Strategy’s stock has come under intense pressure over the past year, prompting renewed debate over whether the company’s aggressive Bitcoin-centered approach is starting to unravel. A closer look, however, shows that despite the sharp correction, the firm’s long-term Bitcoin strategy remains firmly in positive territory.

Steep Stock Decline, Yet Long-Term Strength Remains Intact

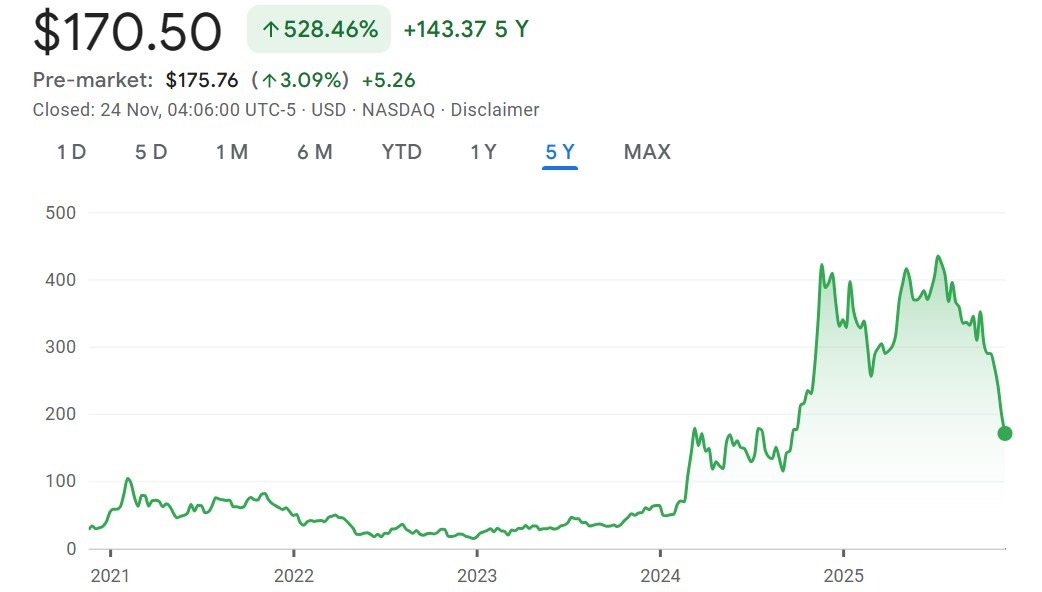

Data indicates that Strategy’s shares have dropped nearly 60 percent over the last twelve months, with more than 40 percent of that decline occurring since the start of the year. After trading around the 300-dollar level in October, the stock has now slipped to approximately 170 dollars.

This steep pullback has fueled speculation that the company’s Bitcoin-driven business model may be losing its edge. Even so, a review of key metrics reveals that Strategy’s Bitcoin investment strategy continues to show profits.

According to BitcoinTreasuries.NET, the company’s average purchase price for Bitcoin sits around 74,430 dollars. With Bitcoin currently trading near 86,000 dollars, Strategy’s position is still up by roughly 16 percent.

Long-term equity performance also paints a different picture than recent volatility might suggest. Over the past five years, Strategy’s stock has gained more than 500 percent, far outperforming major tech names such as Apple (about 130 percent) and Microsoft (around 120 percent). Even over the past two years, Strategy has surged 226 percent, leaving Apple’s 43 percent and Microsoft’s 25 percent gains far behind.

A New Dynamic: Shorting Strategy as a Hedge Against Bitcoin Exposure

The recent sell-off may have less to do with Strategy’s Bitcoin thesis and more with how institutional investors are managing risk in a highly uncertain market.

Speaking to CNBC, BitMine Chairman Tom Lee noted that Strategy’s stock has increasingly become a preferred tool for hedging crypto exposure because of its highly liquid options market. As he explained, investors looking to offset long Bitcoin positions often choose to short Strategy’s stock or buy put options.

This unintended role has made the company vulnerable to volatility unrelated to its operational performance. Instead, its shares have become a proxy for broader market caution, absorbing selling pressure even as its underlying Bitcoin holdings remain profitable.

Saylor Doubles Down: Bitcoin Accumulation Continues

Despite the stock’s decline, Strategy shows no sign of deviating from its core mission. Executive Chairman Michael Saylor reiterated the company’s commitment on X, signaling that the accumulation strategy will continue without hesitation.

On November 17, the company announced the purchase of 8,178 additional Bitcoin, an acquisition valued at approximately 835.6 million dollars. This marks a significant increase compared to recent weekly averages of 400 to 500 BTC.

Following this purchase, Strategy’s total Bitcoin holdings rose to 649,870 BTC, representing a current market value of roughly 56 billion dollars.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.