SUI has once again become the center of attention. The AMINA Bank partnership and $500 million funding signal a strong foundation for price action. However, the $3.50 level has become a technically critical threshold.

The recent rapid growth has increased on-chain activity and shifted investor sentiment. AMINA Bank, the first regulated Swiss institution, has started offering custody and trading services for the SUI token. This development has built a solid bridge between traditional finance and crypto.

Meanwhile, the $500 million treasury funding provided by Mill City Ventures has strengthened the project’s long-term growth plans. With this support, 1.28 million new user accounts were created in just 24 hours. The total number of addresses has exceeded 257.9 million.

According to Binance data, 70.8% of investors in SUI futures are in long positions. The long/short ratio stands at 2.42, indicating continued bullish sentiment among investors.

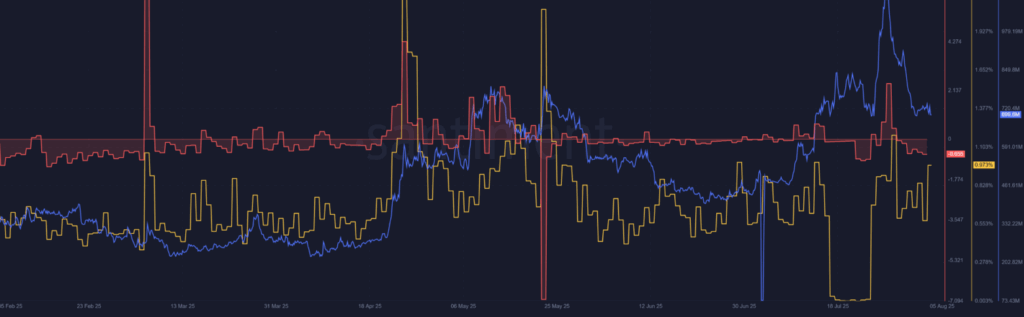

On the other hand, open interest dropped to $699.6 million, revealing waning speculative interest. Additionally, the weighted market sentiment has declined to -0.655. Conversely, the social engagement rate rose to 0.973%. These conflicting metrics create uncertainty over short-term direction.

What Do Technical Indicators Say? SUI Trapped Below VWAP

SUI is currently consolidating just below the $3.50 resistance. This level aligns with the VWAP line and a previously supportive region. At this structurally pivotal point, buyers are preparing for a strong breakout.

Meanwhile, a recovery in short-term EMA levels indicates an effort to stabilize price. Still, sustained movement above $3.50 is needed to confirm a clear direction.

According to crypto analytics platform CryptoPulse, the current structure represents an accumulation zone. However, only a breakout above this resistance will confirm a short-term uptrend.

$SUI has pulled back right into the sweet spot.

Price just hit the VWAP average and is sitting directly on structural support around $3.50. This is exactly where we’ve been waiting to step in.SUI continues to gain recognition across the space and has the structure of a project… pic.twitter.com/f6lVqegA2I

— CryptoPulse (@CryptoPulse_CRU) August 4, 2025

The current setup shows descending highs after rejection from $5.25, indicating that bulls are regrouping just below the key threshold. If $3.50 is breached, the price is expected to move toward $4.00 and then $5.00.

Moreover, strong on-chain activity and institutional backing reinforce the long-term outlook. However, caution is advised in the short term.

With solid partnerships and funding, SUI is reinforcing its foundations. Still, short-term direction depends on the $3.50 resistance. Until this level is broken, the market will remain in wait-and-see mode.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.