The Uniswap ecosystem is entering a historic transformation. Uniswap Labs and the Uniswap Foundation have jointly introduced a new governance proposal titled “UNIfication,” aimed at overhauling both the protocol’s economy and its organizational structure. The proposal includes three groundbreaking steps: the burning of 100 million UNI tokens, the activation of protocol fees, and the unification of Uniswap’s main teams under a single long-term growth strategy.

What Is UNIfication?

The UNIfication proposal seeks to restructure Uniswap’s incentive model to make it the default decentralized exchange for tokenized assets.

The plan directs a portion of transaction fees toward a token burn mechanism, reducing UNI supply and enhancing value accumulation within the ecosystem.

Under the proposal, a percentage of trading fees generated by the protocol — including those from Uniswap’s Layer-2 network, Unichain — will be automatically burned.

Additionally, a new system called Protocol Fee Discount Auctions (PFDA) will allow investors to bid for fee discounts while internalizing MEV (Maximal Extractable Value) revenue for the protocol.

100 Million UNI Burn and a New Fee Model

As part of this economic shift, Uniswap Labs has proposed burning 100 million UNI tokens held in its treasury. This figure roughly matches the estimated cumulative revenue Uniswap would have earned since 2020 if protocol fees had been active.

The new model introduces a deflationary mechanism by channeling a portion of trading fees into the burn process thereby reducing UNI supply and potentially increasing the long-term value of remaining tokens. The proposal also ties in with Uniswap v4, which introduces “hooks”, enabling the protocol to function as an on-chain liquidity aggregator that captures revenue from external sources.

Structural and Organizational Overhaul

UNIfication is not just a tokenomics reform — it’s a complete institutional restructuring. The Uniswap Foundation will be integrated into Uniswap Labs, consolidating all ecosystem teams under a unified growth strategy.

The new entity will be led by a five-member board:

- Hayden Adams (Founder)

- Devin Walsh

- Ken Ng

- Callil Capuozzo

- Hart Lambur

Following this merger, Uniswap Labs will discontinue revenue generation from interfaces, wallets, and APIs, focusing entirely on protocol growth and sustainability.

Growth Fund and Long-Term Vision

The proposal also introduces a 20 million UNI annual growth fund, to be distributed quarterly starting in 2026. This fund will support developer grants, on-chain innovation, and global community expansion.

Following the announcement, UNI’s price surged by 30% in 24 hours, climbing to $8.65. Analysts attribute the rally to renewed optimism around the long-awaited “fee switch” mechanism, which would finally enable Uniswap’s protocol to capture and distribute trading revenue.

Regulatory Shifts and a New Era

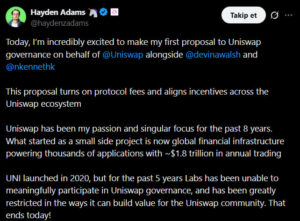

Uniswap founder Hayden Adams explained that the team had previously avoided activating protocol fees due to the regulatory uncertainty in the United States.

However, he now believes that the time has come to move forward:

“UNI was launched in 2020, but for five years Labs couldn’t fully engage in governance. Today, those restrictions end. A new era begins for the Uniswap community.”

If passed, UNIfication would mark the most significant structural transformation in Uniswap’s history since the UNI token launch in 2020. With revenue sharing, a deflationary token model, and a unified ecosystem strategy, Uniswap could solidify its position as DeFi’s market leader — and as a long-term value asset for investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.