The crypto ecosystem is pushing boundaries to reshape traditional investments. Yet, costly stocks, lengthy settlement times, and steep fees exclude smaller investors. Allo (RWA) eliminates these barriers: the world’s first 24/7 tokenized stock exchange. This blockchain-powered platform has tokenized $2.2 billion in RWAs, staked $50 million in BTC, and established a $100 million lending facility. Allo tokenizes stocks on a 1:1 basis for fractional ownership—for instance, 1 aAAPL equals 1 actual Apple share. With zero fees, instant settlement, and DeFi integration, it democratizes investing.

In this article, we’ll dive into Allo’s architecture, staking mechanisms, tokenomics, and team. Ready to step into this innovative realm where real-world assets meet blockchain?

What is Allo (RWA)?

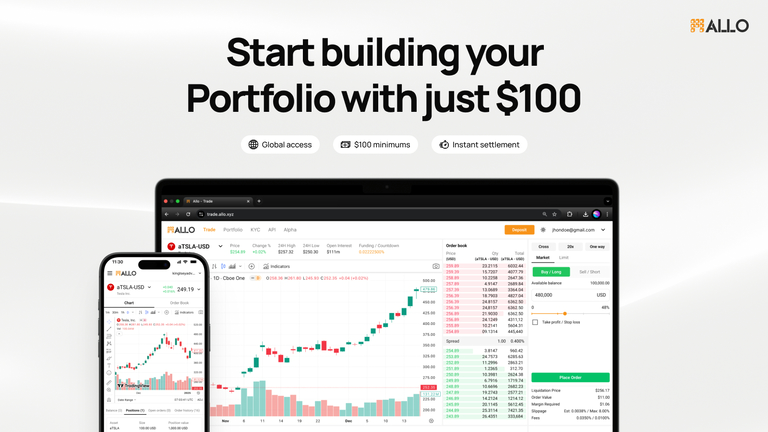

Allo (RWA) is a decentralized protocol for Real World Assets (RWAs). It brings actual stocks onto the blockchain: every token mirrors a real asset held in secure custody on a 1:1 ratio. Users can buy or sell fractions of premium stocks like Apple or Tesla—0.5 aTSLA represents 0.5 genuine Tesla shares. Operating on BNB Chain and Solana, the platform features zero commissions and fully transparent on-chain transactions.

Allo’s strength lies in liquidity and accessibility. Unlike traditional exchanges, it’s open 24/7; smart contracts reduce settlement to minutes. With $2.2 billion in tokenized assets, $50 million in staked BTC, and a $100 million lending pool, its growth is evident. Liquid Staking Tokens (LSTs) like AlloBTC let BTC holders earn yields while preserving liquidity. Babylon integration amplifies rewards; DeFi composability enables lending and borrowing.

Allo standardizes RWA tokenization: real estate, commodities, art, and financial instruments migrate to blockchain. KYC/AML compliant; fractional ownership makes high-value assets reachable. In 2025, Season 2 of the Points campaign rewards on-chain interactions—trading and PnL contests accumulate points.

Allo’s Origins: Vision and Growth Trajectory

Allo launched in 2024 to democratize tokenized stock trading. Founders identified traditional markets’ sluggishness and costs, crafting a blockchain solution. Phase one introduced BTC staking and AlloBTC minting. By 2025, $2.2 billion in RWAs were tokenized; DeepFund enabled on-chain funds, and the Tokenize module digitized assets.

The platform evolved rapidly: Allo Chain as its dedicated blockchain, Trade module with perpetual order books, and a $100 million Lend facility. Season 1 kicked off with social tasks (Galxe Quests, giveaways); Season 2 (May 2025) shifted to on-chain trading and competitions. Allo unlocked global RWA markets—no geographic limits, 24/7 operations.

Allo’s Features: Innovative and User-Centric

Allo delivers a fully integrated ecosystem for RWAs and BTC:

- 1:1 Backing: Tokens fully collateralized by real assets.

- Zero Fees: No commissions or spreads.

- Fractional Ownership: Divide expensive assets into pieces.

- Transparency: All activity on-chain.

- DeFi Integration: AlloBTC for lending and yield farming.

It supports perpetual assets, order books, and TP/SL orders. Track open positions and history for professional-grade trading.

Allo’s Products: Five Core Modules

Allo unites RWAs and BTC through five primary components:

- Allo Chain Custom blockchain infrastructure: fast, low-cost transactions. Bridges to BNB and Solana.

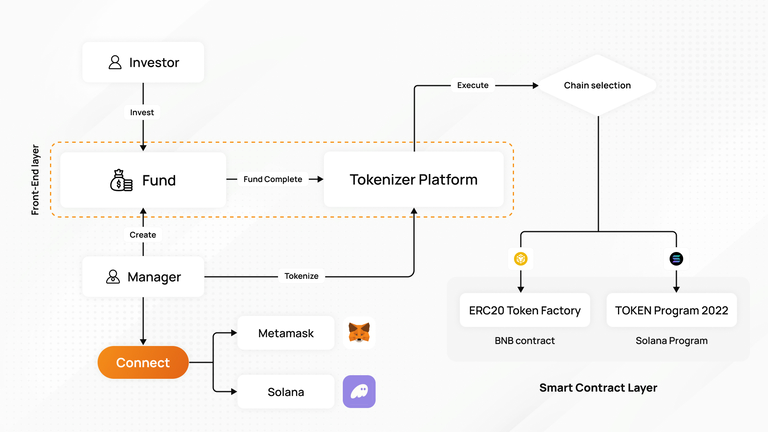

- DeepFund (On-Chain Funds) Migrates investment funds to blockchain with MultiSig security.

Workflow:

- Connect wallet (MetaMask/Phantom).

- Define fund parameters (target, duration, signers).

- Create MultiSig (e.g., 3/5 approvals).

- Investors contribute (USDC, ETH).

- Tokenize upon target.

- Mint ERC20 (BNB) or TOKEN 2022 (Solana).

- Distribute tokens to treasury.

Benefits: Security, transparency, liquidity. Tokens tradable or redeemable.

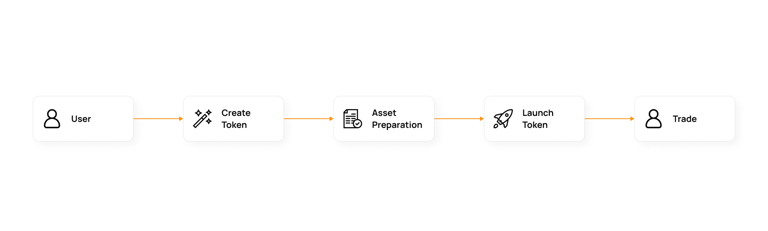

- Tokenize RWA digitization module: real estate, SPVs, commodities, art, financial instruments.

Process:

- User creates token.

- Prepare asset (legal/technical).

- Launch.

- Begin trading.

Blockchain security, fractional ownership, 24/7 liquidity. Compliance mandatory (KYC/AML).

- Trade Tokenized stock marketplace: one-click buys/sells.

Features:

- Perpetual order book.

- Various order types.

- Positions, history, TP/SL.

- Unrestricted global access.

- Smart contract automation.

Cuts costs, boosts efficiency.

- Lend BTC lending facility: $100 million capacity.

With AlloBTC:

- Stake BTC, receive AlloBTC.

- Use as lending collateral.

- Combine staking + lending yields.

Babylon boosts rewards. Maintains liquidity, minimizes risks.

Allo Staking: Liquid BTC via AlloBTC

AlloBTC revolutionizes BTC staking as an LST preserving liquidity.

Phase 1:

- Connect EVM wallet.

- Get BTC deposit address.

- Send, await 6 confirmations.

- COBO Vault API verification.

- Monitor dashboard.

- Mint AlloBTC, send to wallet.

Advantages:

- Yield + liquidity.

- DeFi composability.

- Babylon enhancement.

- No lockup risks.

AlloBTC usable for lending/trading—BTC enters DeFi.

Allo Points: Incentive Campaign

Season 1: Off-chain (Twitter, Discord giveaways, Galxe Quests).

Season 2 (May 2025): On-chain.

- Open positions on AlloX.

- Weekly PnL contests.

Points accumulate for future rewards.

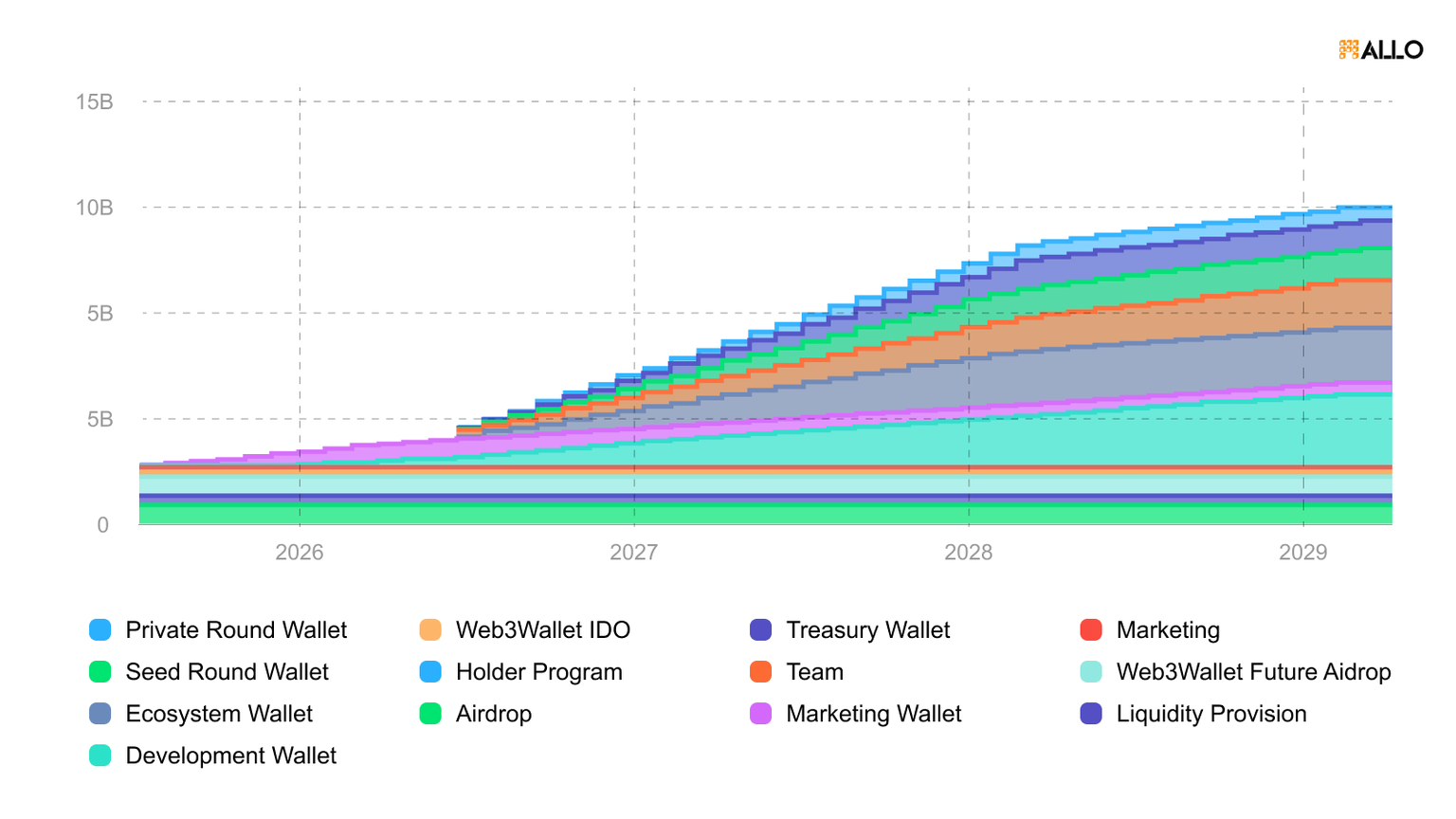

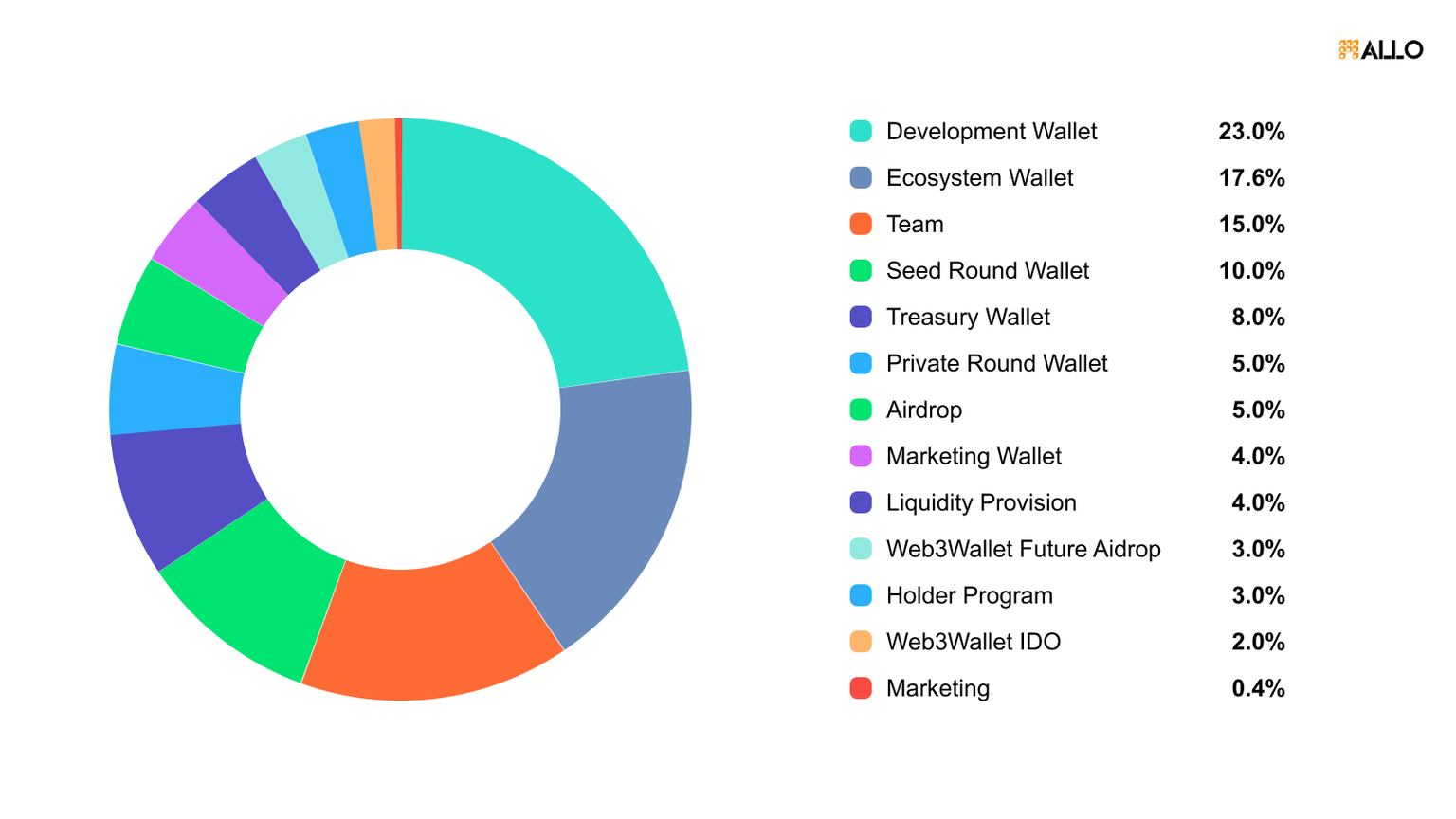

Allo Tokenomics: $RWA and Vesting

Total supply: 10 billion $RWA.

Allocation:

- Development: 23% (2.3B, 4-year linear, 2025-2029)

- Ecosystem: 17.6% (1.76B, 1-year cliff + 2-year linear, 2026-2028)

- Team: 15% (1.5B, 1-year cliff + 3-year linear, 2026-2029)

- Seed: 10% (1B, 1-year cliff + 2-year linear, 2026-2028)

- Treasury: 8% (800M, 1-year cliff + 2-year linear, 2026-2028)

- Private: 5% (500M, 1-year cliff + 2-year linear, 2026-2028)

- Airdrop: 5% (500M, immediate, 2025)

- Marketing Wallet: 4% (400M, 11-month linear, 2025-2026)

- Liquidity: 4% (400M, immediate, 2025)

- Future Airdrop: 3% (300M, immediate, 2025)

- Hodler Program: 3% (300M, immediate, 2025)

- IDO: 2% (200M, immediate, 2025)

- Marketing: 0.4% (40M, immediate, 2025)

Native tokens: AlloBTC & ALLO (BNB Chain).

Vestings ensure long-term sustainability.

Allo Investors and Partners

Allo boasts a robust support network. BNB Chain provides infrastructure for speed and affordability; Gate.io handles listings and liquidity. Early funding and strategic guidance come from Neo Global Capital, Chainfund Capital, Cluster Capital, Morningstar Ventures, and Cogitent Ventures.

Babylon enhances staking yields, while ChainLink delivers oracle integration. Technical collaborations include The BNB Network, Nakamoto, Suig, and Ton Strategy Co.; market expansion partners are Forward Industries, Ethzilla, and Satsuma. These alliances position Allo as an RWA leader—offering global reach and cutting-edge solutions.

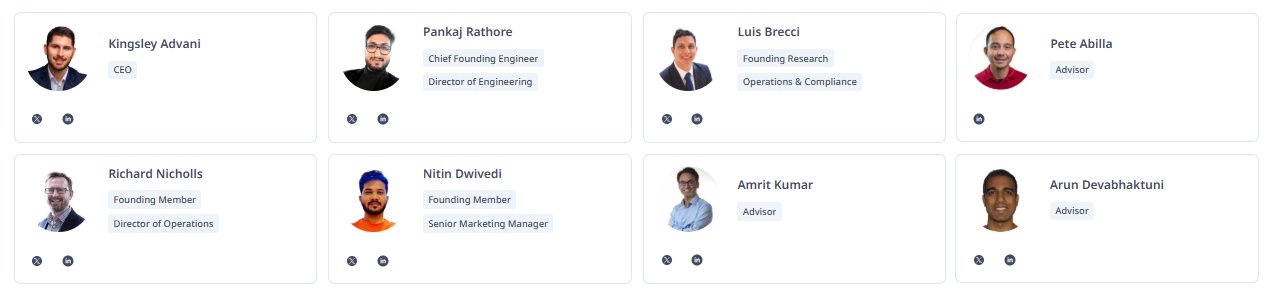

Allo Team: Seasoned Visionaries

Allo is steered by industry pioneers.

Kingsley Advani – CEO. Drives strategic leadership and growth vision.

Pankaj Rathore – Chief Founding Engineer & Director of Engineering. Architects technical framework and development.

Luis Brecci – Founding Research, Operations & Compliance. Expert in research and regulatory adherence.

Richard Nicholls – Founding Member & Director of Operations. Ensures operational efficiency.

Nitin Dwivedi – Founding Member & Senior Marketing Manager. Crafts marketing strategies.

Advisors:

- Amrit Kumar: Blockchain specialist.

- Pete Abilla: Operations consultant.

- Arun Devabhaktuni: Strategic guide.

With decades of RWA and DeFi expertise, the team continually advances the platform.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest newsand updates.