Crypto analytics firm Glassnode issued important warnings in its latest report on Bitcoin’s current market structure. The company emphasized that price action is becoming increasingly fragile and that Bitcoin must reclaim specific cost-basis levels in order to regain upward momentum. While both on-chain and off-chain indicators are showing signs of pressure, the report also notes that patient buyers are still keeping the price within a controlled range.

Bitcoin Under Pressure: Unrealized Losses Rising

According to Glassnode analysts, Bitcoin is under significant pressure due to rising unrealized losses, increasing realized losses, and heavy profit-taking by long-term holders. These indicators suggest that long-held BTC is moving into the market, creating both psychological and structural weakness.

However, demand has not disappeared entirely. This remaining demand is helping Bitcoin stay above the Realized Price level. This implies that a dedicated group of buyers is still absorbing sell pressure a dynamic that, while fragile, provides essential market support.

Two Critical Levels Bitcoin Must Reclaim

Glassnode highlights two key levels that Bitcoin needs to recover in order to overcome its current vulnerability:

- $95,000 → The 0.75 cost-basis quartile

- Around $102,700 → Short-Term Holder Cost Basis (STH Cost Basis)

Reclaiming these zones is considered critical for bulls to regain strength. Analysts state that unless these levels are breached to the upside, Bitcoin will continue to rely on $81,300 the Realized Market Price as a potential bottom zone.

Sideways Movement Increases Time-Based Pressure

Bitcoin’s prolonged sideways consolidation is becoming increasingly problematic. Extended range-bound price action:

- Damages investor psychology,

- Expands unrealized losses,

- Creates conditions for increased sell pressure.

The Relative Unrealized Loss (30-day SMA) has risen to 4.4%, the highest level in two years, indicating that market stress is increasing visibly.

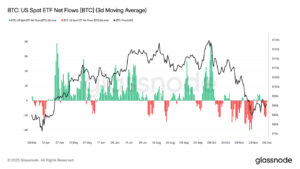

Off-Chain Signals: Weak ETF Flows and Low Liquidity

Off-chain indicators also confirm the weakness. The report notes that:

- Spot Bitcoin ETF flows remain negative,

- Spot market liquidity is low,

- There is no aggressive speculative demand in the futures market.

This environment makes Bitcoin more sensitive to macroeconomic developments.

In the options market, investors are pricing in short-term volatility, with increased demand for protective put options and two-sided defensive structures. This signals caution in the short term but a more balanced outlook further out.

Volatility Expectations

Glassnode believes Bitcoin’s short-term direction depends largely on improved liquidity conditions and reduced seller pressure. As long as liquidity remains tight, the fragile market structure will continue to challenge bullish momentum. If these conditions do not improve, Bitcoin is likely to remain stuck in its current narrow and fragile trading range limiting the potential for meaningful upside breaks.

Assessment

Overall, Glassnode describes the Bitcoin market as “weak but holding on.” Patient demand continues to provide support, but heavy selling pressure is preventing breakout attempts.

According to analysts, for Bitcoin to regain a strong market profile, the following are essential:

- Renewed investor confidence,

- Improved liquidity conditions,

- Reclaiming the critical cost-basis levels.

Otherwise, Bitcoin faces the risk of remaining in a psychologically challenging, time-based pressure zone for an extended period.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.