BitMine executive chairman Tom Lee believes Ethereum may be on the verge of a major breakout in the coming years. According to Lee, ETH could be preparing to follow a trajectory similar to Bitcoin’s explosive 100x rise that began in 2017.

“ETH Is Beginning the Same Path”: Lee Recalls 2017 Bitcoin Call

In a recent post on X, Lee reminded his followers that he first recommended Bitcoin to Fundstrat clients in 2017, when BTC was trading near $1,000. Despite experiencing several deep corrections of up to 75% over the years, Bitcoin has since risen roughly 100 times from that initial recommendation.

Lee now argues that Ethereum is entering a comparable long-term expansion phase, stating:

“We believe ETH is embarking on that same Supercycle.”

During the early months of 2025, Ethereum lagged behind Bitcoin as BTC surged to new record levels. ETH reached its all-time high of $4,946 in August, while Bitcoin climbed above $126,000 in October, marking the peak of its recent rally.

Market Pullback Tests Confidence, but Lee Remains Optimistic

The broader crypto market has since experienced a sharp correction. Bitcoin has dropped about 25% from its top, while Ethereum has declined more than 35% from its peak. Lee attributes this volatility to lingering uncertainty rather than a breakdown in long-term fundamentals.

He emphasized that major multi-year uptrends often require investors to endure intense downturns:

“To benefit from that 100x Supercycle, one had to stomach existential moments to HODL.”

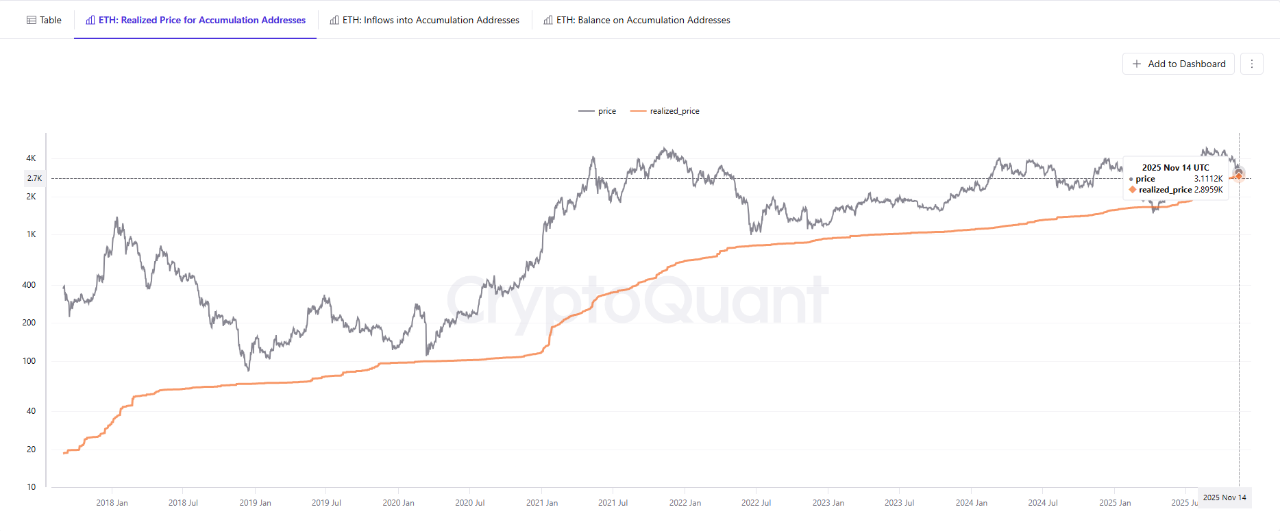

Ethereum Approaches the Cost Basis of Long-Term Holders

Meanwhile, CryptoQuant analyst Burak Kesmeci noted that Ethereum is approaching the average cost basis of long-term accumulators. With ETH trading around $3,150, he said the asset is only about $200 away from reaching the level where seasoned holders have been building positions.

According to Kesmeci, ETH has dipped below this threshold only once—back in April, when global tariffs introduced by U.S. President Donald Trump came into effect.

Data also shows that accumulation has accelerated throughout 2025. Roughly 17 million ETH has flowed into long-term wallets this year, bringing total holdings in these addresses from 10 million ETH at the start of the year to 27 million ETH today.

Kesmeci added that if Ethereum slips below $2,900, history suggests it would not remain at that level for long, describing it as “one of the strongest long-term accumulation zones.”

ETH briefly fell to $3,023 over the past 24 hours but has since stabilized near $3,185.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.