The decentralized finance (DeFi) ecosystem is evolving into a more complex, competitive, and professional structure every day. This transformation makes the technological gap between individual investors and institutional players even more visible, while highlighting automation and AI-driven solutions. This is exactly where Almanak (ALMANAK) stands out as a next-generation AI-based DeFi Agent Platform that goes beyond traditional DeFi tools.

Almanak provides an agent-based infrastructure that allows users to create, test, optimize, and directly deploy automated financial strategies on the blockchain. The platform’s core mission is to make professional-level quantitative (quant) strategies accessible to everyone.

What is Almanak?

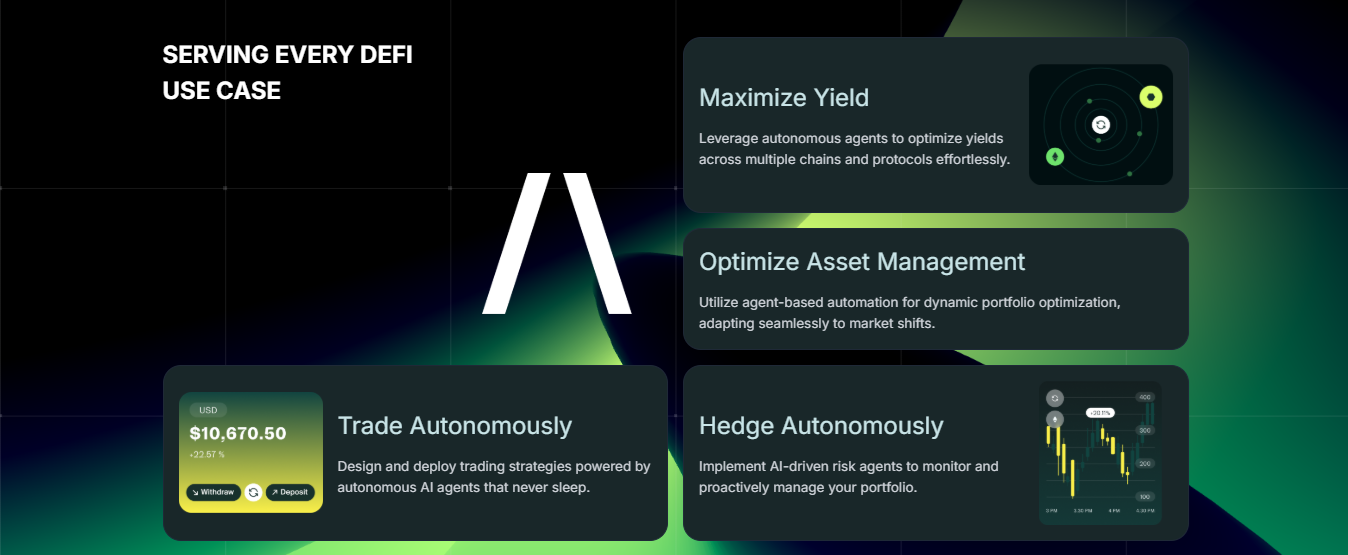

Unlike classic DeFi bots that operate on fixed rules, Almanak uses AI-powered financial agents that analyze market conditions, perform risk calculations, and become increasingly adaptive over time. This enables:

- Elimination of manual trading requirements

- 24/7 automated strategies

- More dynamic risk management

- Simultaneous operations across different chains and protocols

The platform particularly appeals to the following user groups:

- Active DeFi investors

- Developers

- Portfolio managers and professionals

- Individual users seeking automation and advanced analytics

Core Building Blocks of Almanak

Deployments

Deployments allow users’ created strategies to be turned into fully autonomous applications that run directly on the blockchain. This architecture is designed not only to meet today’s automation needs but also to support future self-analyzing and pattern-discovering systems.

Strategies

Strategies are defined through Python-based applications that include:

- Decision-making rules

- Risk parameters

- Market-condition-sensitive models

Over time, this framework will evolve into more adaptive and autonomous strategies.

Wallets

Almanak uses non-custodial wallets built on Safe and Zodiac infrastructure. User funds are never held by the platform. Users only delegate specific permissions to smart contracts, while full control of the assets always remains with the user.

Vaults

The Vault structure enables successful strategies to be tokenized. Through these vaults, users can:

- Scale their strategies by raising capital

- Earn management and performance fees

- Allow other investors to participate in the strategy

These vaults operate fully on-chain, permissionlessly, and asynchronously.

Almanak’s Technology Infrastructure

Almanak features a multi-layered technology stack designed for enterprise-grade security and performance:

- Safe-based secure wallet infrastructure

- High-performance Python execution environment

- Fine-grained permissioning with Zodiac

- Privacy-focused strategy management

- Cross-chain broad protocol integration

- Next-generation AI agent capabilities

All of this is supported by Trusted Execution Environment (TEE) technology, ensuring sensitive data is processed in an isolated and tamper-proof environment.

The Era of Creating Quant Strategies Without Writing Code

One of Almanak’s most distinctive features is its no-code infrastructure. Users simply describe their strategy ideas, and the platform’s AI agents automatically perform the following steps:

- Code & Debug: Strategy is described → production-grade code is generated

- Backtest: Tested across tens of thousands of Monte Carlo scenarios

- Optimize: Risk and return parameters are improved

- Risk Management: Continuous monitoring and hedging mechanisms are established

- Deploy: Live deployment in a non-custodial environment

- Monitor: Real-time performance tracking

This reduces development cycles that once took months in hedge funds to just minutes.

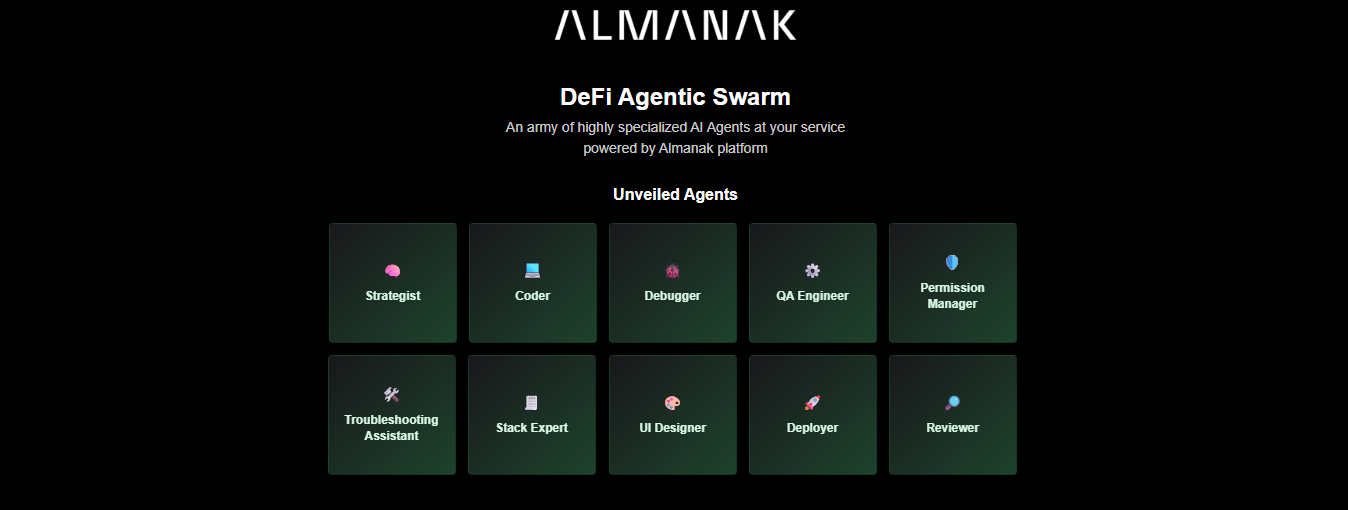

Agent Swarm and Quant Technology Stack

At the heart of Almanak is an Agent Swarm composed of multiple AI agents. These agents collaboratively handle research, coding, testing, optimization, risk management, and deployment processes. The platform also provides:

- Advanced simulators

- Backtesting engines

- Permission-controlled smart accounts

- Vault-based execution system

delivering a full-fledged institutional-grade quantitative trading infrastructure.

Almanak Games and The Pledge Movement

Almanak launched its token through a gamified on-chain model rather than traditional methods. This model consists of two main components:

Almanak Games

Almanak Games is an on-chain trading and liquidity competition running from mid-December to the end of January. Participants can:

- Acquire $ALMANAK

- Hold tokens

- Provide liquidity

- Run automated strategies

All actions are performed exclusively through Almanak Safe Wallets and are rewarded based on performance.

The Pledge Movement

The Pledge Movement is a voluntary community commitment. Users pledge to hold a certain percentage of their $ALMANAK tokens in the same wallet until year-end. This system:

- Grows reward pools

- Strengthens launch stability

- Increases community alignment

There is no lock-up, no cost, and users can withdraw their pledge at any time.

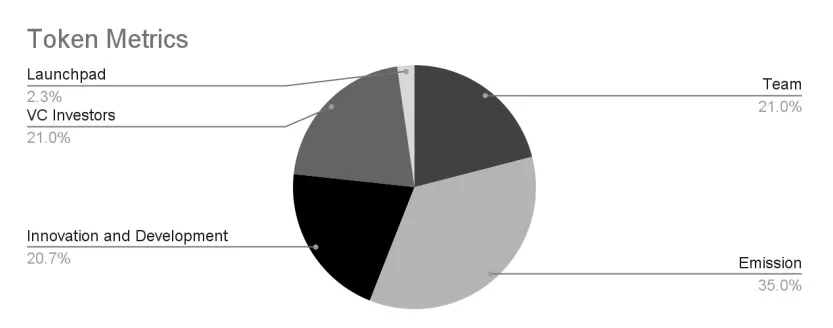

ALMANAK Tokenomics

ALMANAK token distribution is as follows:

- Emissions: 35%

- Team: 21%

- VC Investors: 21%

- R&D and Innovation: 20.7%

- Launchpad: 2.3%

This structure balances sustainable development with investor incentives.

Investors and Partners

Almanak is supported by a strong network of crypto funds and Web3 infrastructure providers. The investors and partners behind the project clearly demonstrate its global growth ambitions:

- Hashkey Capital

- Matrix

- NEAR

- Rockaway

- Sparkle Ventures

- AppWorks

- Artemis Capital

- Bankless Ventures

- Delphi Labs

Almanak Team

Almanak is backed by a strong founding team with expertise in both technology and finance. The team consists of specialists in artificial intelligence, infrastructure engineering, and quantitative finance.

- Michael Herzyk – Co-Founder & CEO

- Lars Suanet – Co-Founder & CTO

- Lukas Napiorkowski – Co-Founder

- 0xAgentKitchen – Head of AI

This team forms the core that shapes both the technical strength and long-term vision of Almanak.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.