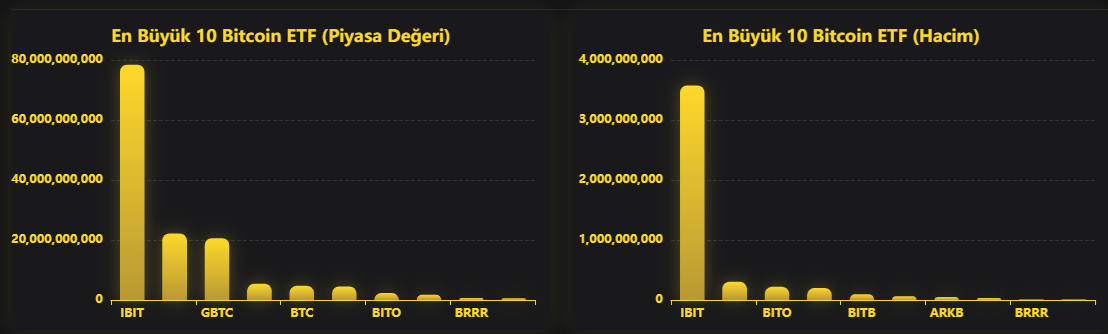

The crypto markets kicked off July with strong momentum. On July 9, 2025, net inflows into spot Bitcoin ETF and Ethereum ETF products showed that investor interest remains strong. In total, approximately $410 million in new capital flowed into these two digital assets.

$215.7 Million Inflows into Spot Bitcoin ETFs

As of July 9, spot Bitcoin ETFs recorded $215.7 million in net inflows. The distribution of these flows is as follows:

-

IBIT: +$125.60 million

-

ARKB: +$57.00 million

-

BTCO: +$9.50 million

-

FBTC: +$4.80 million

-

BITB: +$3.00 million

-

BTC: +$15.80 million

- GBTC, BTCW, BRRR, EZBC, and HODL: $0 inflow

Particularly strong capital inflows into major players like IBIT and ARKB are noteworthy. This suggests that institutional investors’ confidence in Bitcoin remains strong.

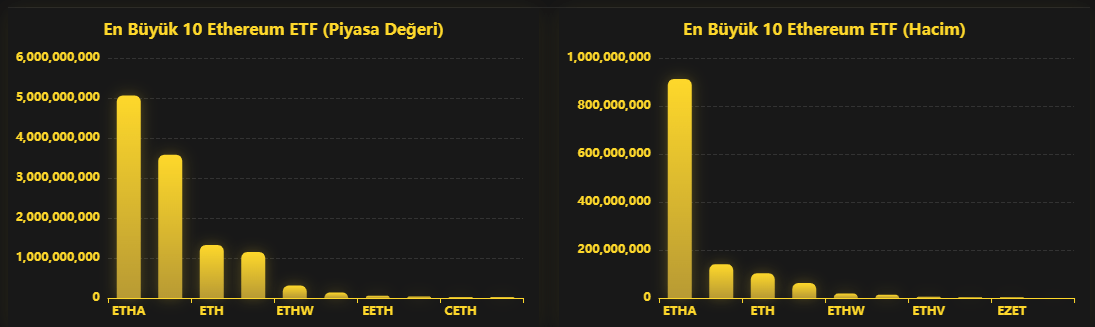

$211.3 Million Inflows into Spot Ethereum ETFs

A similarly strong trend is visible on the Ethereum side. Spot Ethereum ETFs saw $211.3 million in net inflows. The breakdown is as follows:

-

FETH: +$29.50 million

-

EZET: +$5.20 million

-

ETHA: +$158.60 million

-

ETH: +$18.00 million

- QETH, CETH, ETHW, ETHV, ETHE: $0 inflow

The large inflow into BlackRock’s ETHA fund highlights growing confidence in Ethereum’s potential. Ethereum now seems to be closely following Bitcoin in terms of institutional adoption.

Institutional Capital Flow Remains Strong

The July 9 data confirms that there is no slowdown in institutional interest on either the Bitcoin or Ethereum front. ETFs continue to serve as the main entry point into crypto for many investors. These strong inflows once again demonstrate that confidence in the crypto market remains high, and long-term interest is still alive and well.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.