Bitcoin is once again at the center of attention, entering a renewed accumulation phase across all investor groups. The role of large holders—commonly referred to as whale—has become especially prominent in this cycle.

Whale Activity Spiked Over the Past Week!

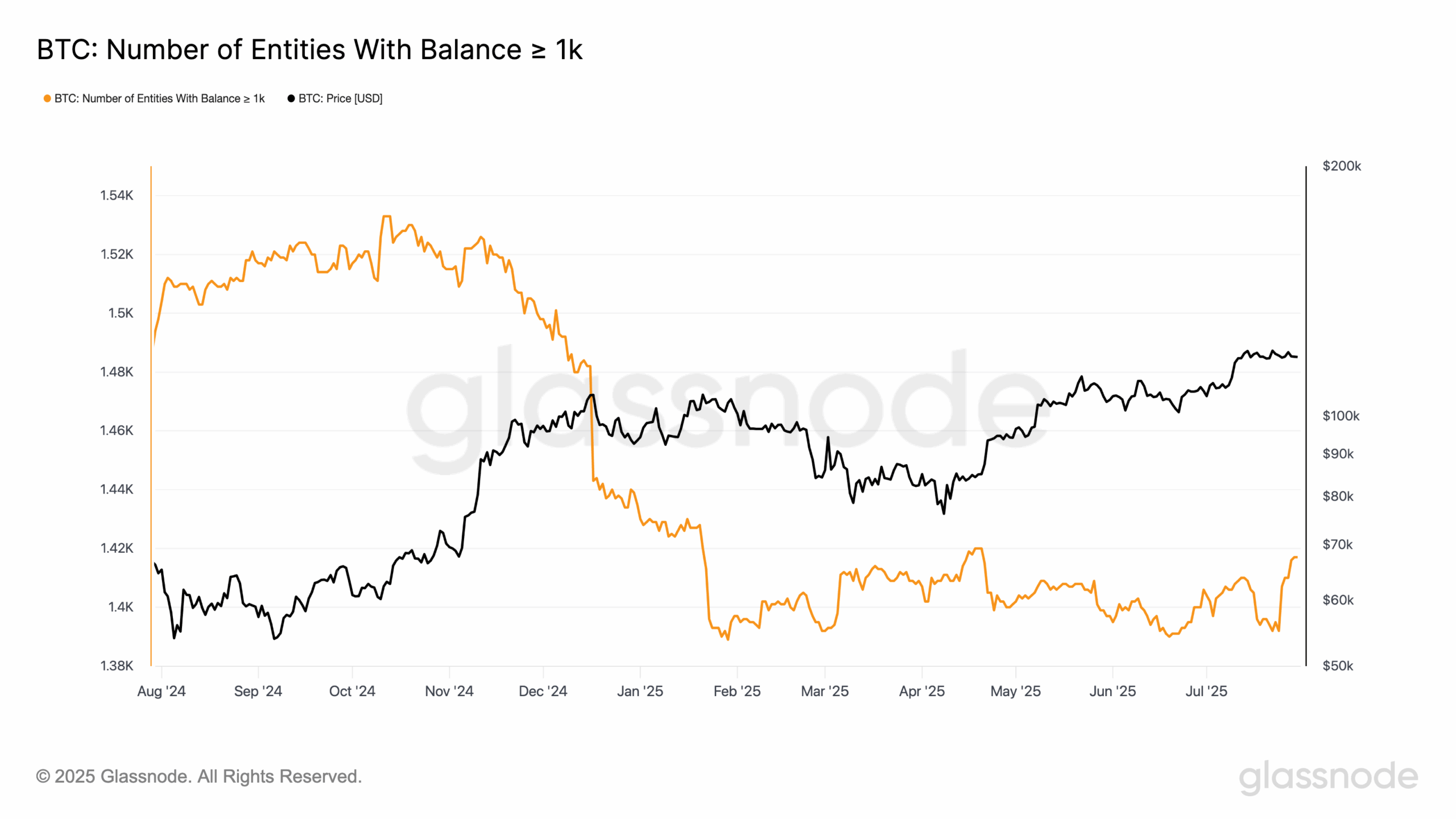

According to data from Glassnode, the number of unique whale entities holding at least 1,000 BTC has increased from 1,392 to 1,417 in just one week. This rise marks one of the highest whale counts of 2025 so far, suggesting a restored confidence among institutional and high-net-worth investors.

Glassnode defines “entities” as individuals or organizations that control multiple addresses but function as a single unit.

Moreover, a key on-chain metric known as the Accumulation Trend Score shows that not only whales but also small holders—those with less than 1 BTC, often called “shrimps”—have been actively accumulating. This alignment between retail and institutional investors is relatively rare and signals a unified market sentiment.

The metric evaluates accumulation strength based on wallet size and purchase behavior over the last 15 days. A score nearing 1 indicates heavy accumulation, while a score approaching 0 reflects distribution. Exchange and miner addresses are excluded to provide a clearer picture of real investor behavior.

Interestingly, the last time such a sustained level of accumulation occurred was in November 2024, during the U.S. election that brought President Trump back to office. That phase was the beginning of a powerful rally that pushed Bitcoin to the $100,000 mark.

With both widespread accumulation and growing whale interest, market analysts are now expressing increased confidence that Bitcoin may be gearing up to retest its all-time highs.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.