The crypto world has undergone a rapid transformation in recent years; however, the most critical gap of this transformation still hasn’t been fully closed: a true blockchain-based banking infrastructure.

Today, millions of users invest in digital assets, actively use stablecoins, and explore decentralized finance (DeFi). Despite this, we still have to turn to traditional banks when applying for a mortgage, the Visa–Mastercard ecosystem dominates daily payments, and the credit infrastructure is still almost entirely controlled by centralized entities.

Avici (AVICI) is a project designed to fill exactly this gap, aiming to become the true “crypto neobank” of the internet era. Avici is building a next-generation financial infrastructure supported by smart contracts, bringing fiat and crypto under a single roof while giving users full ownership of their assets.

In short, Avici is not trying to “rethink” banking — it’s trying to rebuild it from scratch.

What Is Avici? What Does It Aim For?

The goal of Avici DAO is to combine Bitcoin’s ideal of “money independent from central authorities” with the needs of modern finance.

Although Bitcoin is now a global asset class exceeding a trillion dollars, it still isn’t used as a fully decentralized bank in everyday life. Even though stablecoins have millions of users, traditional institutions are still needed for areas such as credit, mortgages, and business financing.

Long-term goals include:

-

Enabling millions of businesses to accept stablecoins

-

Developing an on-chain credit infrastructure

-

Bringing identity verification and credit scoring onto the blockchain

-

Reducing the influence of central banks

-

Creating an ecosystem where people can fully sustain their lives with on-chain assets

For this reason, the company is starting with a credit card and internet banking infrastructure that allows users to easily spend with crypto, and then aims to expand this system to larger financial products such as loans, borrowing, and mortgages.

Products and Ecosystem

The project rebuilds many services offered by traditional banks with an internet-native and self-custody approach. The main products offered by the platform are:

1. Avici Credit Cards (Visa Supported)

The company provides Visa credit cards issued by Rain to its users. These cards stand out as one of the easiest ways to convert crypto assets into spending.

Key features:

-

Spend with crypto, no sale required

-

Apple Pay and Google Pay integration (Tap to Pay)

-

Physical card option

-

Full self-custody model

-

Zero transaction limits

-

Easy verification and high security

When a user deposits USDC into the card, collateral is created in a smart contract, and the card issues a USD credit limit against it. When spending occurs, the corresponding amount is automatically sent from the smart contract to Visa.

The card infrastructure is designed to be entirely self-custody. This means Avici, Rain, or Visa do not control user funds; they only process the spending transaction according to the smart contract.

2. Avici Virtual Bank: USD and EUR Virtual Bank Accounts

USD and EUR accounts that function like traditional bank accounts are available within the Avici app.

Through these accounts, users can:

-

Receive fiat transfers such as salaries, freelance payments, or wire transfers

-

Have incoming fiat automatically converted into USDC

-

Then use it within the Avici wallet

This feature enables crypto users to perform on-ramps without relying on banks for the fiat side. Avici also plans to activate these accounts for off-ramps soon.

3. Avici Smart Wallet: Smart Contract Wallet

The Avici Wallet is a smart wallet created using Zerodev. There is no traditional seed phrase; security is ensured through social login, biometric approval, and passkey mechanisms.

Key features of the wallet:

-

Smart contract-based security

-

No seed phrase, no risk of loss

-

Multi-factor authentication

-

Social recovery mechanism

-

Supports Solana and EVM networks

-

Avici’s own gas sponsor relayer

Gas fees on EVM are covered by Avici, except on the Ethereum mainnet. On Solana, users get 5 free transfers per day.

4. Avici Earn and Upcoming Products

Avici aims to expand its credit and borrowing infrastructure. In the future, the platform plans to offer:

-

On-chain credit scores

-

Mortgage-type long-term loans

-

Global credit marketplace

-

Privacy-focused on-chain transactions

These will provide users with advanced financial products.

How Do Avici Credit Cards Work?

The system is quite simple and completely transparent:

-

The user deposits USDC.

-

This USDC is locked into a smart contract called Loan Escrow.

-

A USD credit limit is created equivalent to the deposited amount.

-

When the user spends, the card balance decreases.

-

An equivalent amount of USDC is transferred from the smart contract to Visa.

Avici or any other institution does not have ownership rights over this collateral; only the amount spent can be withdrawn.

The card can be used at more than 100 million merchants that accept Visa.

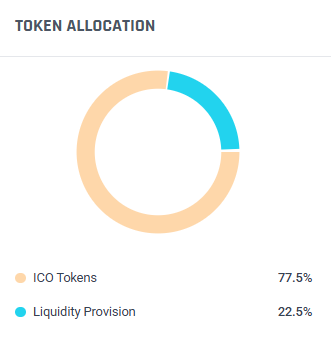

Avici (AVICI) Tokenomics

Avici’s total token supply is set at 12.9 million AVICI.

Distribution:

-

10 million AVICI – ICO (77.5%)

-

2.9 million AVICI – Liquidity (22.5%)

-

0 – Team allocation (may be determined later by community decision)

Liquidity distribution:

-

2 million tokens – Futarchy AMM

-

900,000 tokens – Meteora Pool

The project team prefers long-term incentives to be determined by the community.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.