Copper is not only one of the oldest known metals in human history but also one of the most strategic raw materials in today’s global economy. As an indispensable input for many core sectors such as electricity, energy, industry, technology, and infrastructure, copper goes far beyond being just an industrial metal. For this reason, copper is considered one of the most important indicators used to understand the direction of economic activity.

Today, copper prices are directly linked to global growth expectations, industrial production, energy transition, and infrastructure investments. In this regard, this valuable metal is a closely monitored commodity both in the real economy and in financial markets.

In this guide, you can find detailed and straightforward answers to questions such as what copper is, where it is used, why it is so closely related to economic growth, and how to buy copper.

What is Copper?

Copper, symbolized as Cu in the periodic table, is a soft, easily shapeable metal with high electrical and thermal conductivity. Its ability to be drawn into wires, forged, and used in the production of various alloys makes this metal extremely valuable from an industrial perspective.

It ranks second after silver in terms of electrical conductivity. Thanks to this property, it is one of the fundamental building blocks of the energy and electronics sectors. Its resistance to corrosion also makes it an ideal material for long-lasting infrastructure projects.

These physical properties are directly connected to economic activity. As production, investment, and infrastructure spending increase, demand rises; during periods of economic slowdown, demand generally weakens. For this reason, copper has a strong correlation with economic cycles.

Where is Copper Used?

The wide range of copper’s applications clearly demonstrates why this metal is critical for the global economy.

Construction and Infrastructure

- Electrical installations

- Water and heating systems

- Indoor and outdoor infrastructure solutions

Increases in housing and infrastructure investments play a major role in driving demand.

Industry and Manufacturing

- Industrial machinery

- Electric motors and generators

- Wiring and connection systems

- Alloys such as bronze and brass

Industrial production is one of the main sources of demand.

Energy Sector

- Power generation plants

- Electricity transmission and distribution lines

- Solar and wind energy infrastructure

The rise in renewable energy investments has turned it into a strategic energy metal.

Technology and Electronics

- Electronic circuits

- Computer hardware

- Telecommunications infrastructure

The growth of digitalization and data infrastructure also keeps demand consistently strong.

Automotive and Transportation

- Traditional internal combustion vehicles

- Electric vehicles

- Rail systems and public transportation infrastructure

Especially electric vehicles use significantly more copper than traditional vehicles. This situation increases the strategic importance of this metal for the future.

Why is Copper Considered the “Thermometer of the Economy”?

In the financial world, it is often referred to as “Dr. Copper.” This concept is based on the assumption that copper can “diagnose” the direction of the economy.

The logic is quite simple:

- When the economy grows → industrial and infrastructure investments increase → copper demand rises

- When the economy slows → production and investments decrease → copper demand falls

For this reason, prices can provide leading signals regarding global growth expectations. Although it is not always a perfect indicator, it is accepted as one of the commodities with the strongest correlation to economic cycles.

How to Buy Copper?

Methods for Investing in Copper

There are various methods with different risk and return profiles for those who want to invest in copper.

Mining Stocks

Investment can be made in the shares of companies that extract or process copper. This method depends not only on prices but also on the company’s financial performance.

Notable global companies:

- Freeport-McMoRan (FCX)

- Southern Copper (SCCO)

- Rio Tinto (RIO)

- BHP Group (BHP)

- Vale (VALE)

ETFs and Investment Funds

ETFs and funds that track copper prices or industrial metals provide access to this market without being tied to a single company. They offer diversification advantages.

Futures Contracts (Futures Markets)

Leveraged trading can be done with futures contracts. Positions can be taken for both rising and falling expectations. However, due to leverage, the risk level is high.

Forex (CFD)

In the forex market, transactions are carried out based on price differences without physical delivery. It is suitable for investors who make short-term trades and want to take advantage of volatility.

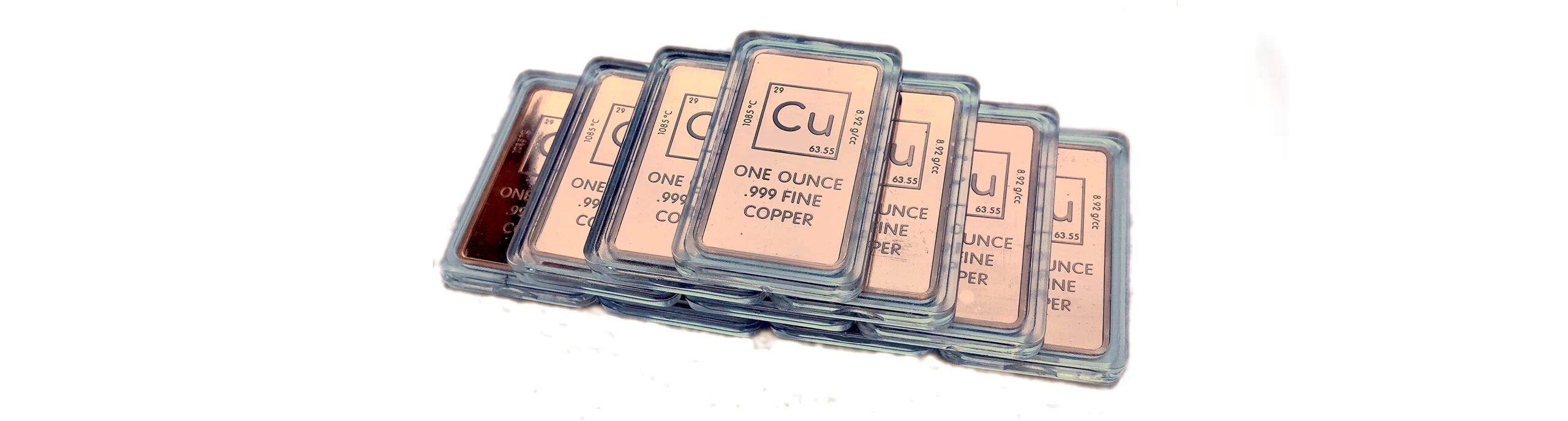

Physical Copper

Purchase of ingots or scrap is possible. However, due to storage costs, low liquidity, and buy-sell spreads, it is generally not preferred by individual investors.

Things to Know Before Investing in Copper

- Global economic data should be closely monitored

- Industrial production data from major economies such as China and the US directly affect prices

- Energy transition and infrastructure investments determine long-term demand

- Leveraged transactions carry high risk and require experience

This content does not constitute investment advice in any way. Markets involve high risk, and it is important to conduct your own research before making investment decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.