One of the most prominent advocates of institutional Bitcoin investments, Strategy is not backing away from its aggressive accumulation approach despite market volatility, short-term declines, and macroeconomic uncertainty. The company took another step last week by purchasing 10,624 Bitcoin. This move once again demonstrates that Strategy is not merely reacting to price movements, but is instead a strategic institution committed to a long-term accumulation model. The firm’s consistent purchases underline its belief that Bitcoin will become the leading store of value in the digital age.

Strategy’s Latest BTC Purchase

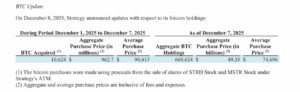

According to the company, the most recent acquisition was made at an average price of $90,615 per Bitcoin. This transaction significantly increased Strategy’s total Bitcoin reserves and sent a strong signal that institutional demand remains intact even in a turbulent market environment. The company’s consistent approach shows that its investment strategy is clearly defined: Strategy is focused on long-term accumulation, regardless of short-term price fluctuations.

The Importance of Institutional Demand

Strategy’s uninterrupted accumulation highlights that institutional investors remain active in the crypto market. Despite recent volatility, the company’s continued buying reflects positive long-term expectations for Bitcoin. Many analysts believe that institutional purchases of this scale play an important role in price stability and long-term market behavior.

Strategy’s management has previously stated that they view Bitcoin as “the most powerful store of value of the digital age.” Reinforcing its unchanged position despite volatility, the company noted:

“We believe Bitcoin will deliver superior long-term performance, and our purchases are a clear reflection of that conviction.”

Evaluation

Strategy’s latest acquisition shows the consistency of its Bitcoin accumulation strategy and the persistence of institutional confidence. From an SEO perspective, key terms include: Bitcoin accumulation, MicroStrategy BTC, institutional Bitcoin demand, Bitcoin price analysis, BTC accumulation strategy. The company’s regular purchases influence market sentiment and serve as a strong signal that reinforces Bitcoin’s institutional adoption.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.