Aave is a decentralized DeFi protocol that allows users to lend their crypto assets to earn interest, borrow against collateral, and implement various investment strategies.

The protocol was originally launched in 2017 as ETHLend, using a peer-to-peer (P2P) lending model. In 2018, it rebranded to Aave and adopted a more efficient pool-based system. “Aave” means “ghost” in Finnish.

Initially built on Ethereum, Aave now operates across multiple networks, including Polygon, Avalanche, Fantom, Arbitrum, and Optimism.

One of Aave’s key features is its liquidity pools. Lenders deposit assets into pools, and borrowers can instantly draw credit from these pools. This pool-based system is faster and more efficient than the traditional one-to-one lending model.

Founder & Team

- Founder / CEO: Stani Kulechov

- Studied law at the University of Helsinki and developed an interest in Ethereum and blockchain technology.

- Developed ETHLend in 2017 and launched the LEND token.

- Transitioned ETHLend to Aave in 2020, migrating LEND tokens to AAVE.

Investors & Partners

Aave launched its LEND tokens through a $16.2 million ICO.

Key investors and partners:

- ParaFi Capital

- Blockchain Capital

- Three Arrows Capital

- Standard Crypto

These partnerships helped Aave establish a strong reputation in the DeFi ecosystem.

Project Vision & Purpose

Aave aims to create fast, secure, and permissionless crypto lending and borrowing systems. Its goal is to make it easy for users to borrow different crypto assets by posting collateral, earn interest, and accelerate mainstream adoption of decentralized finance.

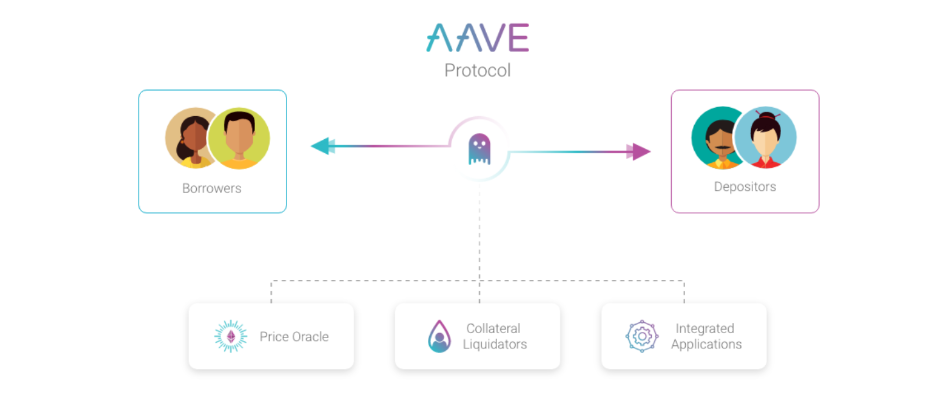

How Aave Works

- Lending Pools: Users deposit assets into pools, and borrowers can access funds instantly.

- aTokens: When users deposit assets, they receive aTokens (e.g., deposit ETH → receive aETH), which automatically earn interest.

- Interest Rates: Dynamic based on pool demand; rates increase with high demand and decrease to attract borrowers.

- Overcollateralization: Borrowers deposit more than the borrowed amount. If collateral drops, automatic liquidation occurs.

- Flash Loans: Instant, uncollateralized loans within a single block for arbitrage, debt refinancing, or DeFi strategies.

Governance

- AAVE Token: Used for protocol governance and staking.

- Token holders can vote on protocol changes and new features.

- stkAAVE holders are also eligible to participate.

- Stake tokens in the Safety Module to earn passive income.

- Aave Governance V3 enables multi-chain governance at low network costs.

Asset Representation (Aave V3)

- aToken: Represents deposited assets and accrued interest.

- StableDebtToken: Represents fixed-rate debt positions.

- VariableDebtToken: Represents variable-rate debt positions.

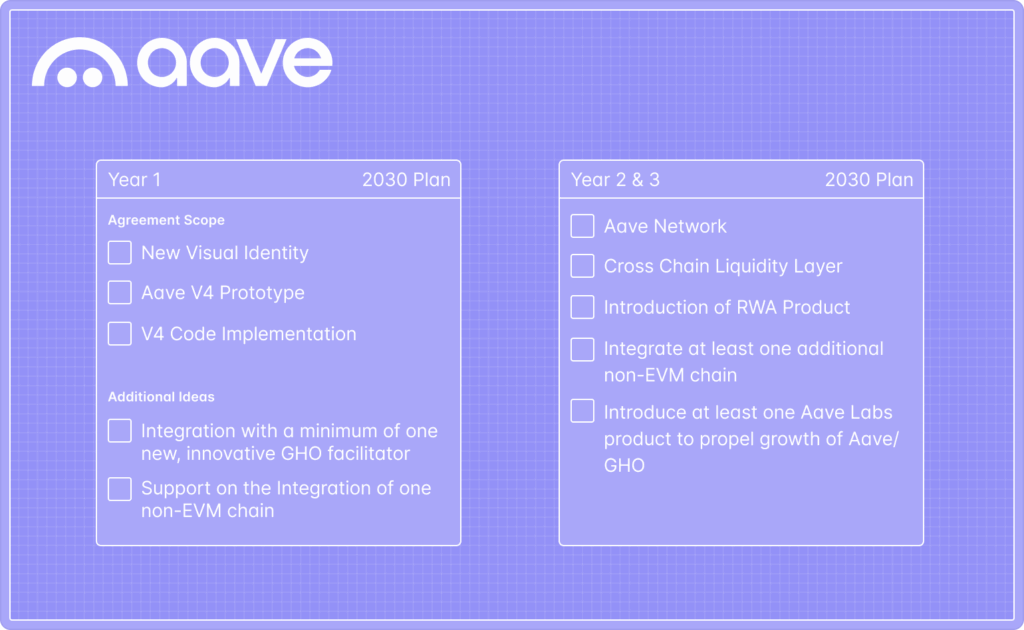

Roadmap

2017: ETHLend ICO & LEND token launch

2018: ETHLend rebrands to Aave

2020: LEND → AAVE token migration

Aave 2030 Plans:

Year 1:

- New Visual Identity

- Aave V4 Prototype & Code Implementation

- Integrate at least one innovative GHO facilitator

- Support for one non-EVM chain

Year 2–3:

- Expand Aave Network

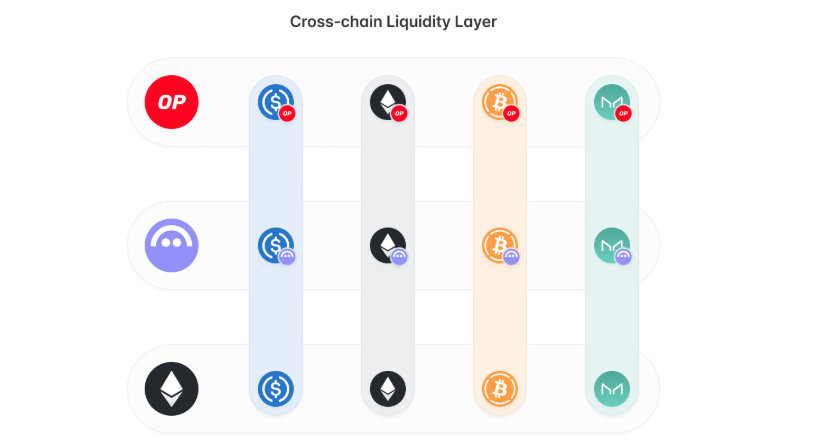

- Cross-chain liquidity layer

- Launch RWA (Real-World Asset) product

- Add at least one additional non-EVM chain

- Introduce at least one Aave Labs product to accelerate Aave/GHO growth

Token Use Cases

- Governance: Vote on protocol decisions.

- Liquidity Pools: Earn returns by contributing AAVE to pools.

- Staking: Contribute to protocol security and earn rewards.

- Collateral: Use AAVE to borrow other assets.

- Cross-Chain: Utilize AAVE across different blockchain networks.

Token Details

- Token Name: AAVE

- Total Supply: 16M AAVE

- Max Supply: Not specified

- Circulating Supply: 15.23M AAVE

Distribution:

- Team & founders: 10–15%

- Investors & partners: 15%

- Liquidity & incentives: 70–75%

Ecosystem

- Built on Ethereum

- Supports lending/borrowing of 17+ crypto assets

- Offers opportunities via liquidity pools and flash loans

Key Features

- Decentralized and secure lending system

- Automatic interest accrual via aTokens

- Flash Loans for uncollateralized borrowing

- Governance and staking for community participation

- Overcollateralization to protect lenders

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.