Canton Network is an open-source Layer-1 blockchain designed for financial institutions (TradFi), prioritizing privacy and scalability. The network connects different financial systems, enabling secure, compliant, and privacy-focused digital transactions for real-world assets (RWA). Key features include real-time synchronization, atomic cross-application transactions, and customizable privacy controls.

Team & Founders

Canton Network is developed by the blockchain company Digital Asset.

-

Yuval Rooz: Co-founder & CEO

-

Eric Saranieki: Co-founder

-

Shaul Kfir: Co-founder

Investors & Notable Partners

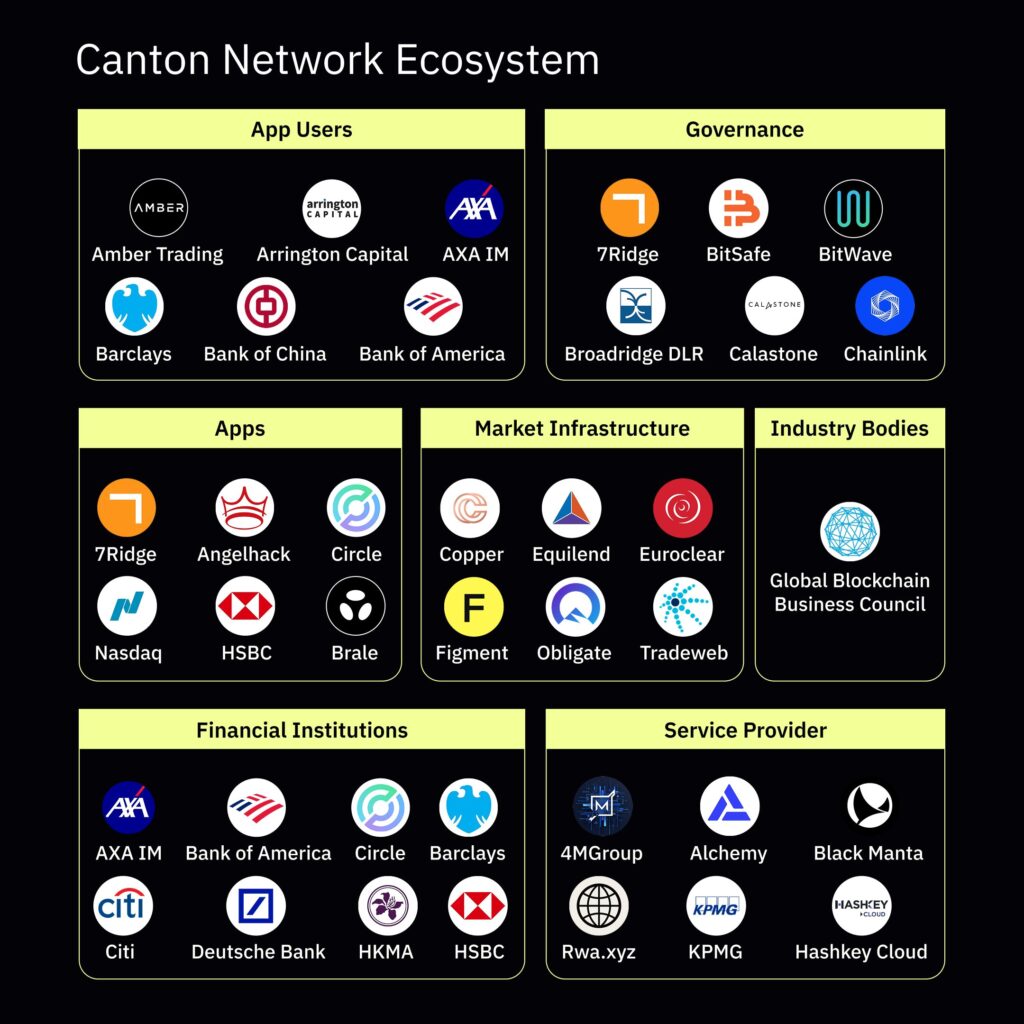

Canton Network has raised $135 million. Key investors and partners include:

-

Traditional Finance: Goldman Sachs, BNP Paribas, Citadel Securities, Tradeweb Markets, DTCC, IMC, Optiver, Microsoft, Chainlink Labs

-

Crypto & Blockchain: Polychain Capital, Circle Ventures, Paxos

-

Leadership Investors: DRW Venture Capital, Tradeweb Markets

These partnerships enhance the project’s credibility and institutional adoption.

Project Idea

Canton Network enables secure, privacy-focused transactions of financial assets digitally. It simplifies data sharing and asset transfers between institutions while allowing synchronized financial operations without a central intermediary.

The network emphasizes privacy, control, and compliance in corporate payments using stablecoins and tokenized cash. It provides 24/7 liquidity, institutional scalability, and regulatory compliance for banks, fintech companies, and payment providers.

How It Works

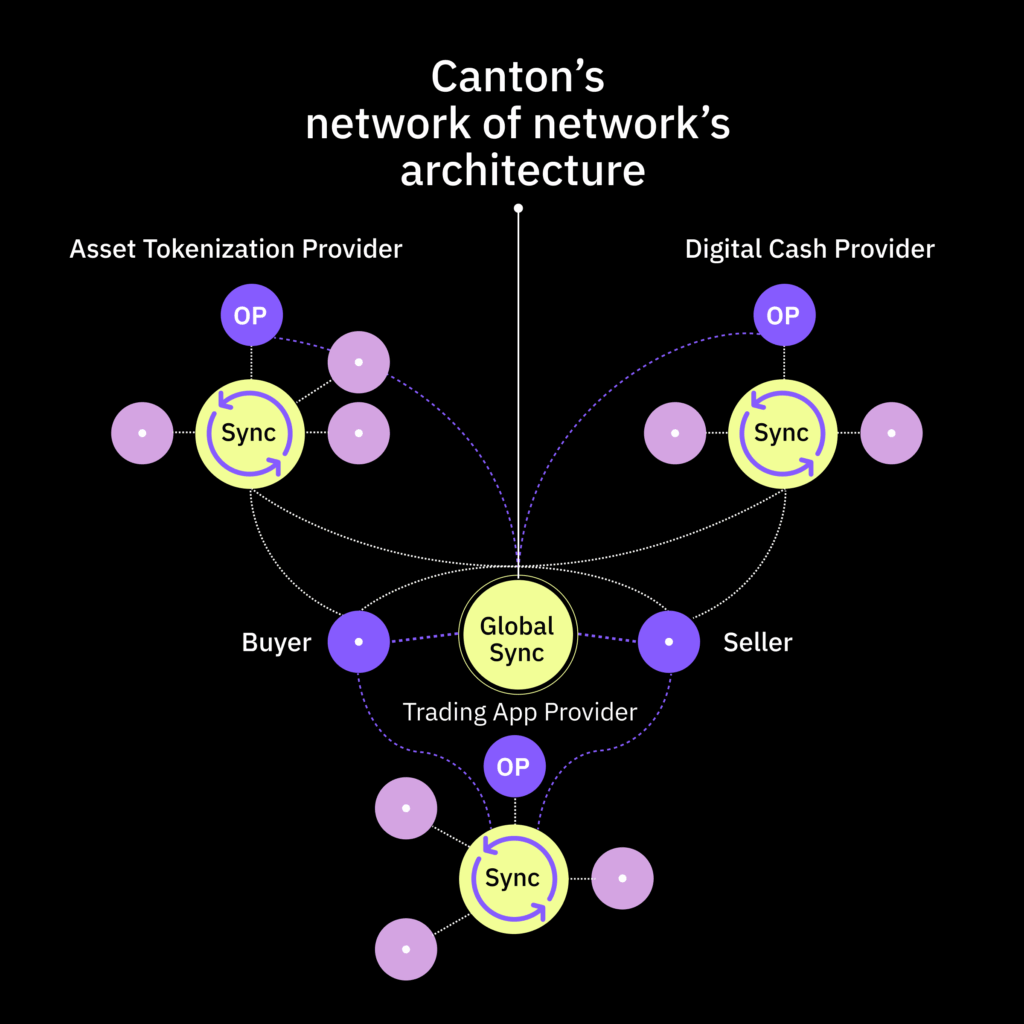

Canton Network operates via a “Network of Networks” architecture, connecting independent sub-networks called sync domains. Applications are built in the Daml language with programmable privacy. Validators only see, verify, and store transactions they are involved in. The Global Synchronizer enables atomic transactions across applications, and fees are paid in Canton Coin (CC). Each application scales independently, reducing congestion and high fees.

-

Sync domains define their own consensus and data policies.

-

Validators validate only their involved transactions; data is segmented and shared only with authorized participants.

-

The Global Synchronizer ensures interoperability between applications and tokens.

Governance

Canton Network features a decentralized governance model.

-

Canton Foundation ensures transparent and neutral operation of the Global Synchronizer.

-

Sync domains set their governance rules while the Global Synchronizer maintains overall network harmony.

Roadmap

-

2023: Network announcement & launch

-

2024: Pilot projects with Euroclear, World Gold Council, Clifford Chance

-

2025+: Expansion of validator & app provider rewards, accelerate app development and adoption

-

5-year horizon: App reward share rises to 62%, Super Validator share reduces to 20%

Canton Coin (CC)

Canton Coin is the native utility token of the Global Synchronizer, supporting tokenized real-world assets and on-chain capital markets while offering configurable privacy controls.

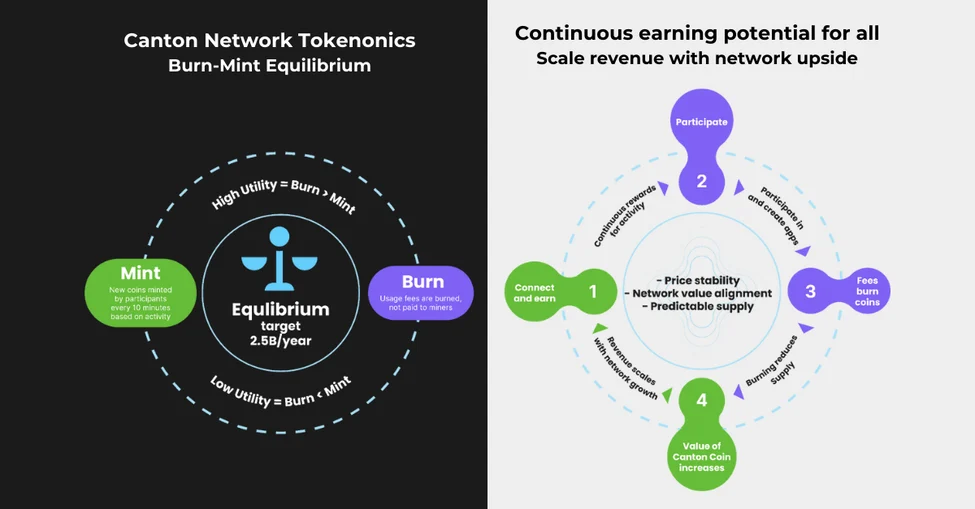

Ways to Earn Tokens:

-

Run the Global Synchronizer → Super Validator rewards

-

Run a full node → Validator rewards

-

Run applications or services → App provider rewards

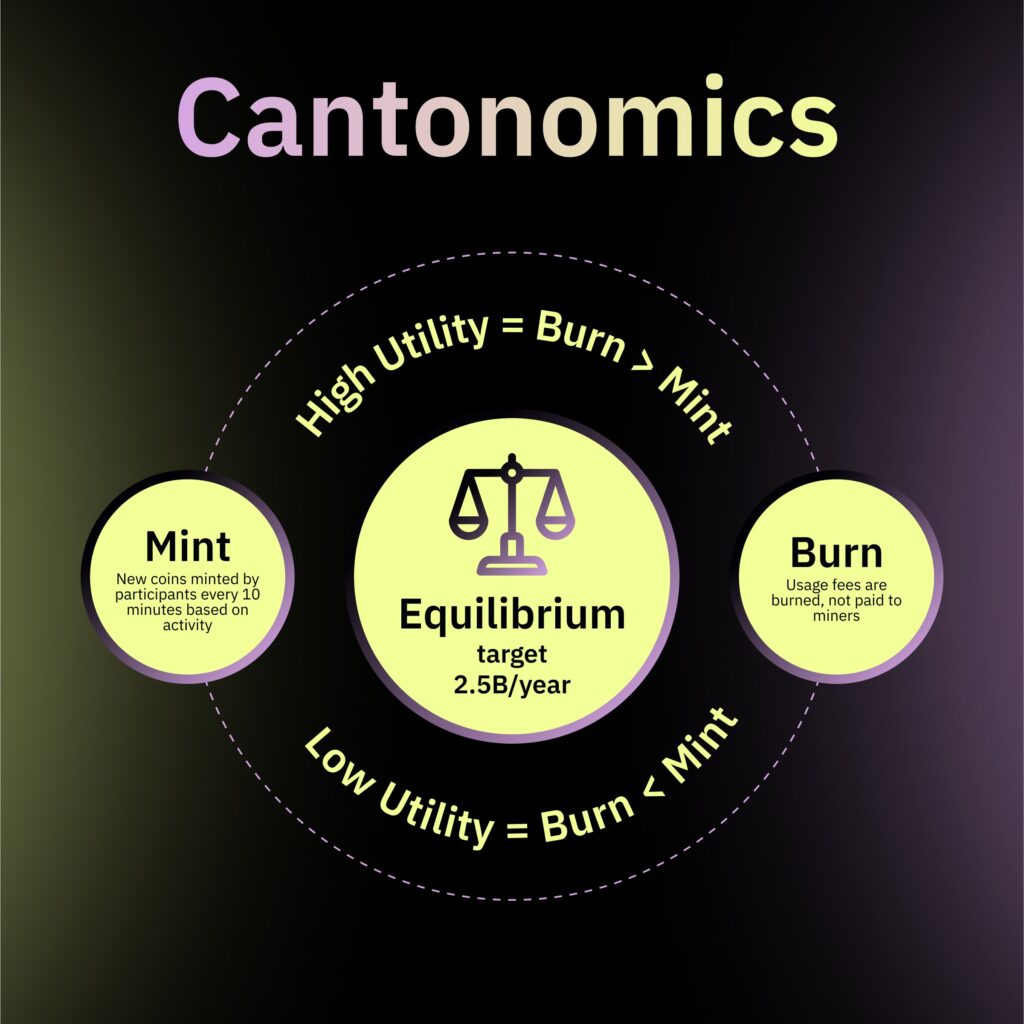

Tokens are distributed according to a mining curve, with burn-mint equilibrium balancing token value against network utility.

Tokenomics & Use Cases

-

Token Name: Canton Coin (CC)

-

Function: Network security, transaction fees, incentives

-

Distribution Model: Fair launch, no pre-mine or VC allocation

-

Total Supply: 32.64B CC

-

Max Supply: Unlimited (∞)

-

Reward Distribution: Super Validators initially high, gradually shifting to app providers (target: app 62%, super validator 20%)

Token Uses

-

Pay fees for the Global Synchronizer & apps

-

Incentivize validators and app providers

-

Optional app payments in CC

-

Increase network transparency

Ecosystem

The ecosystem includes financial institutions, tech providers, and regulators. Applications like Hashnote USYC, Brale, and QCP use the Global Synchronizer for privacy-focused tokenized financial solutions.

Real-World Applications

-

Hashnote USYC: Tokenized money market instrument with private transfers for collateral and yield management

-

Brale: Converts large stablecoins into network-specific equivalents for private corporate payments

-

QCP: Margin management solutions for private trading

Key Features

-

Privacy & Compliance: Only parties involved see transaction data; regulatory-compliant

-

Interoperability: Atomic transactions across apps via Global Synchronizer

-

Scalability & Flexibility: Independent scaling of applications via Network of Networks

-

RWA-Focused: Proven tokenization of real-world assets

-

Tokenomics: Fair launch & burn-mint equilibrium