Stella is a comprehensive ecosystem built around LeverageFi products. Previously known as Alpha Finance Lab, the project rebranded to Stella and continues its journey under the new name.

The project consists of two main product lines:

- Stella Trade: Offers perpetual (Perps) trading via a hybrid Central Limit Order Book (CLOB) combined with Just-in-Time (JIT) liquidity auctions.

- Stella Yield: Provides leveraged yield strategies with a Pay-As-You-Earn (PAYE) model at 0% borrowing cost.

- Stella aims to provide scalable, efficient, and secure DeFi solutions for both individual and institutional investors in leveraged trading and lending.

Team and Founders

Stella was founded in 2020 by Tascha Punyaneramitdee, who previously served as Strategy Head at Band Protocol and has extensive experience in traditional finance and blockchain.

The core team previously developed Alpha Homora, reaching $1.9B TVL in DeFi, demonstrating strong expertise in LeverageFi.

Key Contributors: Developers behind the first leveraged yield farming protocol.

Past Achievements: Tokenization of LP tokens, collateralization models, incubation of multiple successful DeFi projects.

The team aims to expand the LeverageFi ecosystem with 0% borrowing cost and the PAYE model under the Stella brand.

Investors and Partnerships

Stella (ALPHA) boasts a strong investor network:

- Fundraising via Binance Launchpad & Launchpool

- Previous incubated projects attracted top-tier VCs (e.g., Beta Finance, pSTAKE Finance, GuildFi)

- Ecosystem partnerships with DeFi protocols and market-making infrastructures

Project Concept

Stella’s main goals:

- Redefine DeFi lending

- Align interests of lenders and leveraged users via the PAYE model

- Ensure “no profit, no payment” borrowing

- Provide a perpetual trading platform with CEX speed + DEX security via hybrid architecture

How Stella Works

Stella Trade

- Hybrid Architecture: On-chain security + off-chain liquidity

- JIT Liquidity: Market makers provide capital on-demand, increasing capital efficiency

- CLOB Infrastructure: Combines advantages of traditional order books and intent-based models

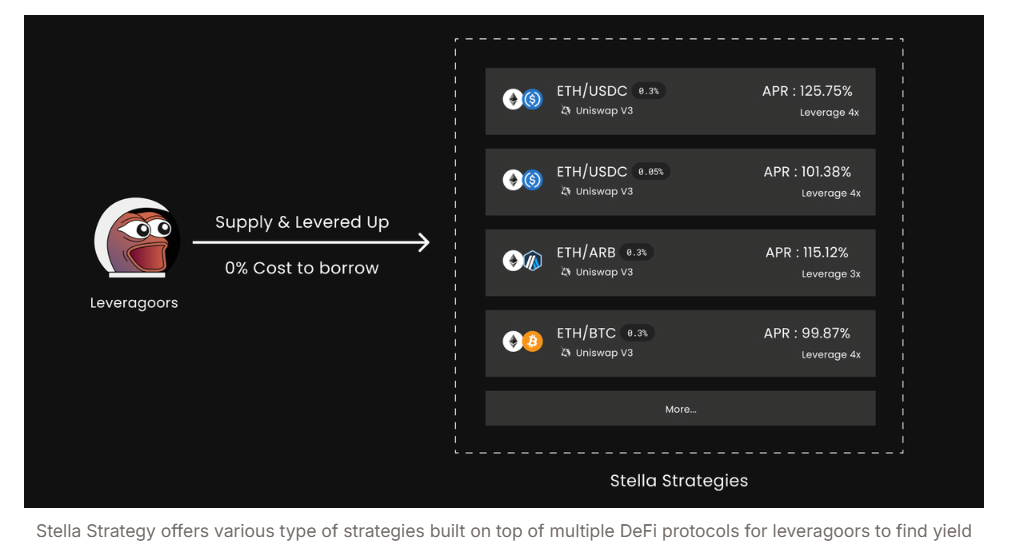

Stella Yield

- 0% Borrowing Cost: Users pay no interest on leveraged positions

- PAYE Model: Protocol shares a portion of profits; no payment if loss occurs

- Diverse Strategies: Integrated leveraged yield opportunities across DeFi protocols

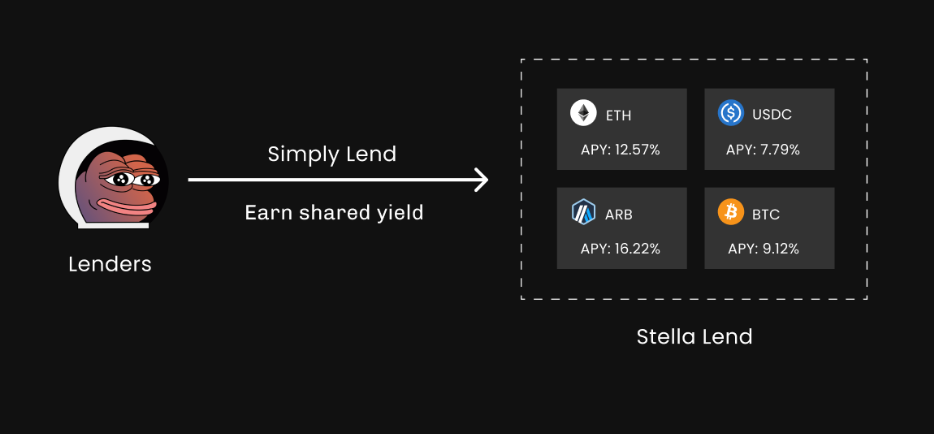

Stella Lend

- Passive Income: Lenders earn yields from leveraged users

- Unlimited APY: Direct share of leveraged trading returns

- Risk Management: Strategy-based borrowing limits and smart contract security

ALPHA Token Overview

ALPHA is Stella’s governance and staking token, designed to ensure protocol sustainability, incentivize users, and empower the DAO.

- Governance: ALPHA holders vote on protocol development via DAO

- Staking: Users earn sALPHA, gaining voting rights and a share of protocol revenue

- Ecosystem Incentives: Early access and exclusive rewards for new projects

- Use Cases: Transaction fees, liquidity provision, and strategy participation in Stella products

Token Details

- Name: ALPHA

- Total Supply: 1,000,000,000 ALPHA

- Circulating Supply: 935,000,000 ALPHA

- Chain: Ethereum Mainnet (ERC-20)

- Type: Governance Token

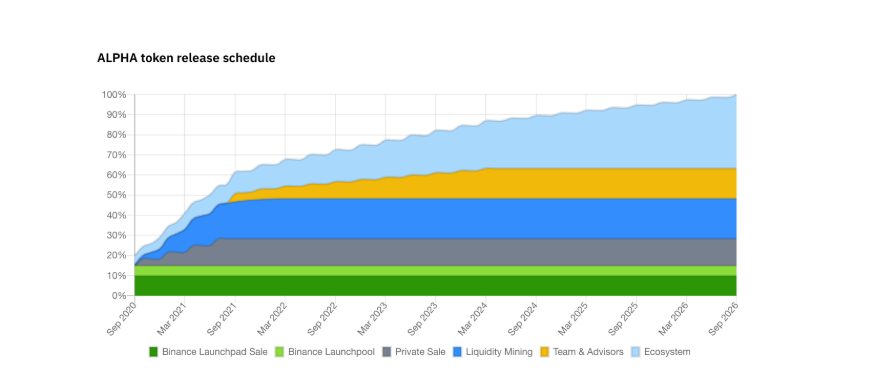

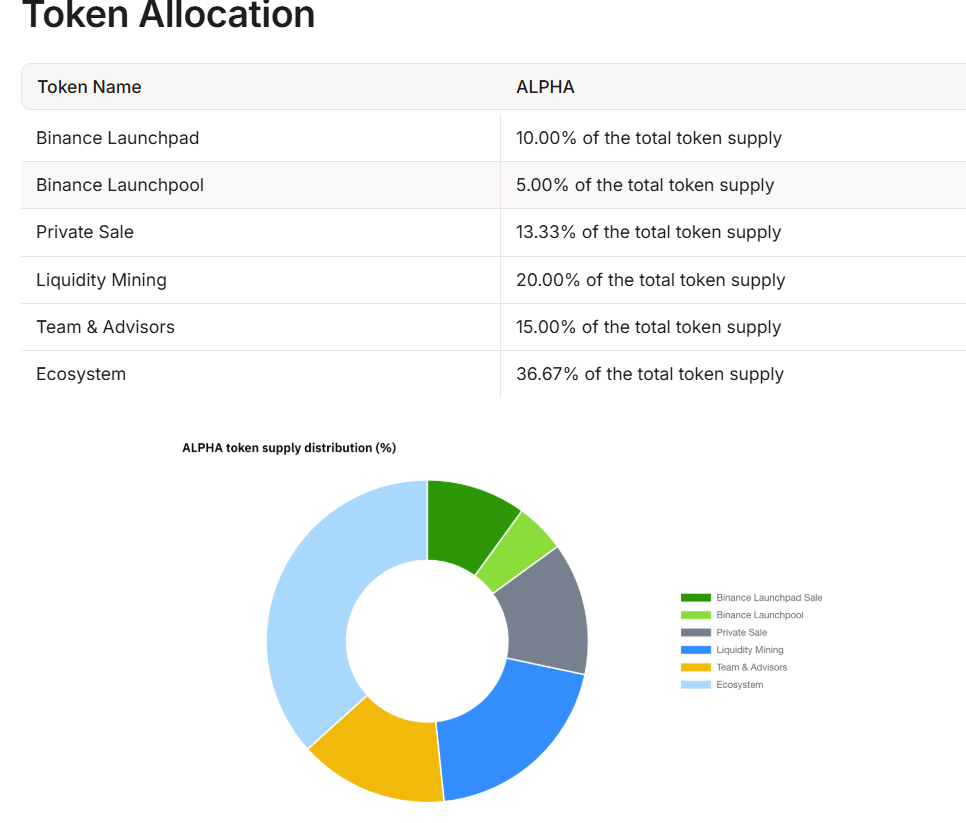

Token Distribution

- Binance Launchpad: 10%

- Binance Launchpool: 5%

- Private Sale: 13.33%

- Liquidity Mining: 20%

- Team & Advisors: 15%

- Ecosystem: 36.67%

Ecosystem

Stella is more than a leveraged protocol—it’s the hub of LeverageFi.

Key Ecosystem Components:

- Stella Trade (Perps + JIT liquidity)

- Stella Yield (0% borrow + PAYE)

- Stella Lend (unlimited APY lending)

- DAO Governance (ALPHA staking)

- Incubation of new DeFi projects

Notable Features:

- 0% Borrowing Cost – Pay only when profitable

- Hybrid CLOB + JIT Architecture – CEX-level speed + DEX security

- PAYE Model – Fair revenue sharing

- Risk Management – Strategy-based borrowing limits

- Multi-Chain Future – Expanding protocol integrations

- DAO Governance – Community-driven development

Roadmap

2025

- Expanded chain integrations for Stella Trade

- PAYE model applied to multiple DeFi protocols

2026–2027

- More cross-chain integrations

- Infrastructure for institutional investors

- Long-Term

- Global DeFi/CeFi bridges

- Advanced DAO governance

Social Media and Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.