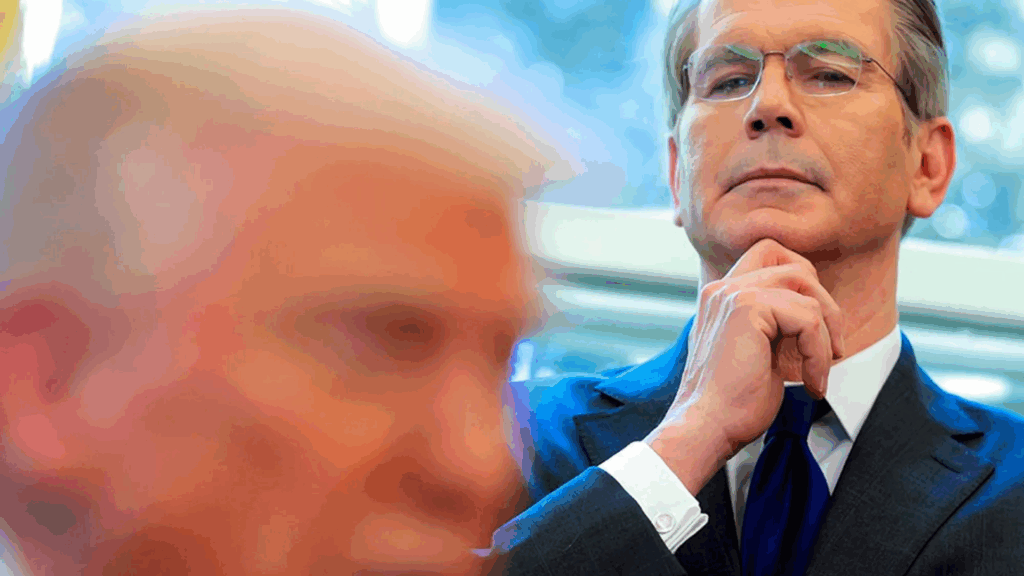

U.S. Treasury Secretary Scott Bessent addressed a wide range of topics in his comprehensive interviews with media outlets such as Bloomberg and Reuters — from inflation and Federal Reserve leadership to U.S.–China relations and market risks. Let’s take a closer look at the highlights:

“No Single Data Point Panic” Warning on Inflation

Scott Bessent emphasized that no single inflation figure should lead to hasty conclusions, stating that “the trend matters.” He underlined that inflation is not currently accelerating. However, according to Reuters, annual consumer inflation rose to 2.7% as of June (with core inflation at 2.9%). This level is above the Fed’s 2% target, but as Bessent pointed out, the overall trend appears resilient.

Confidence in Powell and Leadership Transition

Scott Bessent highlighted that President Trump has reiterated several times that he will not remove Powell from office: “Trump will not fire Powell.” He also announced that the formal process of searching for Powell’s successor has begun, saying “there are strong candidates both within and outside the Fed.” According to BofA analysis, Bessent himself is currently considered the leading candidate with a 26% likelihood.

Highlighting the Fed’s Forecasting Errors

Scott Bessent also pointed out previous misjudgments made by the Fed: “There were major forecasting errors, and they may occur again in this cycle.” These remarks support the Fed’s current cautious stance. Last week, Bessent stated that the Fed may initiate a rate cut as early as September. The current federal funds rate is in the 4.25–4.50% range. Bloomberg also reported that Powell noted the possibility of easing based on incoming data.

You may also be interested in this article: Trump to Unveil AI Strategy on July 23!

Cautious Tone in U.S.–China Dialogue

Bessent stated that the U.S.–China relationship is “in a good place” and announced plans to meet his Chinese counterpart within the next two weeks. AP News reports that this meeting is expected to be a continuation of the high-level talks held in Geneva.

No Need to Worry About August 12 Markets

Scott Bessent criticized market fixation on specific calendar dates, saying “there’s no need to worry about what’s coming on August 12; we won’t rush any deals under market pressure.” This approach helps reinforce investor confidence.

In light of these themes, the overall structure indicates that inflation risk, interest rate expectations, Powell’s future, the Fed’s independence, the U.S.–China balance, and even market stability were all addressed by the Treasury Secretary.

-

Inflation Risk: June inflation rose to 2.7%, but due to temporary stock-related shocks, the Fed continues to monitor the broader trend. This has led to a “wait and see” approach for September.

-

Interest Rate Expectations: Bessent’s remarks have strengthened market anticipation for a rate cut in September. Field data reflects expectations of a 100–125 basis point reduction by late October.

-

Powell & Independence: Trump’s reassurance that “he won’t fire Powell” and the initiation of a formal selection process for a successor is viewed as a positive signal for preserving the Fed’s independence. BofA surveys show that Bessent, Warsh, and Waller are considered strong candidates.

-

U.S.–China Balance: Strengthening diplomatic engagement may reduce uncertainty in both trade and technology sectors. AP data suggests this meeting will mark a significant step toward renewed cooperation between China and the U.S.

-

Market Stability: The August 12 reference sends a “no panic” signal to financial players. This stance could reduce volatility and enhance stability in capital flows.

For the latest breaking crypto news, click here now.