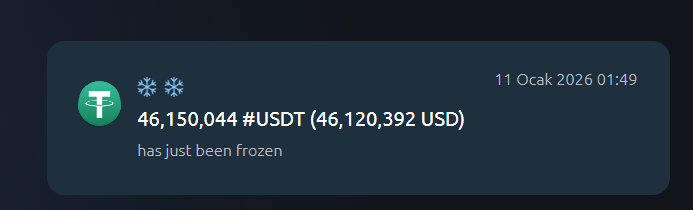

Tether has made another familiar yet controversial move: $182 million vanished in an instant—or more accurately, it was frozen. The operation targeted five separate wallets on the Tron network, each holding between $12 million and $50 million. Why it happened remains unclear; Tether is still silent on the triggers. But one thing is evident in market chatter: this move once again highlights the centralized control power of stablecoins.

Stablecoins Take Center Stage in Illicit Activity

Looking closer at on-chain data, we see that by the end of 2025, approximately 84% of illicit crypto transactions were conducted using stablecoins. Their low volatility and fast transfer capabilities make them particularly attractive to bad actors. The risks have been discussed in the market for years—but even so, USDT usage hasn’t slowed down.

Tether’s Blocklist and Freeze Operations

Between 2023 and 2025, Tether froze around $3.3 billion in assets and added over 7,268 wallets to a blocklist. These figures are massive. Tether isn’t just making occasional big moves; it is consistently intervening to maintain control over the market. Many in the industry say it behaves almost like a central bank with this power.

Market Dominance Remains Intact

Despite these freezes and blocklist additions, USDT’s market capitalization remains around $187 billion, accounting for roughly 60% of the stablecoin market. In other words, no matter how aggressive the interventions are, USDT remains the backbone of the market. How long this will continue remains to be seen.

What the Freezes Reveal

Large-scale freezes make several things clear:

-

Centralized authority remains strong: Tether can freeze funds instantly.

-

Intervention in illicit funds is possible, though the ethical and practical limits are debatable.

-

Stablecoins remain attractive: Low risk and high liquidity continue to draw users.

In short, Tether’s moves are more than just numbers. They are reshaping the discussion around centralized control and compliance in crypto finance, creating a space that both regulators and investors will be watching closely.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.