On the crypto-based prediction market Polymarket, an anonymous trader correctly predicted that Venezuelan President Nicolás Maduro would be captured by U.S. forces, turning a $30,000 position opened just a few days earlier into over $400,000 in profit. This event has reignited discussions about both the power of prediction markets and potential insider information.

How the Trade Generated Massive Gains

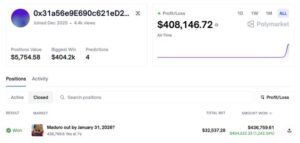

- In December 2025, a Polymarket account placed a total of $32,537 on the outcome that Maduro would leave office by January 31.

- When U.S. President Donald Trump confirmed Maduro’s capture on Saturday morning, the position soared to $404,222—a gain of approximately 1,242%.

- The market had already begun reacting hours before the official announcement, with the “leaves office by Jan 31” contract jumping from just 7 cents on Friday night.

How Polymarket Works

- Users trade shares in future events using crypto.

- Each share is priced between $0–$1, reflecting the market’s probability estimate.

- If the event occurs, shares pay $1; if not, $0.

- In this case, the trader bought a low-probability outcome at 7 cents per share and cashed out at $1 when the event occurred.

Insider Information Speculation

- The timing of bets, just hours before the official announcement, sparked rumors that the trader may have received advance information from sources close to Trump.

- No official confirmation exists; neither the U.S. government nor Polymarket has disclosed the trader’s identity or political connections.

- Experts note that early-access information can give traders an advantage in prediction markets, which is not necessarily illegal.

Multiple Addresses Profited

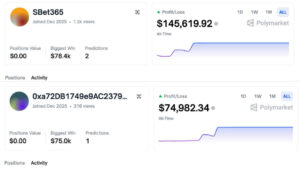

- Blockchain analytics platform Lookonchain reported that three addresses collectively earned $630,400 betting on Maduro’s capture.

- One key address invested $34,000 and made $409,900 in profit.

- Some positions were taken as early as December 27, 2025, days before the operation on January 3, 2026.

- The Venezuela-related markets on Polymarket saw over $120 million in trading volume following Maduro’s capture.

- Many accounts are now placing bets on potential future U.S. military interventions in Venezuela.

Conclusion: Powerful but Controversial

The Maduro case highlights that prediction markets like Polymarket can be extremely effective in aggregating information and pricing events. However, the combination of anonymity, lack of KYC, and high stakes also raises concerns about insider trading. This example demonstrates that these markets carry not only financial but also political and geopolitical influence.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.