Although crypto markets are inherently highly volatile, the past year has been a true rollercoaster experience marked by record liquidations, political scandals, deep price corrections, and historic lows. Especially after Bitcoin surpassed $126,000 in 2025 to reach an all-time high, the market entered a sharp correction phase contrary to expectations. Here is a detailed summary of the critical events that occurred during this turbulent period and etched themselves into investors’ memories:

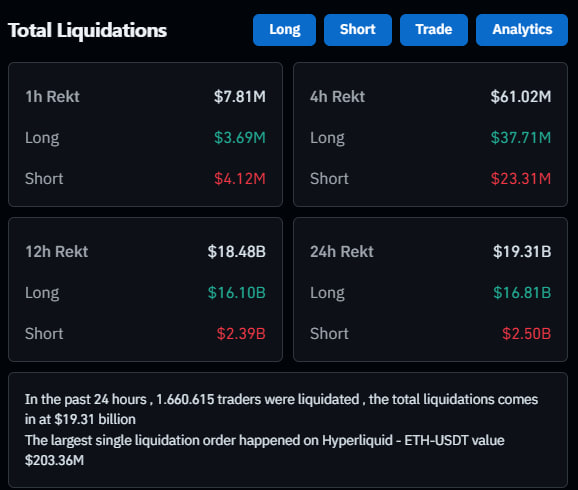

The Largest Liquidation in History: $19 Billion Evaporated

On the night of October 11, 2025, crypto markets witnessed the largest leveraged position liquidation in history. U.S. President Donald Trump’s threat to impose new and high tariffs on Chinese imports suddenly ended global risk appetite and created a massive shock wave in financial markets. Cryptocurrencies were also heavily affected, with over $19 billion in leveraged positions liquidated in just hours. This massive liquidation left many investors in difficult situations while painfully highlighting the market’s vulnerability due to leverage once again.

Bitcoin (BTC) experienced a sharp drop, spiking down from $122,000 levels to below $103,000.

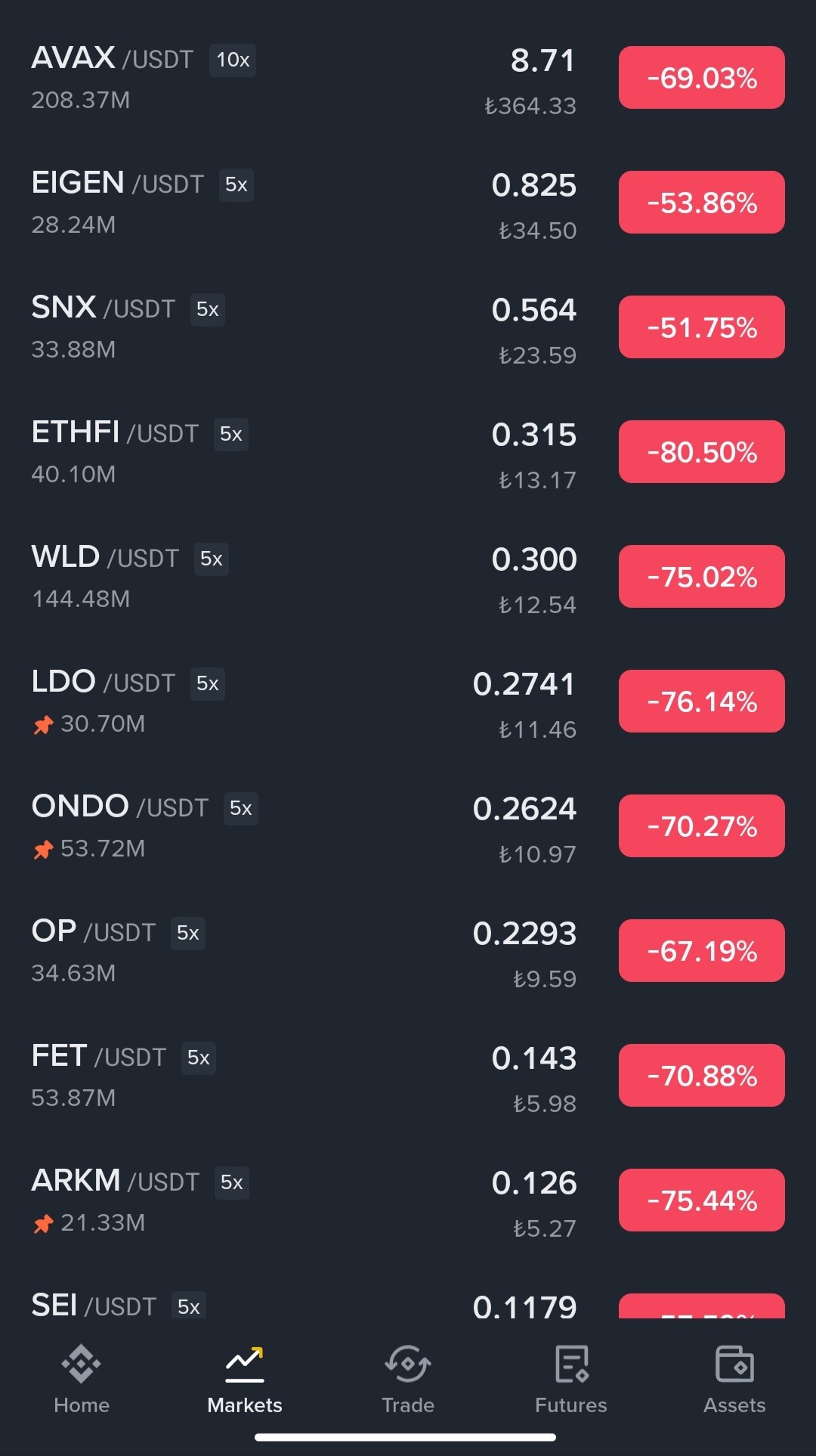

Up to 70% Value Losses in Altcoins on October 11 Night

On the night of October 11, when the record $19 billion liquidation occurred, alongside Bitcoin’s sharp drop, altcoin markets saw massive losses of up to 70%. Particularly high-leverage altcoins with smaller market caps compared to Bitcoin melted away in this panic selling wave. For example, popular altcoins like XRP and Dogecoin (DOGE) experienced significant value losses. The total crypto market cap dropped by approximately $800 billion in just a few hours, falling from $4.3 trillion to $3.64 trillion. These sharp declines once again reminded investors of the risks of leveraged trading and the devastating impact of market shocks on altcoins.

Many Altcoins Dropped to Their Historic Lows

2025 was like a winter season for many altcoins. As a result of deep market-wide corrections and investors shifting toward Bitcoin (increasing “Bitcoin Dominance”), numerous altcoins approached or retested their all-time lows. This was particularly devastating for projects that had inflated with speculative buying during the 2021 and early 2024 bull runs.

Argentina President Scandal: LIBRA Coin and 99% Collapse

In February 2025, Argentine President Javier Milei’s social media post supporting a “meme coin” project called LIBRA caused a major scandal in the crypto market. The coin, associated with the president’s dog’s name, rapidly rose in the first hours with presidential backing, reaching a $4.5 billion market cap. However, immediately after this rapid rise, doubts about the project’s reliability and Milei’s deletion of his posts led to LIBRA’s value collapsing by nearly 99% in hours, dropping to $200 million. This event exposed the extremely speculative nature of meme coin projects and the manipulative influence of political figures, causing many investors to suffer massive losses.

Ethereum Spiking Down to $1,380

The general market correction that began after Bitcoin reached historic highs deeply affected Ethereum (ETH), the largest altcoin. During the sharp price movements in 2025, Ethereum experienced a steep drop to $1,380 levels at one point.

Having shown more resilient performance earlier in the year with less loss relative to Bitcoin, Ethereum retreated to these important psychological levels amid overall market uncertainty and selling pressure. This drop was a concrete example of how panic in the market and macroeconomic factors can impact even the strongest projects.

Fear Index Hit Its Lowest Level in the Last 3 Years

The Fear and Greed Index, which measures sentiment in crypto markets, dropped to 9 amid all these turbulences, reaching one of the lowest levels in the past three years. Values close to 0 on the index represent “Extreme Fear,” while values close to 100 represent “Extreme Greed.”

The index falling to 9 indicated that investors were in great panic and uncertainty, completely avoiding risk, with intense selling pressure dominating the market. Although this level is typically considered close to market bottoms, it was striking data revealing how worn investor psychology was and how shaken confidence in the market had become.

An Unforgettable Year in the Crypto Markets

This chain of events proved that the past year was an unforgettable and lesson-filled period for crypto markets. Excessive leverage, macroeconomic uncertainties, and sudden collapses triggered by political events forced investors to rethink the importance of risk management and market sentiment.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.