The crypto market is turning its attention back to Ripple XRP. According to recent data, whales added 50 million XRP to their wallets over the past seven days. Since the start of 2026, both institutional and retail investors have contributed to this buying wave, with total accumulation exceeding $1 billion. But what does this massive accumulation signal while the broader market remains relatively calm?

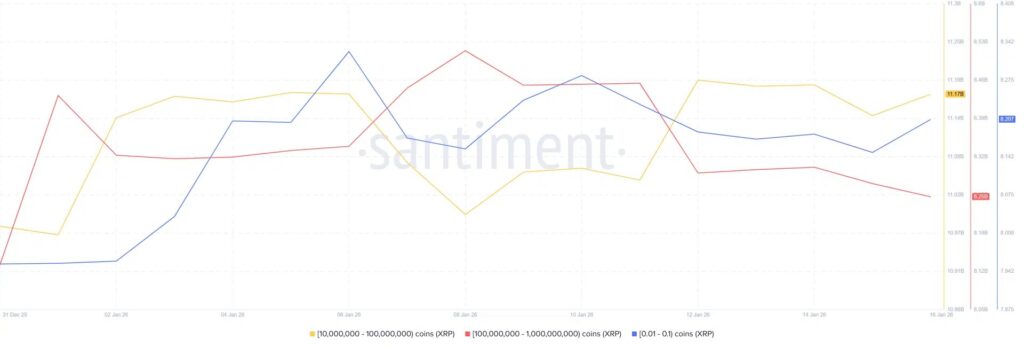

Large Wallets Are Building Positions

On-chain data shows that whales are meaningfully increasing their XRP holdings. The 50 million XRP surge appears more aligned with long-term strategy than short-term speculation.

Despite price fluctuations, these purchases are not coincidental. Large investors tend to build positions during periods of high volatility, suggesting the current price range is perceived as a “risk-adjusted opportunity” by some players.

Retail Investors Also Join the Trend

Accumulation is not limited to whales. According to TheCryptoBasic, retail wallets and whales together have acquired over $1 billion worth of XRP since early 2026.

This trend indicates the market narrative is not one-sided. Small investors often step in during quiet confidence phases before major price moves. In this period, accumulation clearly outweighs distribution.

XRP ETF Flows Begin to Stabilize

Coin Bureau reports that after $40.8 million in net ETF outflows last week, flows have returned to positive territory. This shift may strengthen investor confidence, especially among more traditional participants.

Stabilizing ETF activity could influence overall liquidity behavior in the market. However, it does not guarantee immediate price gains; instead, it signals a gradual restoration of investor trust.

Price Remains Steady Amid Attention

Despite these developments, XRP’s price remains relatively stable. The token traded at $2.06 with a minor 0.04% drop over the past 24 hours, while daily volume exceeded $1.37 billion, reflecting sustained market interest.

Whale buying continues, but the market’s reaction—timing and intensity—remains uncertain. The accumulation phase is far from over, making the coming days critical in determining the asset’s next directional moves.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.