U.S. President Donald Trump’s 100% tariff hikes on Chinese goods shook global financial markets and triggered sharp volatility across the cryptocurrency sector. Leveraged trading positions were hit especially hard, leading to more than $19 billion in liquidations. The sudden correction caused steep price drops in Bitcoin, Ethereum, and other major crypto assets.

For crypto investors, the weekend turned into a period dominated by extreme volatility and panic selling. Traders on leading exchanges such as Binance, OKX, and Bybit suffered partial losses on their positions, with some users briefly facing liquidity issues.

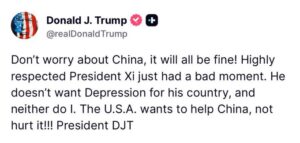

Trump Signals Easing: Open to Dialogue with China

After the heavy weekend sell-off, President Trump’s latest statements indicating openness to dialogue with China sparked signs of recovery across markets. Trump described Xi Jinping as “a leader I deeply respect” and emphasized that the U.S. aims to support, not harm, China, suggesting a potential de-escalation of trade tensions.

These statements led to a partial recovery in crypto assets on Monday, as Bitcoin and Ethereum prices began to climb again. After a wave of panic selling over the weekend, investors had the chance to reassess their positions and stabilize their portfolios.

Reconciliatory remarks made by President Trump and Vice President JD Vance on Sunday further supported investor confidence, prompting a broader search for balance in the markets. However, crypto analysts note that while these developments provided short-term relief, the market remains highly sensitive to geopolitical risks.

Leverage and Massive Liquidations

Before Trump’s announcement of the additional tariffs, a large number of highly leveraged positions were liquidated across the market. According to available data:

- Approximately $19–20 billion worth of positions were wiped out.

- Bitcoin briefly fell below $110,000.

- Ethereum dropped more than 20% within hours, trading around $2,800.

This marked one of the largest liquidation events in recent months. Analysts emphasize that excessive leverage and speculative positions make the crypto market more vulnerable during sudden price swings.

Although Trump’s moderate tone helped restore investor confidence in the short term, experts predict that volatility will remain elevated. Any new policy or trade decision between the U.S. and China could once again cause rapid shifts in crypto asset prices.

Recovery and Market Stabilization

As of Monday, leading cryptocurrencies particularly Bitcoin and Ethereum recorded a 5–8% rebound, signaling cautious optimism among investors amid ongoing geopolitical uncertainty.

However, analysts emphasize that for a new upward trend to begin, several key conditions must be met:

- A sustained easing in U.S.–China relations,

- Improvement in global economic data, and

- Stabilization of leveraged position risks.

The current state of the crypto market is being viewed as a period of volatility shaped by political risks and geopolitical uncertainty, where sentiment and policy signals continue to play a decisive role in price movements.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.