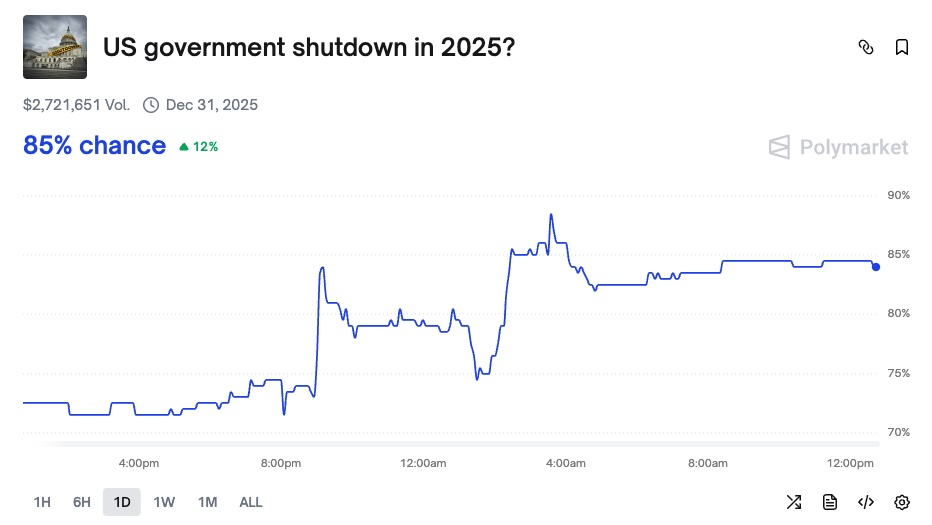

As the risk of a US government shutdown increases, hedge assets like Bitcoin, Gold, and Silver are gaining investor attention. According to Polymarket data, the probability of a shutdown has reached 85%, raising volatility in both traditional and crypto markets.

How Does a Government Shutdown Affect Markets?

If Congress fails to pass a budget agreement, the US government faces a shutdown risk starting October 1. Historically, the S&P 500 tends to weaken ahead of such dates, making investors cautious about both equities and digital assets.

A government shutdown halts the release of economic data, including key unemployment and inflation reports, potentially delaying Federal Reserve policy decisions. Regulatory bodies like the SEC and CFTC will operate at limited capacity, which could postpone crypto ETF applications and IPO processes.

Crypto analysts warn that short-term downside risk in US stocks and cryptocurrencies may increase. BTC, ETH, and highly volatile altcoins could experience temporary swings. Last week, the crypto market saw two liquidations exceeding $1 billion. Historically, US government shutdowns can lead to a short-term drop followed by a strong recovery.

Is History Repeating for Bitcoin, Gold, and Silver?

During the 2018–2019 shutdown, Bitcoin saw a temporary decline before rapidly rising after the closure ended. Similarly, Gold and Silver continue to gain as investors seek safe havens.

Gold prices rose to $3,872 per ounce on September 29, marking a 50% gain year-to-date, signaling a potential rise toward $4,000. Silver reached a 14-year high at $47, supporting risk-off sentiment.

Possible Scenarios for Investors

Polymarket data shows an 85% chance of a US government shutdown. Vice President JD Vance stated, “I think we are headed for a shutdown.” Analyst Amit Investing highlights two possible scenarios:

- The market could see a short-term 5% drop, creating a buying opportunity.

- The market may remain largely unchanged as corporate earnings reports begin in two weeks.

- Investors should prepare for volatility and review risk management strategies across both traditional and crypto assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.