While institutional interest in the crypto market has strengthened again recently, large-scale capital inflows—especially into spot ETFs—are drawing attention. The latest data shows notable net inflows into Bitcoin, as well as Ethereum, XRP, and Solana ETFs. This picture signals rising risk appetite in the market and renewed institutional confidence in crypto assets.

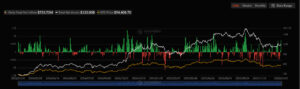

Bitcoin ETFs See Striking Inflows

Bitcoin ETFs clearly led the pack with net inflows of $753.73 million, outperforming all other crypto ETFs by a wide margin. This strong capital movement highlights renewed institutional interest in Bitcoin and reinforces bullish expectations over the medium to long term. In particular, major funds beginning to reposition themselves strengthens Bitcoin’s role as the key trendsetter across the broader market.

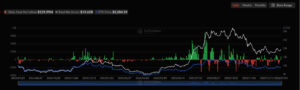

Ethereum ETFs Maintain Strength

Ethereum ETFs recorded net inflows of $129.99 million. This steady capital inflow shows that investors continue to trust Ethereum’s long-term growth potential and the strength of its ecosystem. The expanding use of DeFi, tokenization, and smart contracts remains among the key drivers solidifying Ethereum’s place in institutional portfolios.

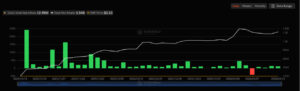

Positive Signals from XRP ETFs

XRP ETFs posted net inflows of $12.98 million, indicating continued institutional interest in XRP. This capital inflow suggests that, as regulatory uncertainties have somewhat eased recently, XRP is being reconsidered within institutional portfolios. Despite short-term volatility, investors are adopting a more cautious but steady positioning strategy, pointing to gradually improving—though not yet fully restored—confidence in XRP.

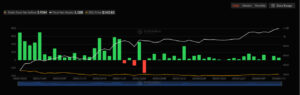

Notable Inflows into Solana ETFs

Solana ETFs recorded net inflows of $5.91 million. Although more modest in size, this capital movement shows that confidence in the Solana ecosystem remains intact and that investors are selectively allocating capital to high-growth altcoins. This outlook points to early signs of a broader recovery spreading across the altcoin market.

Assessment

These strong capital inflows into ETFs clearly demonstrate that price direction in the crypto market is once again being shaped by institutional investors. Especially the large inflows into Bitcoin ETFs indicate not only a short-term rebound but also strengthening medium-term expectations. Overall, this suggests that upcoming market movements may be driven more by institutional risk appetite and reactions to macroeconomic developments rather than retail investor behavior.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.