Velodrome Finance is a decentralized Automated Market Maker (AMM) protocol operating on the Optimism network. Inspired by Andre Cronje’s Solidly model, it offers fast and low-cost transactions.

The platform serves as the liquidity hub within the Optimism ecosystem, providing liquidity providers with flexible trading and high efficiency. By locking VELO tokens, users receive veVELO NFTs, enabling them to vote on liquidity incentives and contribute to platform growth. It is a DeFi-focused AMM built on Web3 infrastructure with an NFT-based governance system.

Team

Velodrome Finance is managed by an anonymous team. Limited public information is available about the founders, though Alexander Cutler is a notable contributor. The project gained support from various communities and protocols at launch, with its strategic positioning on the Optimism network enhancing its ecosystem importance.

Investors & Supporters

Optimism Foundation: Largest strategic supporter, locking 35 million veVELO tokens to strengthen liquidity infrastructure. Provides multiple grants for open-source tool development and ecosystem growth.

- Strategic Partnerships

Frax Finance: Launch partner, early listing of $FRAX and $FXS pairs on Velodrome.

Revest Finance (Resonate): Collaboration since September 2022, enabling LP positions tokenization as FNFTs and yield futures integration.

Inverse Finance DAO: Deepened liquidity on Velodrome via “Velo Fed” and gained voting power with veVELO locking.

- Protocol Partnerships

Velodrome collaborates with numerous DeFi protocols within the Optimism ecosystem to provide capital-efficient liquidity and reinforce its role as the primary liquidity center.

Project Concept

Velodrome introduces innovative approaches to liquidity pools and swap mechanisms in DeFi. Combining the strengths of Curve, Convex, and Uniswap, it aims to offer users efficient token swaps and high-yield liquidity provision.

How It Works

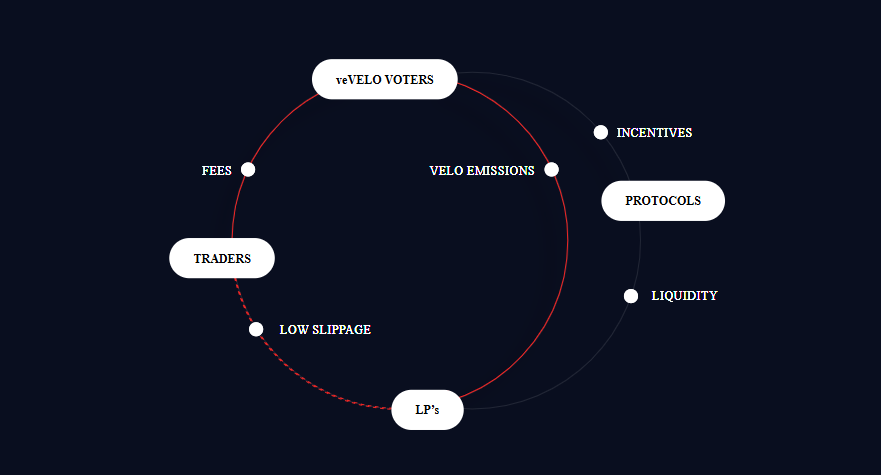

Velodrome is based on two main tokens: VELO and veVELO.

- Liquidity Pools: Users provide liquidity by depositing tokens into pools, earning transaction fees and VELO emissions.

- veVELO (Governance Token): Obtained by locking VELO tokens, veVELO NFTs give holders voting rights on which pools receive more token emissions, directing liquidity where it’s most needed.

- Transaction Routing: Utilizes Optimism Layer-2’s low fees and high speeds for fast and economical user experience.

Roadmap & Key Milestones

- Launch (June 2022): Velodrome Finance officially launched on June 2, 2022.

- Security Audits (2023): Underwent comprehensive audits by Spearbit in February and May 2023.

- Velodrome V2 (June 2023): Released on June 22, 2023, adding concentrated liquidity, dynamic fees, and emission rates to enhance efficiency and user experience.

- Upcoming 2025 Features: SoFinQ Trading Competition, Transact Cloud Integration, Profit Sharing, Tron Chain & Wallet Integration, B2B Crypto Partnership, Airline Industry Integration, New PayFi powered by AI.

- Future Projects: AI Agent, PLG Token Listing, Yield Stable Coin Support, XRPL & Solana Chain Integration, Multi-Chain Wallet, Redesigned Web App, Trader Network Expansion, PayFai Infrastructure Expansion.

What is the VELO Token?

VELO is the native utility token of Velodrome Finance, operating on the Optimism network. It plays a vital role in liquidity mining, governance, and incentive mechanisms within the DeFi ecosystem.

- Liquidity Mining: Users earn VELO rewards by providing liquidity to pools.

- Governance: VELO holders can lock tokens to obtain veVELO governance NFTs, enabling participation in key protocol decisions.

- Incentives & Ecosystem Support: VELO tokens are used to boost pool efficiency and fund grants for developers and partners.

Token Details

- Network: Optimism (Layer 2 Ethereum solution)

- Total Supply: 2.17 billion (may be inflationary)

- Circulating Supply: Approx. 915 million (variable)

- Uses: Liquidity rewards, governance voting, protocol incentives

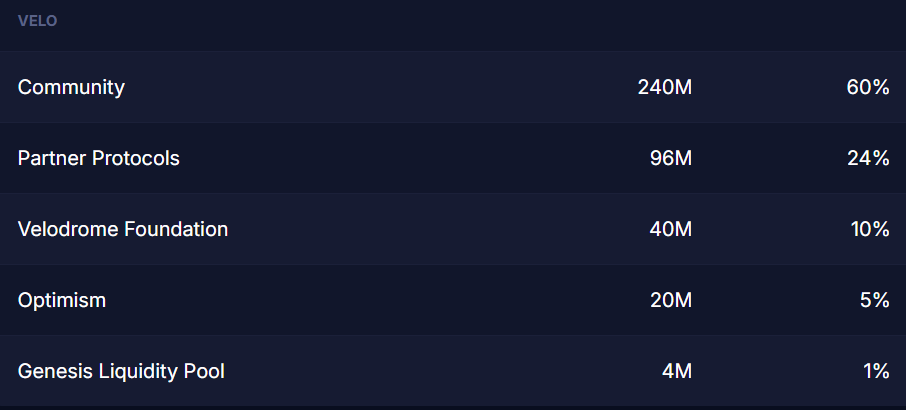

Token Distribution (Total Supply: 400M VELO)

- Community – 240M (60%)

- $WEVE holders: 108M (27%)

- Optimism users: 72M (18%)

- Cross-chain DeFi users (Curve, Convex, Treasure DAO, Platypus, Redacted Cartel, Eminence Finance): 60M (15%)

- Partner Protocols – 96M (24%) distributed via grants and partnerships to 10–15 strategic protocols

- Velodrome Foundation – 40M (10%) fully locked as veVELO, earning 3% of emissions

- Optimism – 20M (5%) locked as veVELO, given for ecosystem support

- Genesis Liquidity Pools – 4M (1%) initially allocated to VELO–USDC pool at launch

Ecosystem

- Next-gen AMM combining Curve, Convex, and Uniswap strengths

- Focused on Optimism network as primary liquidity hub

- Incentives for liquidity providers (LPs) with VELO rewards

- Community-driven governance via veVELO NFTs

- Capital-efficient liquidity distribution to foster ecosystem growth

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.