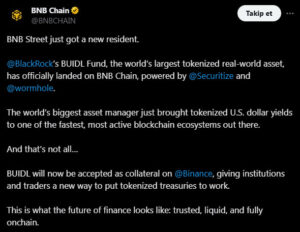

The world’s largest asset manager, BlackRock, and the world’s largest cryptocurrency exchange, Binance, have announced a new collaboration that could mark a major turning point for the crypto ecosystem. The two industry giants have launched a strategic integration that will enable tokenized Treasury products to reach a wider audience.

As part of this partnership, BlackRock’s digital liquidity fund BUIDL (BlackRock USD Institutional Digital Liquidity Fund) is now available on BNB Chain. In addition, BUIDL can now be used as OTC collateral on the Binance platform. With the fund representing more than $2.5 billion in investment value, the integration highlights a significant step forward for institutional capital.

Major Partnership Between BlackRock and Binance: BUIDL Now Live on BNB Chain

In a joint announcement, BlackRock and Binance emphasized that BUIDL has become “a core building block of on-chain finance.” Expanding the fund to BNB Chain increases liquidity across the ecosystem and gives institutional users access to additional collateral options.

Binance’s global institutional clients will now be able to:

- Use their collateral more efficiently

- Access tokenized Treasury products directly

- Hold yield-generating digital assets as active collateral

These features represent a significant transformation, especially for high-volume institutional traders. Binance executive Catherine Chen stated:

“Many of our institutional clients wanted more yield-generating, stable assets they could use as collateral while actively trading. The integration of BUIDL with BNB Chain and Ceffu directly meets this demand.”

BUIDL: The New-Generation On-Chain Liquidity Instrument

Issued by Securitize, BUIDL is a digital liquidity fund designed to maintain a stable value pegged to the U.S. dollar. Thanks to its stablecoin-like structure, it has become a crucial tool in the crypto ecosystem for:

- Collateral

- Liquidity management

- Efficient capital utilization

The fund is already active on major networks such as Ethereum, Aptos, Avalanche, and Solana, and also available on L2 solutions like Arbitrum, Polygon, and Optimism. The BNB Chain integration further expands its reach, placing it at the center of multi-chain institutional finance.

Why BNB Chain? The Ecosystem’s Rapid Growth Stands Out

BNB Chain has recently gained strong momentum, driven by:

- The rise of derivatives platform Aster

- Binance Alpha integrations

- The expanding Binance Wallet ecosystem

- Major RWA (Real-World Asset) projects like Ondo Finance moving to BNB Chain

These developments have accelerated the network’s push into institutional capital markets. BlackRock making its fund available on BNB Chain indicates confidence not only in the network’s technical capabilities but also in its institutional compliance framework.

The BlackRock–Binance Partnership Brings Institutional Transformation to Crypto

The integration of BUIDL into BNB Chain is strategically important for both Binance and BlackRock. This move showcases how tokenized Treasury products are growing within the crypto ecosystem and how real institutional finance is becoming intertwined with blockchain.

Institutional investors can now access:

- A broader range of collateral options

- On-chain liquidity tools

- Multi-chain asset management — all through a unified environment

This development supports BNB Chain’s strong growth trend while making BlackRock’s institutional approach to crypto more visible than ever.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.