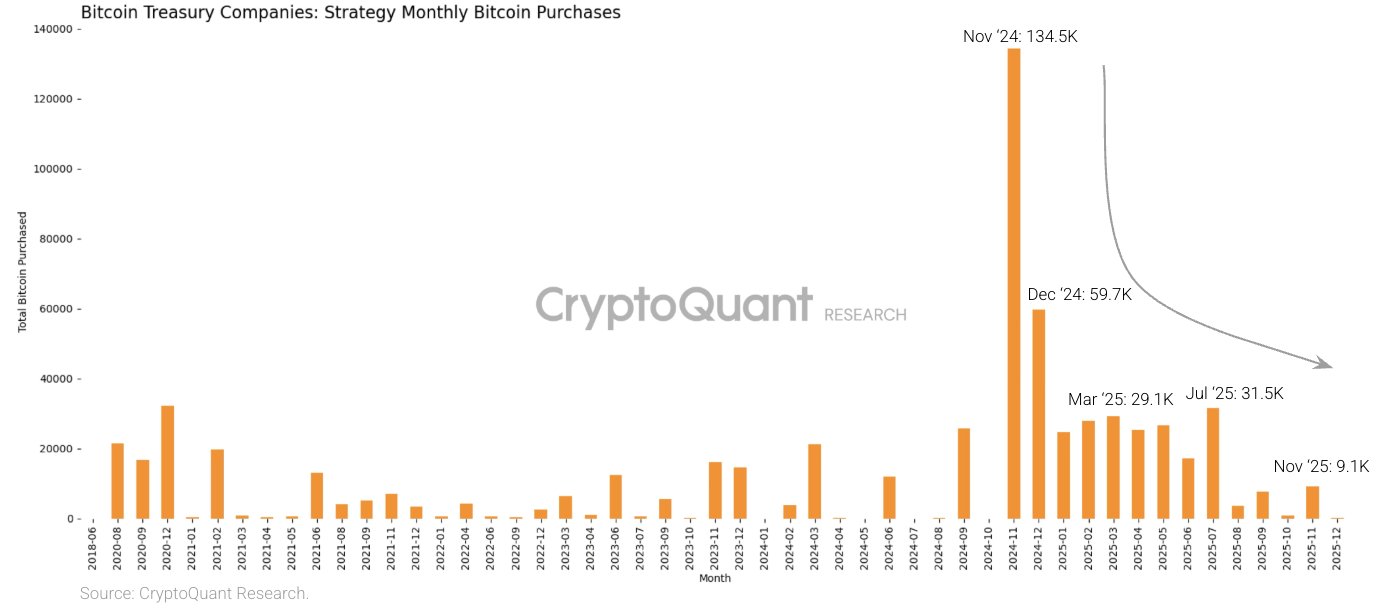

Strategy, widely recognized as the largest corporate holder of Bitcoin, has significantly scaled back its accumulation pace throughout 2025. According to analysts at CryptoQuant, this shift signals that the company may be fortifying its balance sheet in anticipation of an extended downturn in the crypto market.

A Steep Decline in Monthly Purchases

A recent CryptoQuant report highlights a substantial contraction in Strategy’s monthly Bitcoin purchases compared to its peak accumulation levels at the end of 2024. The firm’s buying volume, which once reached 134,000 BTC at its highest point, dropped to just 9,100 BTC in November 2025. Data for the current month shows a minimal addition of only 135 BTC. Analysts interpret this sharp reduction as an attempt to build a 24-month financial buffer, suggesting a strategic preparation for a potentially harsh market cycle.

Despite the overall slowdown, Strategy made one notable acquisition on November 17, purchasing 8,178 BTC for roughly $835.5 million — its largest single addition since July. This brought the company’s total holdings to 649,870 BTC, valued at approximately $58.7 billion.

Market Pressures Trigger Defensive Measures

The broader contraction in the digital asset treasury sector, combined with stress on mining companies, has placed Strategy under closer scrutiny in recent months. As the once-popular BTC proxy trade unwinds, companies accumulating large crypto reserves have been forced to reassess their financial strategies.

In November, CEO Phong Le stated that Strategy could sell a portion of its Bitcoin holdings if necessary, but only under two conditions: if the company’s stock were to drop below its net asset value or if access to financing became constrained.

To safeguard against such scenarios, the firm has established a $1.4 billion cash reserve earmarked for dividend payments and debt obligations. This reserve currently provides around 12 months of coverage, with plans to expand it further to create a two-year buffer.

Index Inclusion Challenges Ahead

Strategy’s efforts to secure inclusion in major equity indexes have encountered new obstacles as well. MSCI has proposed a rule change that would make companies with 50% or more of their balance sheet held in crypto assets ineligible for index inclusion. If implemented, the policy would limit Strategy’s access to passive investment inflows.

Company co-founder Michael Saylor confirmed that Strategy is in active discussions with MSCI regarding the proposed changes, which are expected to take effect in January.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.