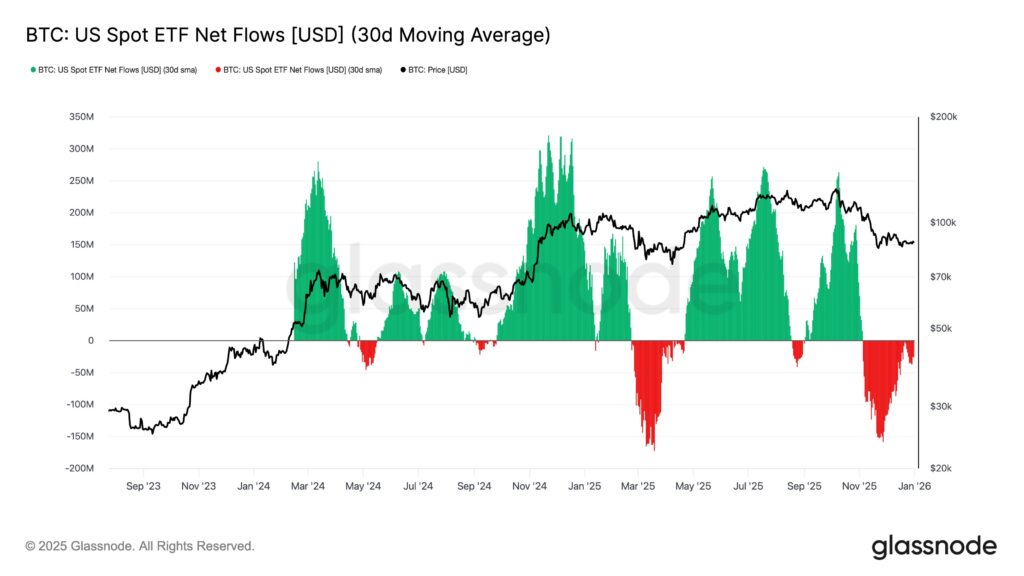

Crypto ETF flows remained resilient toward the final stretch of 2025, even as digital asset prices lost momentum. Volatility eased, trading activity thinned, and risk appetite cooled across major cryptocurrencies — but capital did not exit. It shifted form.

US investors funneled more than $31.7 billion into crypto exchange-traded funds over the year, signaling a change in how exposure is being built. The figure falls short of 2024’s peak inflows, yet the timing carries more weight. Money moved in as prices softened, not as rallies accelerated.

Capital Moved Even as Prices Slipped

Bitcoin entered the year above $93,000 and gradually drifted lower. Ether and large-cap altcoins followed a similar pattern, struggling to regain momentum in the closing months. Despite that backdrop, ETF inflows never fully reversed.

The explanation appears less speculative and more structural. A more crypto-friendly US regulatory environment — including new leadership at the Securities and Exchange Commission — reduced friction around regulated products. Approvals accelerated, and uncertainty shifted away from access toward allocation.

In short, investors weren’t chasing price. They were securing positioning.

BlackRock Pulled Away From the Field

The most decisive split in 2025 emerged inside the ETF market itself. BlackRock’s iShares Bitcoin Trust (IBIT) absorbed roughly $24.7 billion in net inflows by year-end, leaving competitors far behind.

IBIT’s intake was nearly five times larger than Fidelity’s FBTC, its closest rival. Bloomberg ETF analysts noted that IBIT ranked among the top ETFs globally by inflows, trailing only broad index and Treasury-focused funds.

Strip IBIT out of the equation, and the picture flips. The remaining spot Bitcoin ETFs collectively recorded net outflows over the year. Capital concentrated rather than diversified, reinforcing the idea that scale — not variety — drove investor confidence.

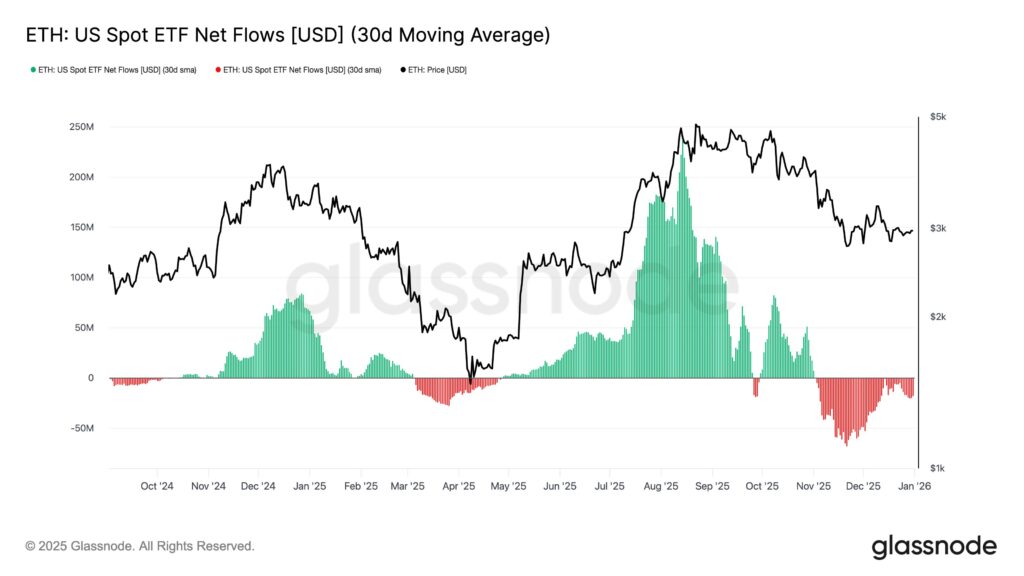

Ethereum ETFs Followed the Same Pattern

A similar dynamic played out on the Ethereum side. BlackRock’s ETHA product maintained its lead with nearly $12.6 billion in total inflows, even as it went more than two weeks without recording new demand.

Fidelity’s FETH and Grayscale’s Ethereum Mini Trust trailed well behind. Recent flow data suggests demand has flattened across the board, hinting at a slower start to 2026 rather than an immediate rebound.

Institutional interest remains present — but measured.

Bitwise Files Applications for 11 New Altcoin ETFs

More ETFs Are Coming, Fewer Will Survive

The second half of 2025 introduced regulated exposure to Litecoin, Solana, and XRP through newly approved ETF products. Access expanded quickly, but traction varied.

Looking ahead, analysts expect 2026 to bring an explosion in crypto ETF launches under new generic listing standards. Dozens — potentially more than a hundred — products could reach the market.

That growth, however, carries its own risk. Without sustained demand and distribution power, many of these ETFs may struggle to survive beyond 2027. The inflow data already suggests winners are being chosen early.

The year ended with strong headline numbers, but beneath them sits a quieter signal: capital is selective, patient, and increasingly intolerant of weak structures.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.