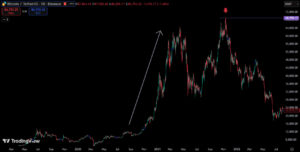

In December 2020, the cryptocurrency world experienced one of the most pivotal moments in its history. Exactly five years ago today, Bitcoin (BTC) shattered the previously “unbeatable” $20,000 barrier, sparking one of the largest bull runs in modern financial history. But what has happened since that “crazy night”? From Elon Musk’s tweets to SEC lawsuits, bankruptcies, and the eventual $100,000 peak, here’s the thrilling story.

The Night That Went Down in History

Some dates are unforgettable for crypto investors. The night connecting December 16 to 17 was one of them. The $20,000 level, which had haunted investors since 2017 and symbolized a three-year “bear hibernation,” was obliterated by Bitcoin. That day marked more than a price movement—it was a monumental step toward the global adoption of digital assets. Today, Bitcoin has stabilized around $85,000 after surpassing its historical $100,000 peak, but five years ago, those numbers were just a dream.

The 2020 Rally: Record-Breaking Amid a Pandemic

2020 was a challenging year globally. Under the shadow of COVID-19 and worldwide lockdowns, financial markets suffered a major crash in March. Yet by year-end, the winds had shifted. Fueled by PayPal’s crypto initiatives, the market ignited in December. After surpassing its 2017 peak, Bitcoin didn’t look back. The rally was so aggressive that:

- January: $40,000

- February: $50,000

- March: $60,000

Each level fell in succession, and unlike today, altcoins were also participating, creating a festive atmosphere across the market.

Elon Musk: The Market Mover

During that period, Elon Musk became the figure who could make or break the market with a single tweet. Tesla’s addition of Bitcoin to its balance sheet and the announcement that it would accept BTC for vehicle sales fueled Bitcoin to $64,000. The excitement peaked on April 14, the day Coinbase went public. Yet Musk also showed the other side of the coin: in May, citing environmental concerns over fossil fuel usage in mining, he halted Bitcoin payments, delivering a cold shock to the market. Tesla’s partial asset sales under a “liquidity test” further rattled investor confidence.

XRP and the SEC Lawsuit: The Bull They Missed

While most of the market was thriving, XRP quietly suffered a blow. During the height of the crypto frenzy, the SEC filed a lawsuit against Ripple on December 19, 2020, preventing XRP from fully participating in the 2021 bull season. At the time, no one could have predicted that the SEC would eventually step back and that Ripple would survive the battle, albeit scarred. This lawsuit became the first major example of regulation’s destructive potential on the market.

From Peak to Trough: $69,000 and Beyond

Following a summer dip, Bitcoin reached $69,000 in November 2021 with the approval of Futures ETFs, setting the then all-time high (ATH). However, this signaled a long winter ahead. The U.S. Federal Reserve’s (Fed) warnings that inflation was not transitory and subsequent rate hikes ended the party. 2022 witnessed some of the darkest moments in crypto history:

- Russia-Ukraine War

- Terra (LUNA) Collapse: Billions evaporated

- FTX Bankruptcy: Collapse of the world’s second-largest exchange

The Great Comeback: 2024 and the Trump Effect

Bitcoin, recovering through 2022 and 2023, showed its real strength in 2024. The approval of Spot Bitcoin ETFs in January opened the doors for institutional capital. The election of Donald Trump as U.S. President in November and his “Crypto-Friendly America” vision was the final catalyst. Bitcoin surpassed $100,000 for the first time in history, giving those who remembered the $20,000 night five years ago a moment to reflect: “Look how far we’ve come…”

Those who celebrated $20,000 five years ago now view the $85,000 level as a mere correction. This demonstrates how mature the crypto market has become and how expectations have evolved. The story that began in 2020 hasn’t ended—it continues, with new actors and new numbers writing the next chapters.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.