowers individuals to retain control over their assets, enabling secure and sustainable DeFi opportunities.

Vision: A world where everyone has access to financial stability and growth without geographic or socio-economic barriers. STBL aims to democratize stablecoin usage through a transparent, decentralized, and community-driven ecosystem.

Core Principles:

- Decentralized Financial Freedom

- Sustainable and Fair Yield

- Cross-Border Financial Inclusion

- Technological Innovation & Security

- Community Governance & Participation

Developer-Focused Features

STBL offers a modular and scalable architecture for developers:

- Modular & Composable: Minting, staking, and vault management are separated into independent contracts.

- Secure & Audited: All contracts undergo third-party audits and are transparently managed.

- Real-World Asset Integration: Tokenized RWAs open access to new financial markets.

- Scalable Infrastructure: Supports multi-chain and DeFi protocol integrations.

Token Supply and Distribution

- Total Supply: 10,000,000,000 STBL

- Max Supply: 10,000,000,000 STBL

- Circulating Supply: 500,000,000 STBL

Tokenomics and Governance

- STBL uses a three-token model for stability and community engagement:

- USST: USD-pegged stablecoin backed by RWAs

- YLD: NFT-based yield token providing passive income

- STBL: Governance token of the protocol

Governance Mechanism:

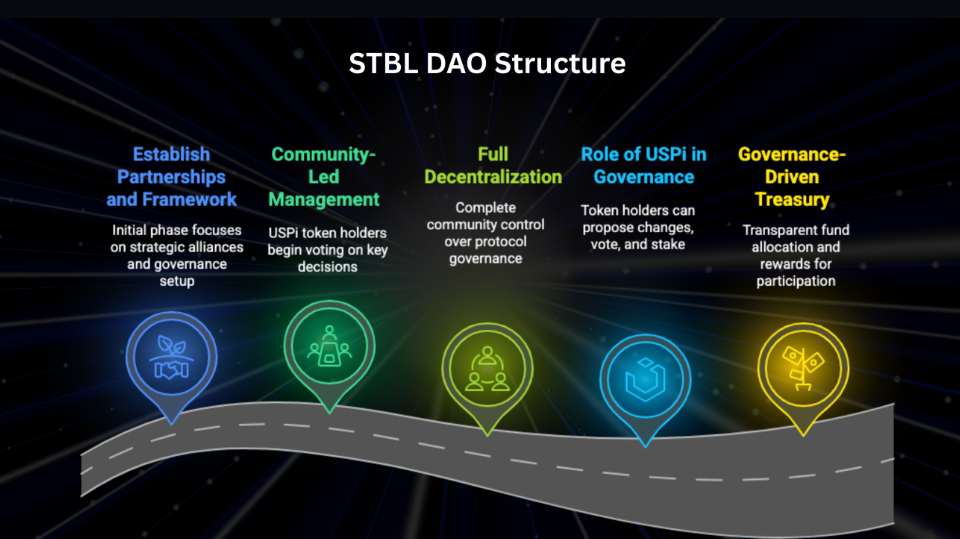

- DAO Structure: All governance decisions are community-driven.

- Voting: USST holders vote on upgrades, collateral management, and yield policies.

- Delegated Staking: Voting rights can be delegated.

- Treasury Management: Allocation and spending are guided by community proposals.

Ecosystem and Features

- RWA Integration: USST backed by T-bills and private credit instruments

- Passive Yield: YLD generates yield without staking

- No Lockups, No Penalties: Tokens can be withdrawn anytime

- Sustainability: Yield comes from asset performance

- Ease of Use: Simple minting and wallet integration

- Community-Driven Governance: DAO ensures transparency

- High Capital Efficiency: Dual-token model balances stability and yield

- Security & Compliance: Regular smart contract audits

- Cross-Chain Compatibility: Plans for expansion across multiple blockchain networks

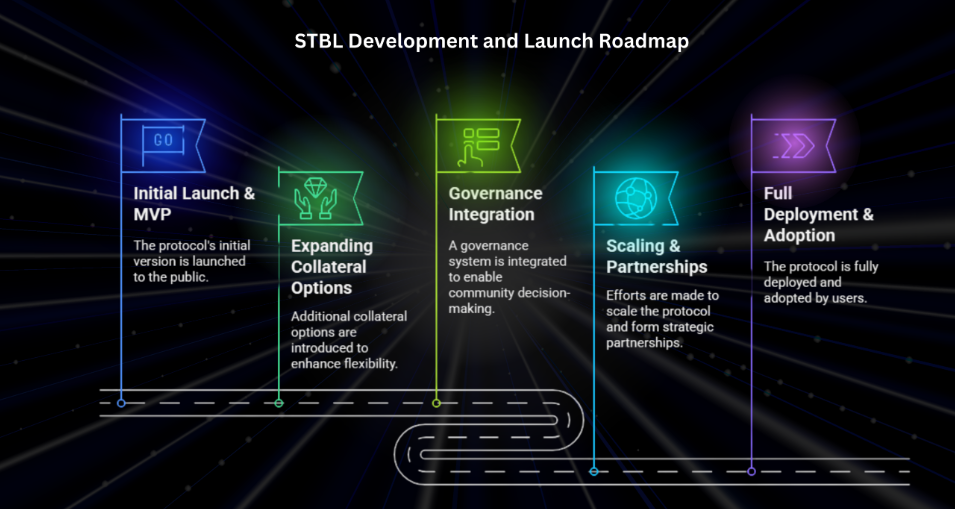

Roadmap

Q1 2025 – Launch & MVP

- Minting of USST and YLD, with basic governance activated

- Initial liquidity pools and early user participation

Q2 2025 – Governance

- Implementation of decentralized governance for USST

- Risk management and community-driven transparency

Q3 2025 – Collateral & Staking

- Addition of new tokenized RWAs

- Flexible staking options and tiered rewards

Q4 2025 – Scaling & Partnerships

Institutional partnerships, DEX integrations, and cross-border payment solutions

Q1 2026 – Full Distribution

Mass adoption, STBL Payments rollout, and global ecosystem expansion

FAQ

What is STBL?

STBL is a next-gen stablecoin protocol using RWAs as collateral, designed with a user-first model.

How is USST minted?

Users mint USST by collateralizing tokenized RWAs on-chain.

What is the purpose of the YLD token?

YLD represents yield generated from collateral and provides passive returns.

Is STBL secure?

Yes. STBL is fully decentralized, transparent, and governed by audited smart contracts, ensuring user control of funds.

Is STBL listed on Binance?

Yes. STBL is listed on Binance, enhancing global investor access, liquidity, and adoption.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.