The cryptocurrency market experienced a sharp wave of selling today on a scale not seen in recent months. Bitcoin fell below the psychological $80,000 level for the first time since April, heightening anxiety across the markets. This move is being interpreted not only as a price-based pullback but also as a critical break that has put pressure on investor confidence. Behind this sudden decline are not just technical levels, but a convergence of macroeconomic developments, political uncertainties, and crypto-specific factors all coming into play at the same time.

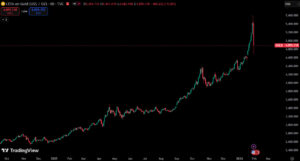

Bitcoin Breaks Below the $80,000 Support

During the day, Bitcoin declined to as low as $78,750, while Binance data showed an intraday low of $75,800. This sharp move signals the loss of the strong psychological support level around $80,000, which the market had long been trying to defend. Bitcoin’s weakness increased overall risk perception across the market, accelerating selling pressure in altcoins and spreading losses more broadly.

Fed Uncertainty and the Kevin Warsh Effect

One of the key triggers behind the decline was uncertainty surrounding the U.S. Federal Reserve. Donald Trump announced that he has nominated Kevin Warsh to replace Jerome Powell, whose term ends in May. Kevin Warsh is widely regarded by markets as a hawkish figure who is less supportive of interest rate cuts. Following this development, expectations for interest rate cuts by the Fed in 2026 weakened significantly. Some Wall Street institutions are even discussing the possibility of interest rate hikes coming back onto the table.

Sharp Declines in Gold and Silver Also Hit Crypto

The weakening outlook for rate cuts did not only impact the crypto market; it also put strong pressure on assets such as gold and silver, which had been rallying for an extended period. The pullback in precious metals reinforced risk-off sentiment across markets and triggered chain reactions of selling in Bitcoin and altcoins, which are considered risk assets. This macro shift pushed investors toward more cautious positioning and led to a rapid decline in risk appetite within the crypto market.

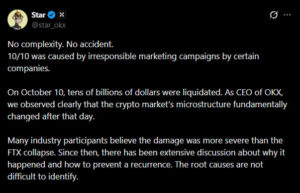

Binance and October 10 Liquidation Debates

Internal dynamics within the crypto market may also have contributed to the depth of the recent decline. In recent days, several influential market participants have suggested that the current pullback may be linked to technical issues and large-scale liquidations that occurred on Binance on October 10. Particularly in derivatives markets, forced liquidations are said to have weakened overall liquidity and accelerated selling pressure.

Some market commentators argue that the scale of these liquidations may have been even larger than those seen during the FTX collapse, potentially causing lasting damage to the structural balance of the crypto market. These discussions have further increased uncertainty, acting as an additional pressure point that limits risk appetite and deepens the loss of confidence among investors.

Geopolitical Risks Back in Focus

In addition to macroeconomic and sector-specific developments, geopolitical risks are also weighing on the markets. Donald Trump’s:

- Demand for Greenland from Denmark

- Desire to reassert control over the Panama Canal

- Weakening prospects for peace in the Russia–Ukraine war

- Rumors of a potential U.S. intervention against Iran

have significantly increased global risk perception. Moreover, Trump’s continued threats of imposing tariffs on countries opposing his demands have further deepened market uncertainty.

Multiple Factors at Work Simultaneously

The sharp decline seen today in Bitcoin and altcoins cannot be explained by a single cause. Uncertainty surrounding the Fed, rapid shifts in interest rate expectations, liquidation debates linked to Binance, the pullback in precious metals, and rising geopolitical risks are all simultaneously exerting pressure on the cryptocurrency market. The combination of these factors is strengthening investors’ risk-averse behavior and suggests that market volatility may remain elevated in the short term.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.