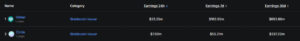

Despite the overall downtrend in the crypto market over the past few weeks, several projects managed to increase their revenues. On-chain data analyzing platform earnings, stablecoin issuance, and DeFi transaction fees revealed some striking results. The top-earning projects of the last 30 days were announced — Tether, Tron, and Circle ranked as the top three, while several DeFi protocols and next-generation networks also showed impressive growth.

Tether (USDT) Maintains Its Top Position

Stablecoin giant Tether led the list with $693.88 million in revenue over the last 30 days. Although this marks a slight 2.1% decline, Tether continues to dominate the market thanks to the interest-bearing reserves that generate substantial income.

Analysts attribute Tether’s performance to its high-yield reserve management strategy, largely backed by U.S. Treasury securities. Experts emphasize that this underscores the dominance of stablecoins in the crypto economy and their ability to generate consistent revenue even in volatile markets.

Circle, issuer of USDC, EUROC, and USYC, earned $237.22 million, marking a 0.6% increase from the previous month. Circle’s regulatory compliance and strong institutional presence continue to attract corporate investors. Benefiting from high interest rates, the company’s revenue growth reflects its solid positioning ahead of global stablecoin regulations expected in 2025.

Rising Stars: DeFi Projects on the Move

DeFi platforms also showed notable strength in revenue rankings, with increased trading activity and higher transaction fees boosting their performance.

- Hyperliquid (HYPE) – $104.2 million (+8.0%)

The next-generation decentralized derivatives exchange saw an 8% revenue increase in the past month, reaching $104.3 million. Rising volume and growing institutional participation have made Hyperliquid one of the most active DeFi platforms. - pump.fun (PUMP) – $36.1 million (−36.7%)

Despite a 36.7% drop in revenue, the meme-coin launch platform remains fourth among DeFi projects by earnings. While trading volume declined, the project’s strong community base shows that user engagement in DeFi remains resilient even amid market corrections.

Ethereum and Base Double Their Revenues

Two major networks — Ethereum (ETH) and Base — recorded surprising revenue growth.

- Ethereum saw a 61.6% increase in revenue, earning $19.6 million, driven by higher transaction fees and renewed on-chain activity.

- Base, Coinbase’s Layer-2 network, achieved an impressive 102.7% revenue jump to $10.3 million, fueled by the expanding DeFi ecosystem and rising user adoption.

Experts note that Ethereum’s growth reflects the resurgence of on-chain development and network usage, while Base’s strong performance highlights the rapid institutional integration of Layer-2 solutions.

![]()

Mixed Results Across DeFi and Layer-1 Networks

While stablecoin issuers and DeFi platforms dominate the top revenue ranks, the data clearly shows where real demand and utility exist within the crypto market.

| Project | 30-Day Revenue | Change |

| Tether (USDT) | $693.88M | −2.1% |

| Tron (TRX) | $227M | −2.2% |

| Circle (USDC) | $237.22M | +0.6% |

| PancakeSwap (CAKE) | $49.8M | −1.5% |

| Ethena (ENA) | $37M | −31.3% |

| Axiom Trade | $21.5M | −44.5% |

| Aave (AAVE) | $13.9M | −3.9% |

| Aerodrome (AERO) | $13.8M | −3.4% |

| Phantom | $12.7M | −19.1% |

| Aethir (ATH) | $9.2M | −27.8% |

| Lido Finance (LDO) | $8.3M | −3.3% |

Analysis

Even though the broader crypto market remains bearish, revenue-generating projects continue to perform strongly through transaction fees, yield income, and stablecoin operations. The dominance of DeFi protocols in the top 15 revenue list reaffirms the core role of decentralized finance in the crypto ecosystem.

Analysts believe that through 2025, projects with strong revenue models will increasingly shape long-term investor preferences, highlighting a shift from speculative hype toward fundamentally sustainable blockchain businesses.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.