Strategy, widely recognized for its Bitcoin-centered treasury approach, has announced plans to convert approximately $6 billion in convertible bond debt into equity over the next three to six years. The initiative, outlined by founder Michael Saylor, is designed to reduce balance sheet leverage and enhance the company’s long-term financial flexibility.

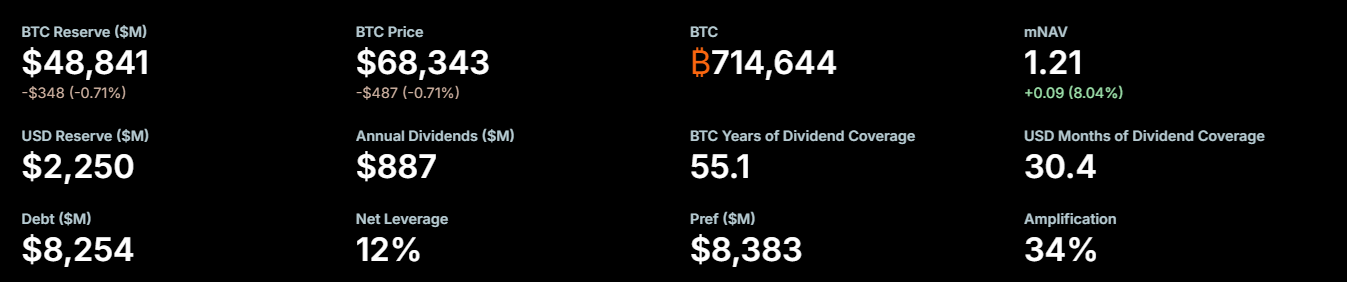

According to company statements, Strategy maintains a capital structure resilient enough to withstand extreme downside scenarios in Bitcoin’s price. Management asserts that even if Bitcoin were to decline to $8,000, the firm would still hold sufficient assets to fully cover its outstanding debt obligations. With roughly 714,644 BTC on its balance sheet—valued at approximately $49 billion—the company’s digital asset reserves significantly exceed its $6 billion in convertible debt. In practical terms, Bitcoin would need to fall by about 88% for asset values to align with the debt level.

What Converting Convertible Debt Means

Converting convertible bonds into equity involves issuing shares to bondholders instead of repaying the principal in cash. This strategy reduces debt liabilities and strengthens the company’s equity base, potentially lowering financial risk during volatile market cycles.

However, such a move carries implications for existing shareholders. Issuing new shares can lead to dilution, reducing the proportional ownership of current investors. Despite this trade-off, Strategy appears to prioritize balance sheet durability and long-term sustainability over short-term equity concentration.

Bitcoin Exposure and Current Positioning

Strategy’s average Bitcoin acquisition cost stands at approximately $76,000 per BTC. With Bitcoin currently trading near $68,400, the company is operating at an unrealized loss of roughly 10% on its holdings. Nonetheless, recent signals from Saylor suggest that the firm may continue accumulating Bitcoin. If another purchase is executed, it would mark 12 consecutive weeks of buying activity.

Stock Performance and Market Context

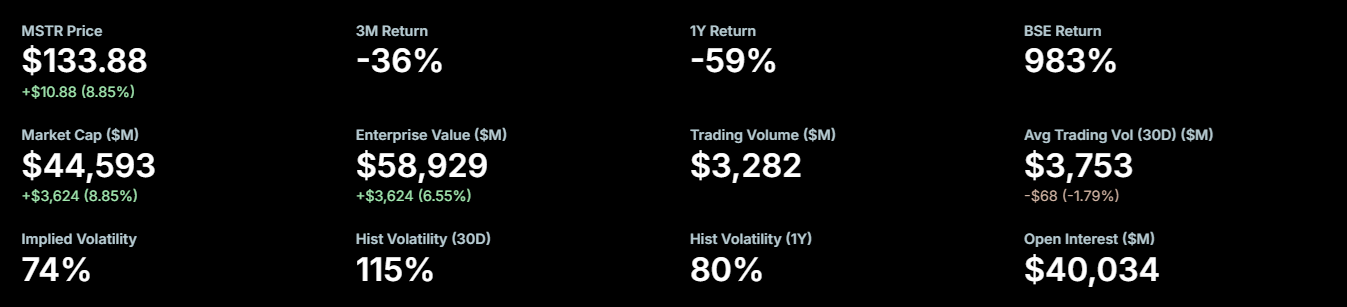

Strategy’s stock (MSTR) closed the week at $133.88, reflecting an 8.8% gain, coinciding with Bitcoin’s brief recovery above the $70,000 level. However, the cryptocurrency later retreated back toward $68,400.

Despite the recent uptick, MSTR shares remain approximately 70% below their mid-July all-time high of $456. Similarly, Bitcoin has declined around 50% from its early October peak.

The company’s decision to equitize its convertible debt represents a strategic recalibration at the intersection of corporate finance and digital asset exposure, and it remains a closely watched development in both markets.

This article does not constitute investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.