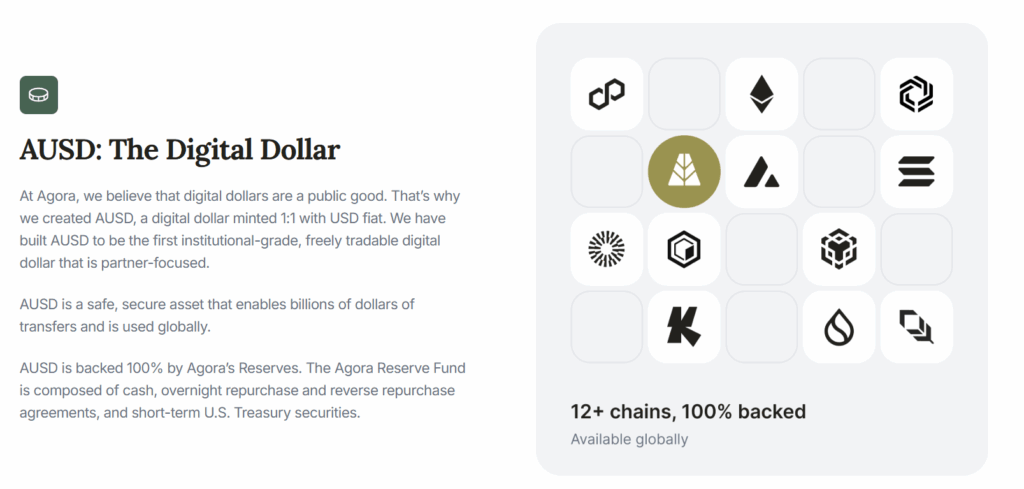

Agora is a blockchain platform aimed at accelerating financial transactions and promoting global adoption of digital currency. At the center of its ecosystem is AUSD (Agora Dollar), a stablecoin backed 1:1 with USD, allowing users to conduct secure, fast, and low-cost digital transactions.

What is AUSD Stablecoin?

AUSD can be used for decentralized transfers, DeFi applications, payments, NFTs, and digital voting solutions. Gas optimization ensures low transaction fees, while providing secure infrastructure for institutional partners.

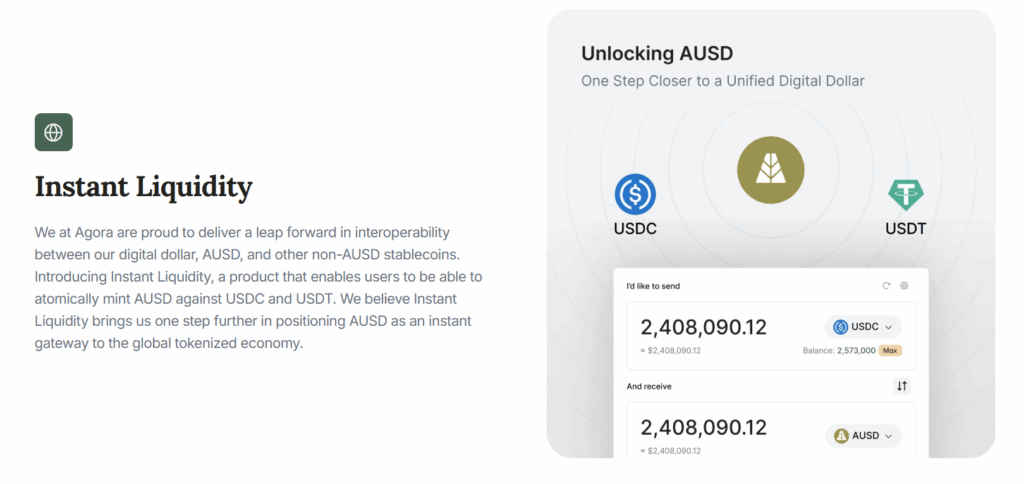

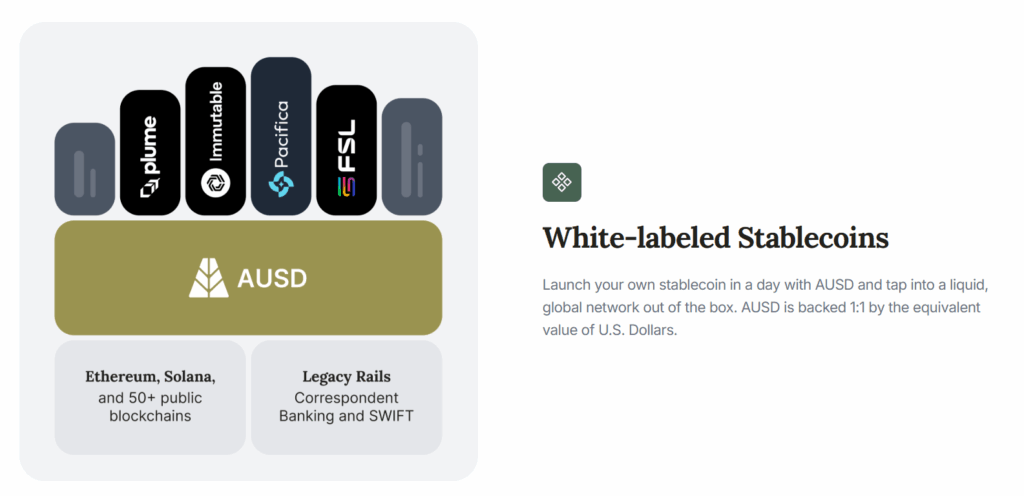

AUSD’s Instant Liquidity feature allows users to atomically mint the token against USDC and USDT. Cross-Chain Bridging enables transfers across different blockchains, and White-Labeled Stablecoin infrastructure allows partners to launch their own stablecoins within a day.

AUSD is 100% backed by the Agora Reserve Fund, consisting of cash, overnight repurchase/reverse repurchase agreements, and short-term U.S. Treasury securities, ensuring security and constant accessibility.

What is $AUSD?

$AUSD is the official token symbol on the Agora platform. It is a 1:1 USD-backed stablecoin serving as a secure payment and transfer medium for both institutional and individual users. It integrates with Ethereum, Solana, 50+ public blockchains, and traditional finance rails (Correspondent Banking and SWIFT). Users can atomically mint AUSD against USDC and USDT, enabling interoperability across stablecoins.

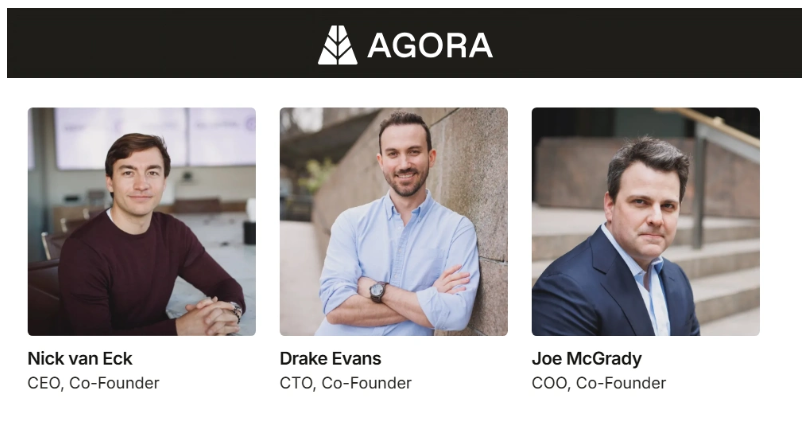

Team and Founders

The Agora project is managed by a team with extensive experience in blockchain, finance, and technology:

-

Nick van Eck – CEO, finance and crypto leader

-

Drake Evans – Blockchain and DeFi solutions expert

-

Joe McGrady – Token economics and financial infrastructure specialist

-

Tony Zhao (potential) – Development and strategy advisor

Investors and Notable Partners

Agora raised $12M in seed funding (2024) and $50M in Series A (2025), totaling $62M, led by Paradigm (Charlie Noyes). Other investors include Dragonfly (early-stage supporter) and VanEck (strategic partner for reserve management).

Notable Partnerships:

-

Blockchains: Avalanche, Solana, Polygon, Injective, Mantle, Sui, Monad (native AUSD integration)

-

Financial Institutions: VanEck (reserve management), State Street (custody), Galaxy (OTC trading)

-

DeFi & Payment Providers: Alchemy Pay (173+ countries fiat on-ramp), Mercado Bitcoin (Brazil), BENQI (Avalanche lending), Upshift (earnAUSD yield product)

-

Others: Wormhole (cross-chain bridging), AggLayer (native stablecoin), CB Insights (2025 Top 100 Fintech Startup)

Project Concept

-

Core Idea: Create a reliable digital dollar (AUSD) backed 1:1 with USD, minimizing barriers to access, transfer, and usage.

-

Scope: Extends beyond financial services to secure digital voting (VOTE token) and low-latency streaming capabilities.

How the Project Works

Agora mints AUSD 1:1 with USD, with reserves managed by VanEck and State Street (cash, repo agreements, short-term US Treasuries). Users can acquire AUSD with fiat, perform cross-chain transfers via Wormhole, and mint AUSD atomically against USDC/USDT.

Partners can launch their own stablecoins on AUSD infrastructure via White-Label Stablecoin services. Gas-optimized transactions are fast and low-cost (e.g., seconds on Injective network).

Ecosystem Products

-

Instant Liquidity: Atomic minting against USDC/USDT

-

Cross-Chain Bridging: Compatibility across 12+ blockchains (Ethereum, Avalanche, Solana, etc.)

-

earnAUSD: Yield-bearing version via Upshift, enabling DeFi basis trade opportunities

AUSD is ERC-20 based with advanced ERC standards and available on 12+ chains: Ethereum, Solana, Polygon, Avalanche, Arbitrum, Optimism, Plume, Immutable, FSL, Pacifica, and enterprise/cat2 solutions.

-

Security via RBAC (Role-Based Access Control)

-

Token Transfer: By users and delegates

-

Minting/Burning Mechanisms: Supply and inflation control

-

Asset Freezing: For financial crime or misuse

-

Gasless Transfers: ERC-3009 for user-friendly transactions

Governance

-

Admin: Contract upgrade, role assignment, and revocation

-

Pauser: Pause/resume contracts

-

Freezer: Freeze tokens

-

Minter: Token minting

-

Burner: Token burning

Token Use Cases

-

Digital payments

-

Lending/borrowing on DeFi platforms

-

NFT and digital asset transfers

-

Institutional and retail financial transactions

Token Information

-

Name: Agora Dollar (AUSD)

-

Standard: ERC-20 (supports ERC-712, ERC-1271, ERC-2612, ERC-3009)

-

Stablecoin: 1:1 USD

-

Features: Gas optimization, RBAC, freezing, minting/burning

-

Total Supply: 128.9M AUSD

-

Circulating Supply: 128.9M AUSD

-

Max Supply: ∞

Ecosystem and Features

AUSD ecosystem provides secure, continuous access to digital finance. Instant Liquidity allows fast atomic swaps with USDC/USDT. Cross-Chain Bridging enables multi-chain transfers. White-Labeled Stablecoin infrastructure allows partners to quickly launch their stablecoins. Supported by ERC and Solana standards, the ecosystem is designed for both retail and institutional users, offering low-cost, secure digital financial services.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.