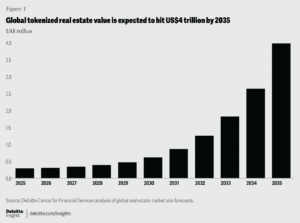

Deloitte’s April 24, 2025 report predicts that blockchain-based tokenization could revolutionize the real estate sector. According to the research, the tokenized real estate market, which currently stands at less than $300 billion, could exceed $4 trillion by 2035, achieving a 27% compound annual growth rate (CAGR).

The basis of this huge growth lies in the transparency, automation, and accessibility advantages provided by the blockchain infrastructure. In particular, the development of digital asset standardization and the increased use of smart contracts minimize the need for intermediaries in investments and accelerate investment processes.

In the tokenization process, real-world assets (RWA) are divided into digital representatives on the blockchain. These small shares allow investors to own properties without encountering high entry barriers. This mechanism provides an important solution to the low liquidity of real estate in the classical model.

Working from Home, Digitalization and Tokenization

Remote working models that have become permanent after the COVID-19 pandemic, climate change risks and technological advances have redefined the way real estate assets are used. Now office buildings are turning into artificial intelligence data centers, logistics hubs or energy efficient living spaces.

This change is increasing investors’ desire to invest not only in traditional property types but also in transformed, modern-purpose assets. This is where tokenization comes into play, offering investors flexible, customizable and programmable investment strategies.

For example, by tokenizing a real estate asset, investors can only invest in the energy-efficient part of a logistics center. Thus, the blockchain-based “fractional investment” model opens the way for micro-level strategic investments.

You may also notice this article: DeFi Development Corp’s Huge Move

Regulatory Approaches to Tokenization

The future of tokenization is not only dependent on technological developments; the maturation of the regulatory framework is also critical. Plume Network founder Chris Yin states that increasing RWA (real-world asset) adoption could encourage global regulators to produce more inclusive and innovation-friendly policies.

Yin likens the tokenization process to the aggressive growth process Uber experienced before it was regulated: “As demand increases, regulatory clarity will inevitably come.”

On the other hand, some industry leaders are cautious about whether tokenization will directly create efficiency in the real estate field. According to Securitize COO Michael Sonnenshein, the role of intermediaries and escrow services in the real estate sector could be reduced thanks to blockchain technology. But today, what the market demands are more liquid, digital assets that can be exchanged quickly.

Click now for last minute cryptocurrency news.