As the crypto market went through a sharp correction in November, one important metric closely tied to investor behavior stablecoin exchange reserves rose noticeably. Despite the total crypto market falling to its lowest level in four months, the increase in stablecoin reserves signals a different kind of activity within the market’s internal dynamics. This suggests that instead of abandoning crypto, investors are moving capital into “wait mode,” preparing for their next move.

Why Are Stablecoin Reserves Rising?

In November, the crypto market lost about 12.3%, falling to its lowest levels since July. Total market capitalization dropped from $3.6 trillion on November 1 to $3.19 trillion. Losses in major assets reinforced this picture. Bitcoin struggled to hold key psychological levels, dipping below $100,000 several times and briefly falling under $97,000 today. Ethereum fell more than 17% in November, dropping to the $3,200 range.

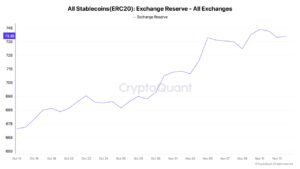

Despite all this pressure, stablecoin reserves are moving in the opposite direction. According to CryptoQuant data, approximately $2.63 billion worth of stablecoins flowed into exchanges during November. This increase shows that in periods of market turbulence, investors shift toward safer asset classes. Stablecoins especially USDT and USDC serve as digital cash during uncertain times, offering an ideal parking zone for investors seeking to minimize risk.

Alongside the rise in stablecoin reserves, another critical signal is the noticeable decline in stablecoin withdrawals from exchanges. This indicates that investors are keeping their stablecoins on exchanges rather than moving them off-platform. In other words, capital is not leaving the market; it is staying on the sidelines.

CryptoQuant analyst Maartunn recalls that when Bitcoin approached $125,000, stablecoin outflows exceeded 72,000, but now the trend has completely reversed. This behavioral shift shows that investors are not exiting the market they are waiting for opportunities.

The “Dry Powder” Effect: A Hint of an Upcoming Rally?

The large amount of stablecoins accumulating on exchanges is often referred to as “dry powder” in the crypto market. This term refers to potential liquidity that can be deployed quickly when favorable conditions arise. Analysts interpret the situation as follows:

“Stablecoins are piling onto exchanges. This is one of the clearest signals that new capital is preparing to be deployed. Such strong inflows were also observed during previous cycles when the market was gathering liquidity right before a major move.”

Stablecoin accumulation has historically signaled major rallies. When investor sentiment shifts suddenly, these reserves can rapidly turn into Bitcoin and altcoin purchases, igniting a new wave of bullish momentum.

Capital Is Not Flowing Into Bitcoin Yet

Analysts at Swissblock note that while rising liquidity is a positive signal, it has not yet translated into significant capital inflows to Bitcoin. Bitcoin is currently trying to hold the $97,000–$98,500 support zone.

According to analysts, two main scenarios could restart capital inflows:

- Capitulation scenario

A sharp drop in Bitcoin to around $95,000 could create an attractive entry point for aggressive buyers. - Restoration of confidence

If Bitcoin reclaims the $100,000 level, it could signal market strength and trigger new capital inflows.

Until one of these scenarios occurs, most of the stablecoin reserves will likely remain in waiting mode.

Rising Stablecoin Reserves Signal the Market Is Preparing for Battle

Overall, while the crypto market remains under pressure, the increase in stablecoin reserves on exchanges shows that investors are not fleeing—on the contrary, they are waiting and watching for opportunities. This liquidity could lay the groundwork for a strong wave of upward momentum in Bitcoin and altcoins once the right trigger emerges.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.