Bitcoin, the pioneer of cryptocurrencies, stands unrivaled in terms of security and decentralization. However, it faces challenges like limited transaction throughput and a lack of programmability. Enter Bitlayer (BTR), an innovative Layer 2 solution designed to overcome these limitations while preserving Bitcoin’s core strengths. In this article, we’ll explore what Bitlayer is, the role of the BTR token, its visionary roadmap, and how it’s transforming the Bitcoin ecosystem with groundbreaking advancements.

What is Bitlayer?

Bitlayer is a pioneering Layer 2 platform built specifically for Bitcoin, integrating the robust security of Bitcoin’s base layer with the programmability of the Ethereum ecosystem. Leveraging the BitVM framework, Bitlayer introduces the first rollup solution tailored for Bitcoin, enabling developers to create sophisticated smart contracts and decentralized applications (dApps) that were previously unfeasible on Bitcoin’s native framework. With full compatibility with the Ethereum Virtual Machine (EVM), Bitlayer allows seamless migration of Ethereum-based applications, making it a bridge between Bitcoin’s security and Ethereum’s flexibility.

Far more than just a scaling solution, Bitlayer redefines Bitcoin’s potential by unlocking opportunities in decentralized finance (DeFi), trustless systems, and scalable infrastructure. The BTR token serves as the backbone of this ecosystem, driving governance and incentivizing participation.

Challenges Bitlayer Addresses

Despite Bitcoin’s dominance in security and decentralization, it faces inherent limitations that Bitlayer tackles head-on:

-

Limited Transaction Capacity and High Fees

Bitcoin’s main chain prioritizes security, resulting in low transaction throughput (a few transactions per second) and high fees, making microtransactions impractical. Bitlayer’s rollup technology significantly boosts transaction capacity while reducing costs, enabling high-volume, low-cost transactions. -

Lack of Programmability

Bitcoin’s restrictive scripting language cannot support complex smart contracts, hindering the development of modern DeFi protocols or automated trading systems. Bitlayer introduces Turing-complete programmability, offering developers the flexibility akin to Ethereum. -

Absence of Trustless Bridges

Bitcoin lacks native mechanisms for trustless interoperability with other blockchains. Current bridging solutions often rely on centralized custodians or multisig setups, introducing security risks. Bitlayer’s BitVM Bridge provides a decentralized, trust-minimized solution for cross-chain asset transfers. -

Developer Accessibility Barriers

Bitcoin’s complex scripting system poses a steep learning curve for developers. By offering EVM compatibility, Bitlayer enables Ethereum developers to use familiar tools like Solidity, lowering the entry barrier and fostering innovation.

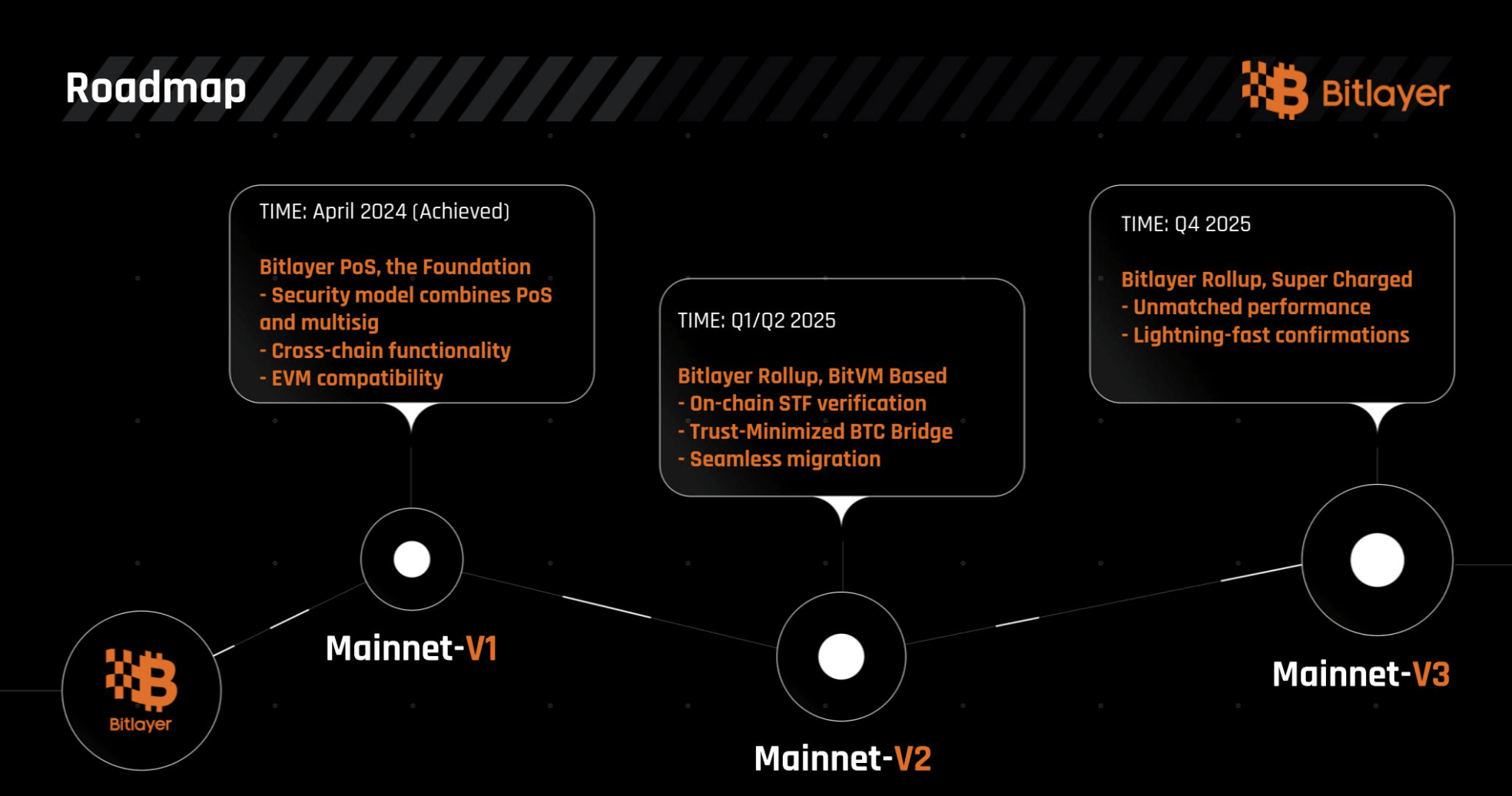

Bitlayer’s Vision and Roadmap

Bitlayer’s mission is to scale Bitcoin while upholding its core principles of security and decentralization. The platform aims to transform Bitcoin from a store of value into a robust infrastructure for decentralized finance (BTCFi) and innovative applications. Here’s an overview of Bitlayer’s roadmap:

1. First Phase: Bitlayer PoS (Mainnet V1) – April 2024

Launched in April 2024, Bitlayer’s first phase combines Proof of Stake (PoS) with multisignature (multisig) technology to ensure robust security. With full EVM compatibility, developers and users can seamlessly build and interact within a Bitcoin-based ecosystem. Cross-chain functionality enables asset transfers between Bitcoin, Ethereum, and other networks. This phase is complete, with a testnet available for experimentation.

2. Second Phase: Bitlayer Rollup (Mainnet V2) – Q1/Q2 2025

Bitlayer will evolve into a Bitcoin-native rollup powered by BitVM, fully inheriting Bitcoin’s security. The BitVM Bridge will enable trust-minimized cross-chain transfers, and Layer 2 state transitions will be verified on Bitcoin’s main chain. Applications will transition seamlessly from the PoS phase to the rollup architecture.

3. Third Phase: Supercharged Rollup – Q4 2025

In this phase, Bitlayer will achieve a staggering 20,000 transactions per second (TPS), making it ideal for high-volume applications. Transactions will receive soft confirmations in just 3 seconds, delivering a near-instant user experience. Combined with Bitcoin’s security, this positions Bitlayer as a leading solution for enterprise-grade applications.

BTR Token: Powering the Ecosystem

The BTR token is the native currency of the Bitlayer ecosystem, with a total supply of 1 billion tokens. It serves two primary functions:

-

Ecosystem Incentives: BTR rewards participants, including developers, users, and partners, fostering growth and engagement within the ecosystem.

-

Governance: BTR holders can vote on proposals and influence platform parameters, ensuring a decentralized and community-driven structure.

Tokenomics Breakdown

Bitlayer’s token distribution is designed to support sustainable growth:

-

80% is allocated for liquidity and smart contract execution.

-

15% supports ecosystem development, marketing, and community initiatives.

-

5% is reserved for advisors and exchange listings.

This structure ensures BTR maintains its value while driving the ecosystem’s expansion.

Bitlayer’s Technical Features

Bitlayer combines Bitcoin’s security with Ethereum’s versatility through a range of innovative features:

-

EVM Compatibility: Ethereum applications can be seamlessly ported to Bitlayer.

-

BitVM Bridge: Enables trust-minimized transfers of Bitcoin assets across chains.

-

Bitcoin-Equivalent Security: Layer 2 state transitions are verified on Bitcoin’s main chain using BitVM-based proofs.

-

Flexible Data Availability: Users can choose between Bitcoin-native or third-party data availability solutions.

Bitlayer vs. Ethereum: A Comparison

Bitlayer and Ethereum offer distinct advantages. Here’s how they stack up:

-

Gas Fees: Bitlayer uses BTC as its gas token, leveraging innovative mechanisms to keep costs low. Ethereum’s gas fees fluctuate with network demand, often becoming expensive during peak times.

-

EVM Support: Bitlayer supports EVM features up to the Cancun update (excluding certain opcodes), while Ethereum offers full EVM support.

-

Solidity Versions: Bitlayer supports Solidity up to v0.8.28, whereas Ethereum supports the latest Solidity versions.

Bitlayer’s combination of Bitcoin’s security and low-cost transactions makes it an attractive alternative for developers and users.

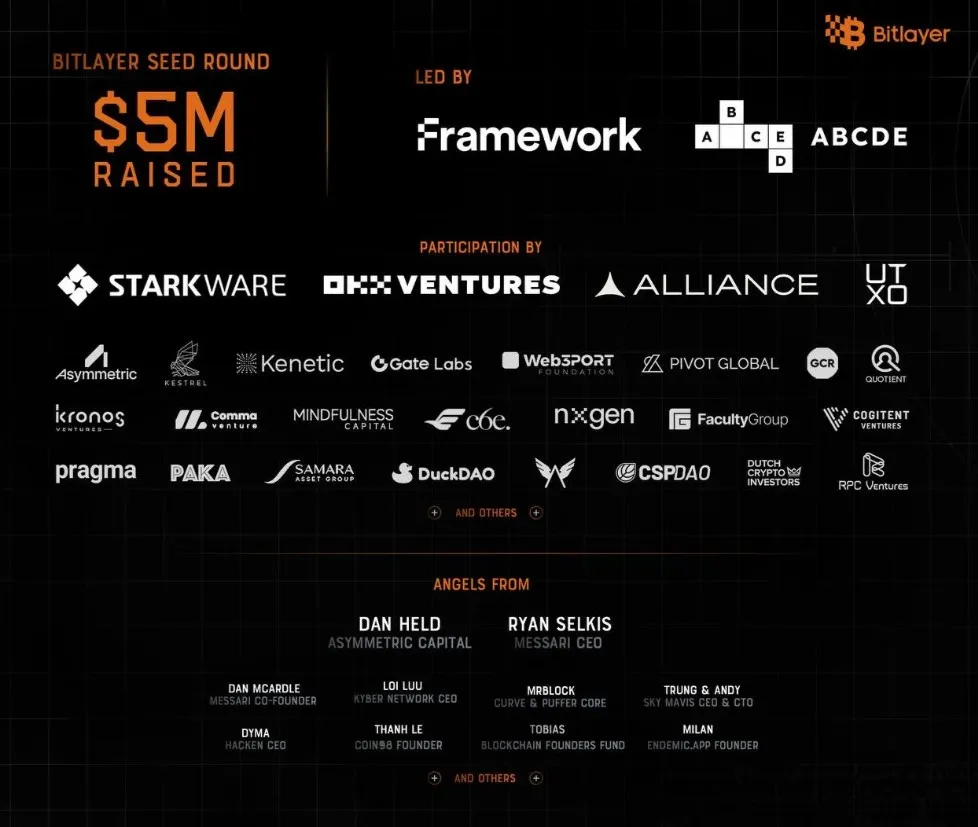

Bitlayer’s Investors

Bitlayer is backed by a robust group of investors, including OKX Ventures, StarkWare, Alliance, UTXO, Asymmetric, Kesrel, Kenetic, Gate Labs, Web3Port Foundation, Pivot Global, GCR, Quotient, Kronos Ventures, Comma Ventures, Mindfulness Capital, NxGen, Faculty Group, and more. This strong investor base underscores the project’s credibility and potential.

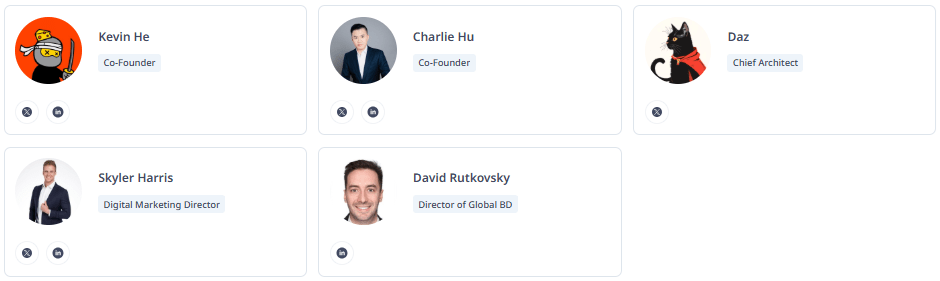

Bitlayer Founding Team

Bitlayer is driven by a talented team with deep expertise in blockchain technology. Kevin He and Charlie Hu (Co-Founders) lead the project’s vision, while Daz (Chief Architect) oversees the technical infrastructure. Skyler Harris (Digital Marketing Director) and David Rutkovsky (Director of Global Business Development) drive Bitlayer’s global outreach and growth.

Official Links

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.