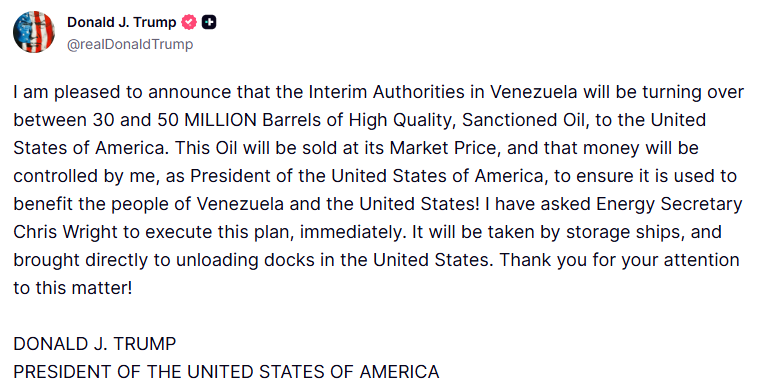

Recent moves by US President Donald Trump have pushed Venezuela back into the global spotlight, not only for its vast energy resources but also for its rumored exposure to digital assets. The announcement that Venezuelan “interim authorities” would transfer between 30 and 50 million barrels of oil to the United States has triggered wider discussions about what other state-linked assets could follow.

A Strategic Oil Transfer

According to Trump’s statement, the oil will be sold at prevailing market prices, with proceeds placed directly under US government control. At an estimated price of around $56 per barrel, the transaction could generate between $1.7 billion and $2.8 billion in value.

This move appears to be more than a one-off operation. The White House has scheduled meetings with executives from major energy firms including Exxon, Chevron, and ConocoPhillips, signaling a broader reassessment of Venezuela’s role in global energy markets. Given that Venezuela holds the world’s largest proven crude oil reserves, Washington’s interest may extend well beyond this initial shipment.

Energy Secretary Chris Wright has reportedly been instructed to move quickly, with oil storage vessels expected to transport the crude directly to US ports.

Attention Shifts to Bitcoin Holdings

With tangible resources now changing hands, market participants have begun questioning whether Venezuela holds other assets of strategic importance—most notably Bitcoin. Years of international sanctions have limited the country’s access to traditional financial infrastructure, making alternative systems a logical area of experimentation.

Speculation around Venezuela’s Bitcoin reserves varies dramatically. Some claims suggest holdings worth tens of billions of dollars, while more conservative estimates place the figure at only a few hundred BTC. To date, none of these claims have been confirmed through on-chain evidence, and no identifiable wallets or custodial arrangements have surfaced.

Why Bitcoin Changes the Equation

Unlike oil, Bitcoin cannot be physically seized or rerouted. Confiscation would require direct access to private keys or cooperation from custodians operating under US jurisdiction. Given Venezuela’s sanctions status, reliance on US-aligned custodians would be highly unlikely.

Any Bitcoin holdings would likely be fragmented across multiple wallets, further complicating attribution. However, this same structure creates a unique risk: if the necessary credentials were obtained, digital assets could be transferred almost instantly, without the logistical barriers associated with physical commodities.

Implications for a Strategic Bitcoin Reserve

These developments intersect with Trump’s stated goal of building a strategic Bitcoin reserve without burdening taxpayers. Critics have questioned how such a reserve could be accumulated without direct market purchases. In theory, asset seizures linked to criminal proceedings could offer one pathway—assuming substantial holdings exist and can be legally tied to sanctioned individuals.

For now, Venezuela’s oil is en route to American shores. Its Bitcoin, if it exists in meaningful quantities, remains locked behind unknown keys—beyond reach, yet impossible to ignore.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.