Tea-Fi is defined as a unified super app in decentralized finance (DeFi). It aims to offer users swaps, yield, payments, and loyalty services in one seamless ecosystem. Its TeaPOT Flywheel mechanism converts all platform and partner revenues into productive capital, turning protocol growth into user rewards and sustained adoption.

Project Vision

Tea-Fi simplifies DeFi by allowing users to perform swap, stake, and lending activities in a single application. With its AI Copilot, hidden yield opportunities are discovered, and every transaction is rewarded through TeaPOT. The platform aligns with 2025’s user-centric, private, and incentive-based DeFi trends through self-custody security, zero-knowledge privacy, and yield aggregation.

Its mission is to empower individuals and communities by simplifying decentralized finance and creating an accessible ecosystem where users can manage, grow, and protect their digital assets seamlessly.

Tea-Fi Team

-

Matan Doyich – Founder & CEO

-

Eli Ruby – COO

-

Dudi Dvir – Head of Global Marketing

-

Nadav Hapeled – Head of Community

Notable Partnerships

Tea-Fi collaborates with Polygon, Binance Wallet, Coingecko, Chainalysis, Quickswap, 1inch Exchange, Mastercard, SYNDIKA, Yellow Capital, ORBS, and LI.FI.

How Does It Work?

Tea-Fi is a super app that unifies complex DeFi operations in one platform backed by a sustainable economic model.

Sustainable Economy – TeaPOT

-

Rewards are funded by protocol revenue, not inflation.

-

A portion of revenue goes to $TEA buybacks and reinvestment to strengthen token value.

User-Friendly Modules

-

Multi-Chain Platform: Manage assets and transactions on 40+ blockchains from one dashboard.

-

SuperSwap: One-click cross-chain swaps.

-

Easy-Gas (NOGA): Pay transaction fees with stablecoins or ERC-20 tokens.

-

TeaCard & Smart Yield Engine: Spend DeFi yields and invest efficiently with AI-powered vaults.

Growth & Integration

Modular PAA (Partner Applications) can easily join the ecosystem and share revenue through TeaPOT.

Token Utility – $TEA

-

Economic Alignment: All protocol revenue flows through TeaPOT; buybacks and reinvestments increase token value.

-

Access Gateway: Holding $TEA enables entry and locking for governance, boosted APY, and exclusive perks.

-

Yield Payments: Rewards are distributed directly in $TEA.

-

Fueling TeaPOT: Vault activity powers buybacks, rewards, and ecosystem expansion.

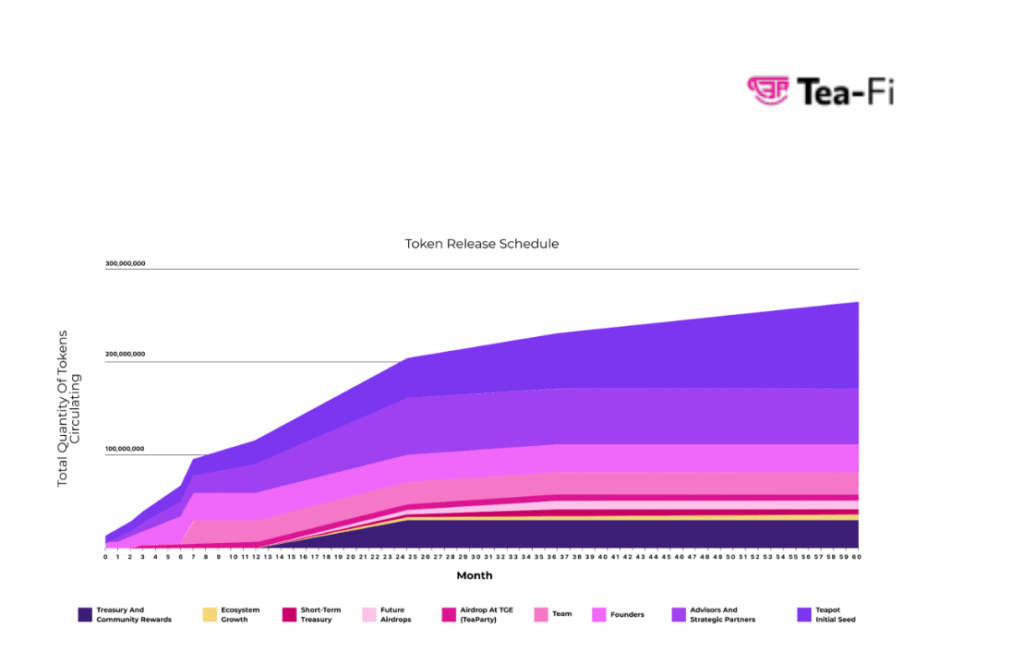

TEA Token Metrics

-

Total Supply: 300M TEA

-

Max Supply: 300M TEA

-

Circulating Supply: 50.01M TEA

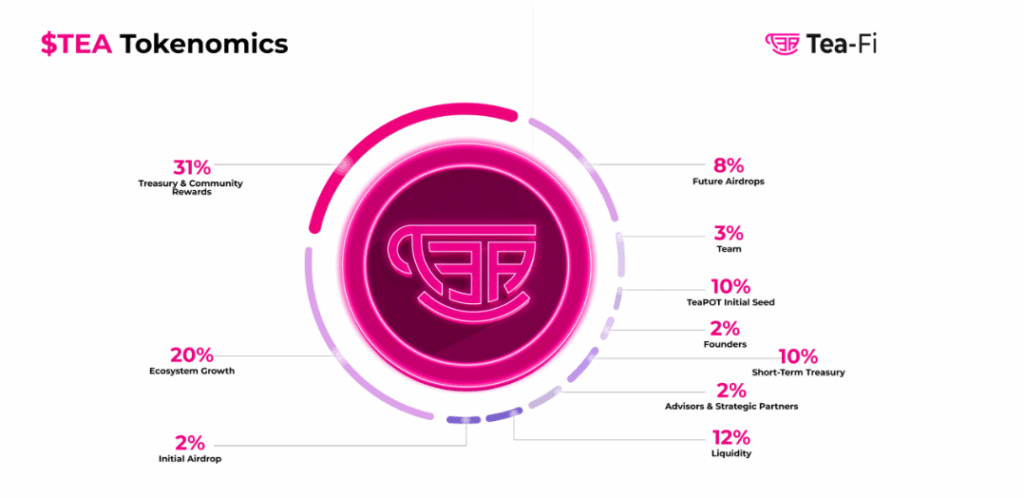

Token Distribution

- Treasury & Community: 31%

- Ecosystem Growth: 20%

- Liquidity: 12%

- TeaPOT Seed: 10%

- Short-Term Treasury: 10%

- Future Airdrops: 8%

- Team: 3%

- Founders: 2%

- Initial Airdrop: 2%

- Advisors & Partners: 2%

Governance – veTEA

-

Current governance is managed by the core team and partner committee.

-

veTEA will launch at TGE, allowing users to lock TEA up to 7 years for voting power, boosted yields, and special privileges.

-

veTEA holders govern reward allocation, vault settings, and ecosystem integrations.

-

In time, veTEA will transition governance to a full DAO model.

Ecosystem Highlights

TeaPOT Flywheel converts platform and partner revenues into productive capital to boost rewards and ecosystem growth. Its modular structure enables quick integration of new strategies and partner applications, while multi-chain support ensures seamless liquidity, swaps, staking, and rewards.

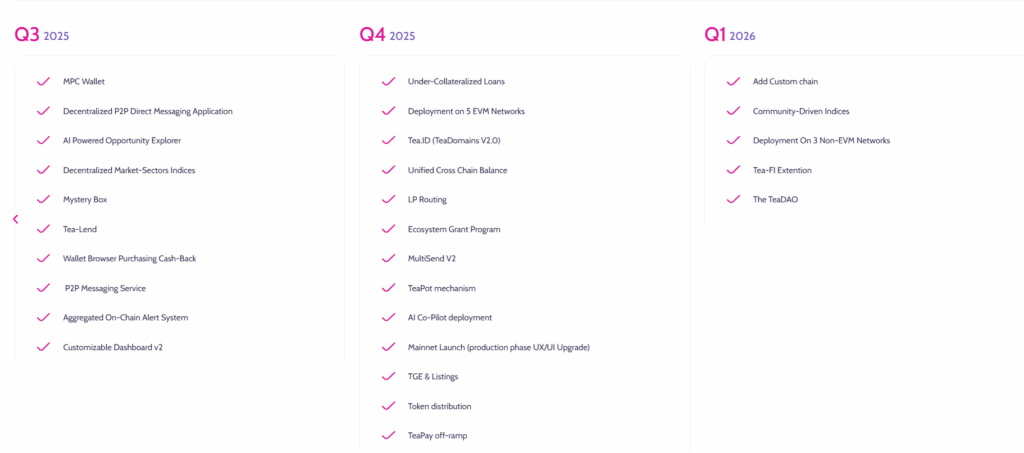

Roadmap

- Q3 2024: Community sale, first airdrop, TGE.

- Q4 2024: Beta launch, Easy-Gas v1, customizable dashboard, TWAP, limit & DCA orders, LP participation, ZK privacy, Super-Swap.

- Q1 2025: Multi-chain wallet, cross-chain support, synthetic assets, loyalty protocol, custom token addition, tiered revenue sharing, on-ramp integration, Tea-Wallet Web Connect.

- Q3 2025: MPC Wallet, AI Discovery Explorer, Tea-Lend, PDP messaging, Mystery Box, Dashboard v2.

Current Status: Early staking live (1.6M TEA pool, 8-month lock, 200% APY), listed on MEXC and Kraken. - Late 2025–2026: Low-collateral loans, Tea ID v2, cross-chain balance, LP routing, TeaPOT upgrades, TGE & listings, chain integrations, TeaDAO, non-EVM deployment.

Key Features

-

Easy-Gas: Pay gas fees using USDT, USDC, DAI, TEA, or synthetic assets.

-

Cross-Chain Connectivity: Swap and transfer assets across blockchains.

-

Self-Custody Security: Full asset control for users.

-

Privacy Layer: Zero-knowledge technology protects financial activity.

-

$TEA Staking: Lock TEA for high, time-based rewards.

Real-Yield Model

Tea-Fi routes all platform revenue to TeaPOT, strengthening the TEA token without inflation. User activity is rewarded via TeaDrops, driving protocol expansion. Each PAA joining the ecosystem contributes to sustainable tokenomics, growth, and community engagement.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.