The first U.S government shutdown in six years has raised uncertainty in traditional markets, but crypto analysts suggest it may mark a turning point for digital assets. Some believe that both Bitcoin and altcoins could have already found their bottom as investors look for alternatives amid political gridlock.

First U.S Shutdown Since 2018

For the first time since the 35-day closure in late 2018, the U.S. government has entered a shutdown. The deadlock stems from Congress’ inability to pass the funding bill for the 2026 fiscal year, highlighting sharp partisan divisions between Democrats and Republicans.

At the heart of the dispute lies a temporary funding measure known as the continuing resolution (CR). Republicans pushed the measure forward without additional policy adjustments demanded by Democrats. Senate Majority Leader Chuck Schumer insisted on permanently extending tax credits under the Affordable Care Act, warning that millions could otherwise lose health coverage.

Bitcoin and Gold See Safe-Haven Demand

As the political standoff deepens, investors are seeking safety in alternative assets. Bitcoin gained more than 3% in the past 24 hours, trading around $117,227, while gold prices climbed by 0.7%. The moves suggest increasing demand from institutional and retail players looking to hedge against prolonged uncertainty.

Have Altcoins Already Bottomed Out?

Ryan Lee, chief analyst at Bitget, argued that both Bitcoin and the S&P 500 could benefit from the shutdown scenario. He noted that prolonged budget deadlocks tend to keep U.S. interest rates lower, a factor that often supports risk assets.

According to Lee, Bitcoin’s independence from government and political events makes it particularly attractive to traditional investors:

“Bitcoin stands to benefit from this environment. While short-term corrections are likely, many leading altcoins appear to have already reached their bottom.”

Lee also highlighted that Bitcoin reclaiming the $116,000 level is a strong signal heading into October, historically considered one of the most positive months for crypto markets.

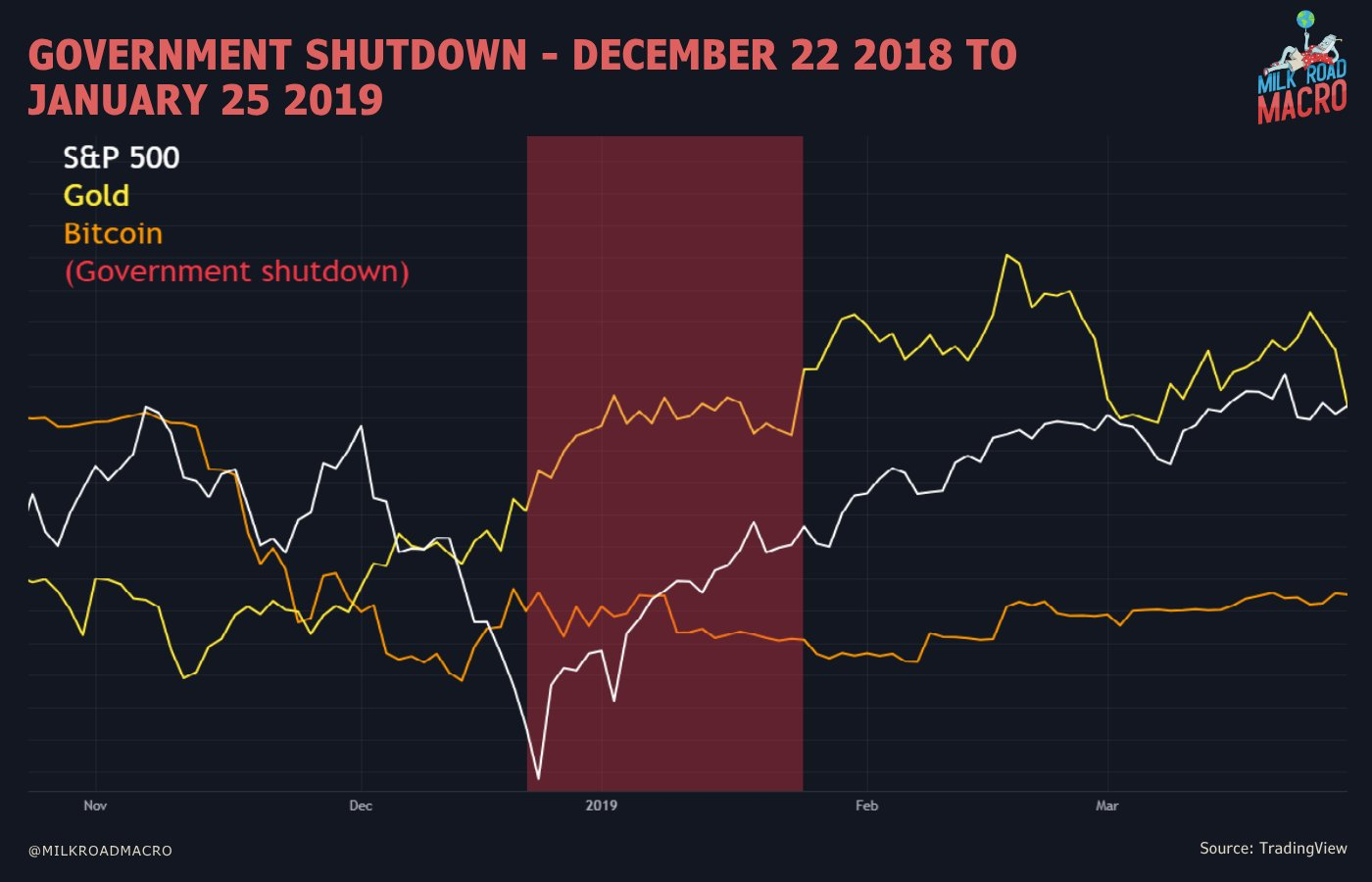

Mixed Market Reactions in the Past

History shows that markets don’t always respond uniformly to government shutdowns. In 2013, stocks fell while Bitcoin rallied. By contrast, the 2019 shutdown saw both equities and Bitcoin decline simultaneously.

As one macro research outlet noted, shutdowns disrupt government operations but their impact on markets varies significantly each time.

Federal Reserve and Investor Outlook

Past shutdowns have often nudged the Federal Reserve toward more dovish monetary policies. On average, the S&P 500 delivered a 13% yearly gain in the aftermath of such events, according to trading data. Some analysts even argue that markets historically “welcome” shutdowns due to the resulting policy flexibility.

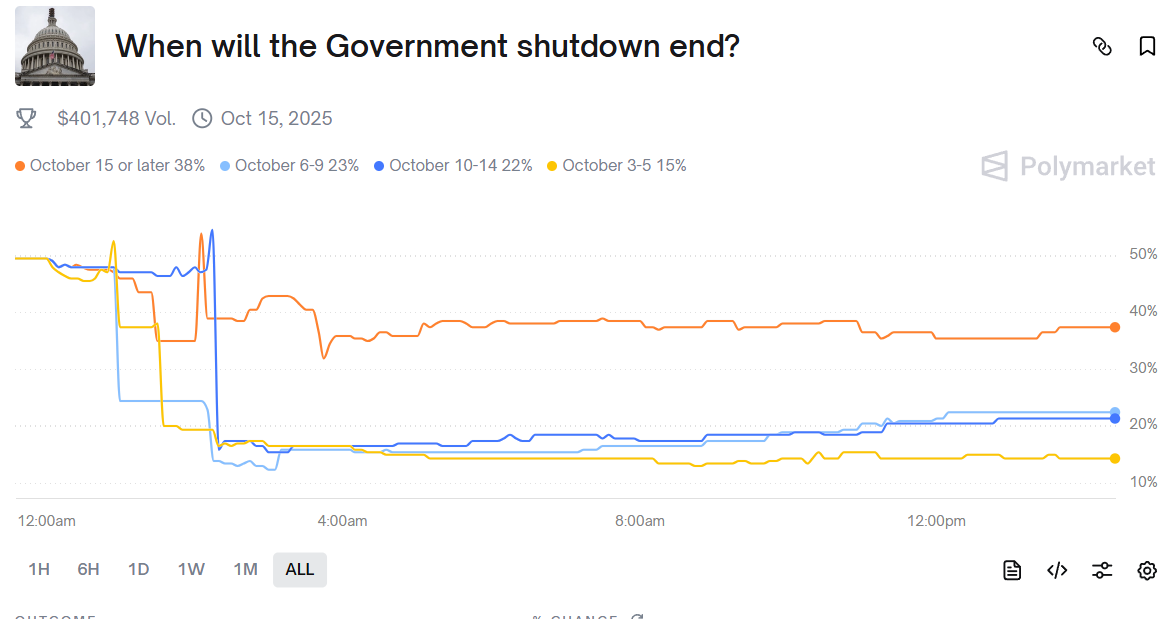

Meanwhile, prediction market platform Polymarket currently places the probability of the shutdown ending by October 15 at around 38%.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest newsand updates.