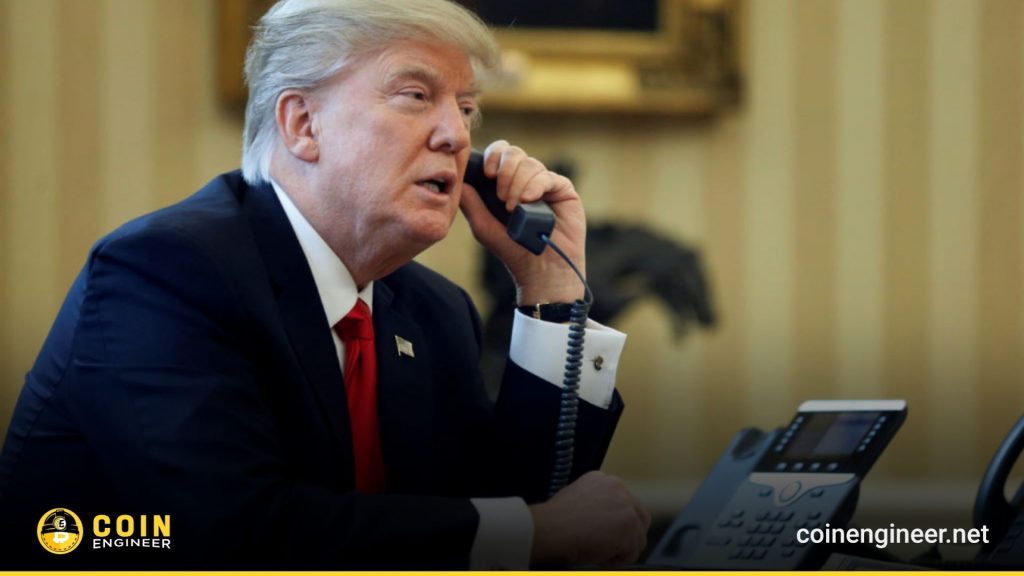

Trade policy in the United States has once again taken center stage following a major judicial decision. After the U.S. Supreme Court ruled that President Donald Trump could not rely on national emergency powers during peacetime to impose tariffs, the president swiftly announced a new 10% global tariff under alternative legal authority.

The Court invalidated Trump’s previous use of the International Emergency Economic Powers Act (IEEPA) as the basis for broad tariff measures. In its opinion, the justices emphasized that in the roughly fifty years since the law’s enactment, no president had invoked it to implement tariffs of such scale. The ruling also reaffirmed that under Article I, Section 8 of the U.S. Constitution, the authority to levy taxes and duties rests with Congress.

A Shift to Alternative Trade Laws

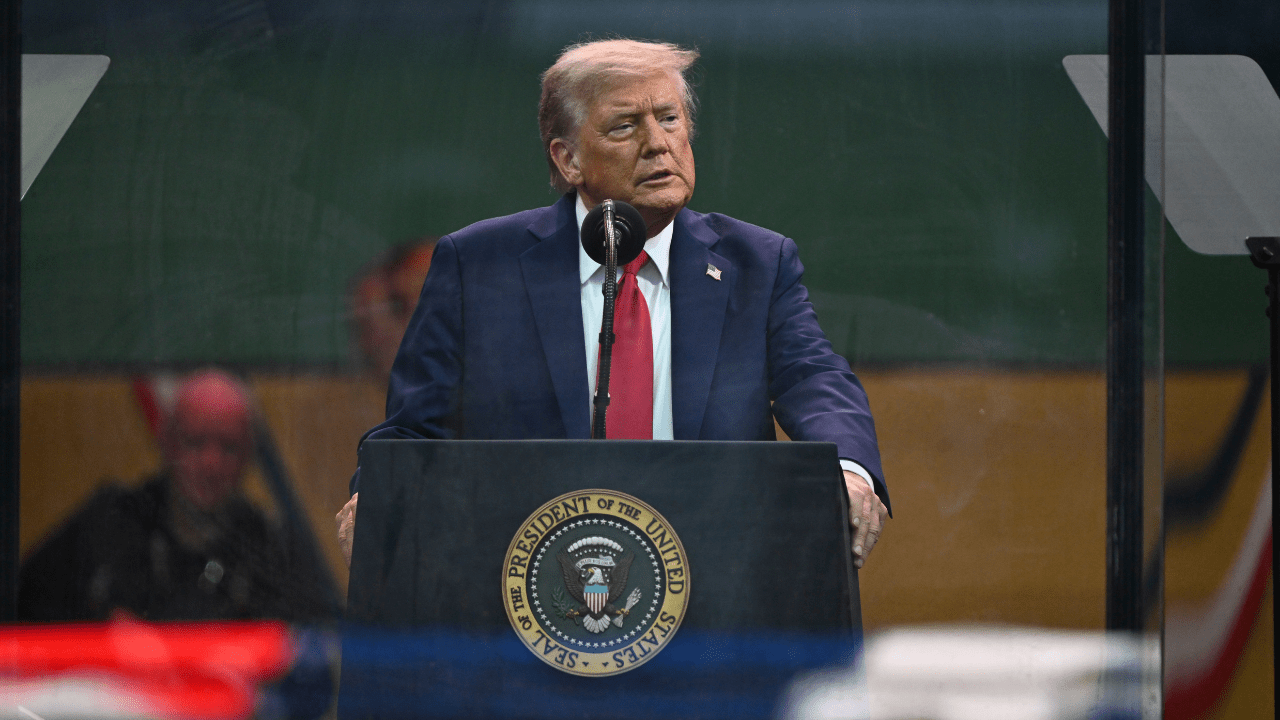

Rather than retreating, Trump signaled a strategic pivot. Describing the Court’s decision as misguided, he made clear that tariffs would remain a central component of his trade agenda. The newly announced 10% global tariff will be implemented using provisions from the Trade Expansion Act of 1962 and the Trade Act of 1974.

Specifically, Trump confirmed that existing national security tariffs under Sections 232 and 301 will remain fully in effect. In addition, he intends to invoke Section 122 to layer a new 10% global tariff on top of standard duties already in place. This approach reframes the legal justification while maintaining the substance of the trade policy.

Background: Previous Tariffs and Legal Challenges

Prior to the Supreme Court’s decision, the administration had imposed a 25% tariff on most imports from Canada and Mexico, along with a 10% tariff on Chinese goods under IEEPA. These measures were justified on grounds ranging from combating drug inflows framed as a public health crisis to addressing trade imbalances that allegedly threatened U.S. industrial capacity.

The Supreme Court, however, concluded that these justifications did not meet the threshold for national security emergencies under IEEPA, thereby limiting executive authority in this context.

Potential Market Impact

Historically, tariff announcements have triggered volatility across global markets, particularly in high-risk asset classes such as equities and cryptocurrencies. Heightened trade tensions often undermine investor confidence and contribute to short-term sell-offs.

With a new 10% global tariff now on the table, market participants will be closely monitoring both the legal ramifications and the broader economic consequences. Trade policy uncertainty may once again become a key driver of financial market sentiment in the weeks ahead.

In the comment section, you can freely share your comments about the topic. Additionally, don’ t forget to follow us on Telegram, Youtube and Twitter for the latest news and updates.