Cypher (CYPR) is an innovative blockchain protocol designed as a Web3 banking gateway for the digital age. Built on Base Chain, Cypher offers an open economic alternative to traditional credit card points and airline miles. It enables crypto management and staking across 18+ Ethereum, Tron, and Cosmos chains. This article explores what Cypher (CYPR) is, how it works, and the opportunities it provides in detail.

What is Cypher (CYPR)?

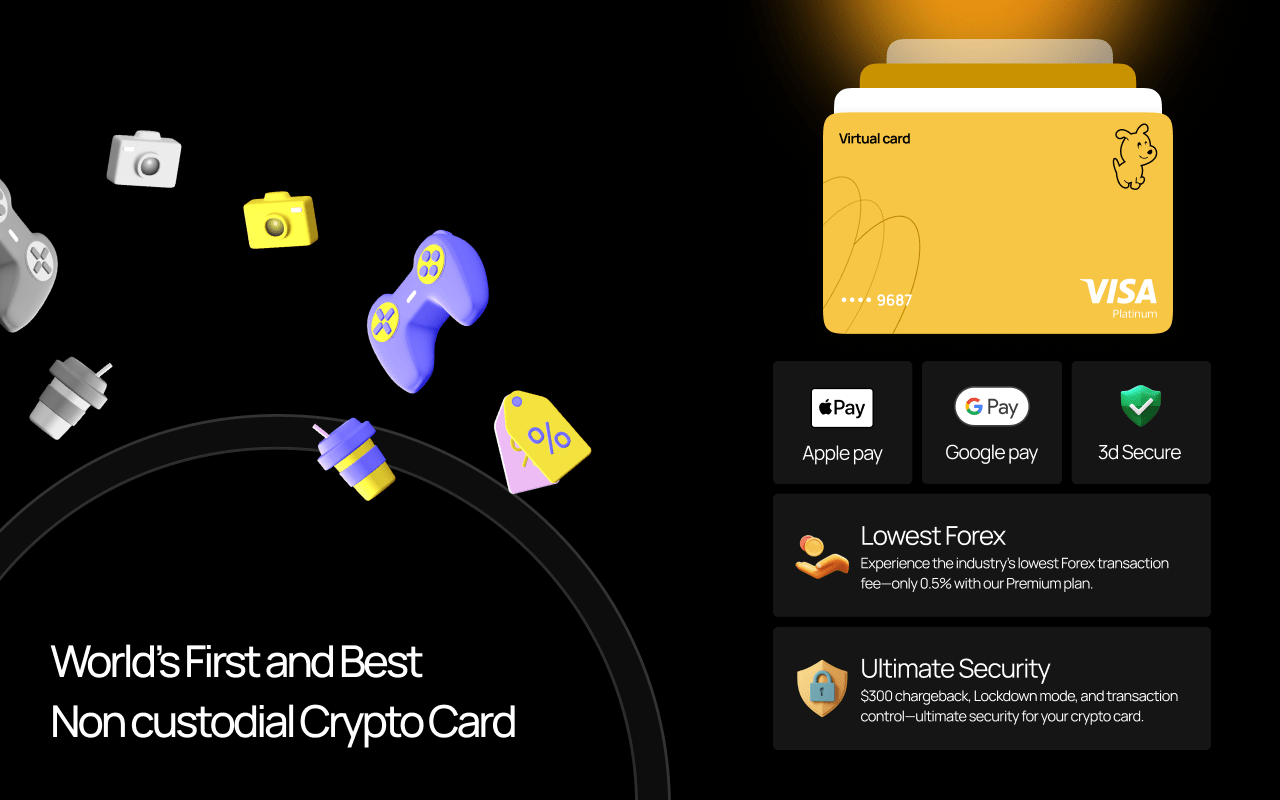

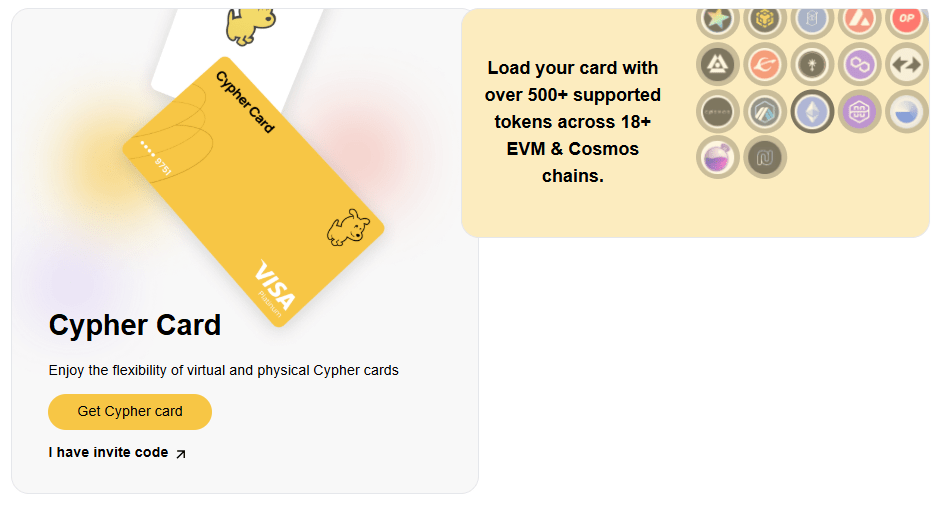

Cypher is a Web3 banking platform where users can manage 500+ tokens across 18+ EVM and Cosmos chains and make payments using virtual and physical Cypher Cards. It supports payments at over 40 million online and offline merchants with non-custodial wallets. Operating as a non-custodial crypto card product for over three years, Cypher introduces the CYPR protocol to create a rewarding ecosystem. Running on Base Chain, this protocol connects consumer behavior to on-chain governance with a transparent, community-driven reward system. The $CYPR token, with a fixed 1 billion supply, is used for governance and rewards.

Purpose of Cypher (CYPR)

Cypher addresses the opacity, centralized control, and limited redemption value of traditional reward systems. By linking consumer behavior to protocol mechanics, it rewards users through spending and governance. Merchants compete for user attention with better services and strategic incentives, creating a dynamic marketplace. $CYPR tokens are used for spending rewards, governance, and additional incentives, fostering a flywheel between brands, influencers, AI agents, and crypto card users. Long-term sustainability is ensured through a fixed supply, decaying emissions, and the low-cost Base Chain.

How Does Cypher (CYPR) Work?

Cypher operates through spending-based rewards, a referral system, and governance:

Flywheel Economic Model:

- Spending → Earn $CYPR: Users earn $CYPR tokens by spending within the Cypher ecosystem.

- $CYPR → Lock → Vote → Direct Emissions → Additional Rewards: Locking $CYPR (veCYPR) grants voting power to direct merchant emissions and earn extra rewards.

- Merchants → Add Bribes → Incentivize Voting: Merchants offer bribes (USDC, ETH, etc.) to attract votes; only voters receive bribe shares.

- DeFi Protocols → Provide Liquidity → Enhance $CYPR Utility: As $CYPR demand grows, DeFi liquidity providers deepen markets, supporting staking and yield farming.

Epoch Structure:

- Duration: 2-week cycles balance voting and reward distribution.

- Voting Period: veCYPR holders determine merchant reward allocations; votes are locked until the epoch ends.

- Distribution: Spending and referral rewards are distributed based on votes and spending.

Vote-Escrow (veCYPR):

- Maximum 2-year lock; voting power proportional to lock duration.

- Lifetime Lock: Constant voting power, cancelable (converts to 2-year decaying lock).

- Voting Power: (Locked Amount / Max Lock Duration) × Lock Duration; decays linearly.

Spending Rewards:

- Base Rewards: All users earn rewards proportional to spending; Premium users receive higher multipliers.

- Boosted Rewards: Merchants with more votes receive larger reward pools, distributed by user spending.

Referral Rewards:

- New users are rewarded on their first qualifying spend; rewards split between referrer and referee.

- Enhanced referral rewards go to voters whose referees spend at supported merchants.

Bribe Mechanism:

- Merchants offer bribes to attract votes; only veCYPR holders receive shares.

- Transparent, offered in various tokens (USDC, ETH); distributed by voting power.

Technical Infrastructure:

- Base Chain enables low-cost, scalable transactions.

- Chaos Labs Edge (primary) and Pyth Network (secondary) oracles; transitioning to pull model in April 2025.

- MrSablier open-source Rust Keepers manage liquidations and automated orders.

Cypher (CYPR) Use Cases

Cypher is used for:

- Crypto Spending: Payments at 40M+ merchants with Cypher Card.

- Governance: $CYPR for directing emissions and DAO voting.

- Rewards: Earn $CYPR through spending and referrals.

- Business Solutions: Team expense management and accounting integration with Gnosis Safe or Ledger.

Usage Steps:

- Obtain a Cypher Card and load it with 500+ tokens.

- Connect a wallet for online/offline payments.

- Stake/lock $CYPR for governance participation.

- Invite new users via referrals to earn rewards.

Advantages of Cypher (CYPR)

- Transparency: Open reward system, no centralized control.

- User Control: veCYPR enables governance and reward direction.

- Economic Returns: 100% revenue sharing, spending, and bribe rewards.

- Sustainability: Fixed supply, decaying emissions.

- Accessibility: 18+ chains, 500+ tokens, 40M+ merchants.

- Business Solutions: Web3-compatible tools for team expenses.

Risks of Cypher (CYPR)

- Centralization: Team controls vesting tokens initially.

- Market Volatility: $CYPR demand may be speculative.

- Regulation: Crypto cards and reward systems carry regulatory risks.

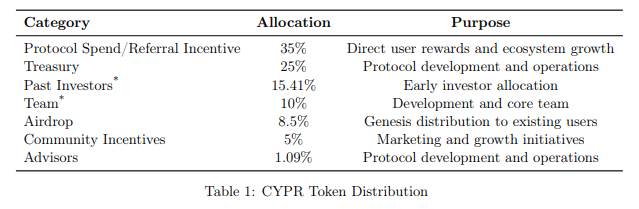

Cypher (CYPR) Tokenomics

Total Supply: 1,000,000,000 $CYPR (fixed, non-inflationary).

Distribution:

- Protocol Spend/Referral Incentive: 35% (20-year emission)

- Treasury: 25%

- Past Investors: 15.41% (12-month lock, 3-year linear vesting)

- Team: 10% (12-month lock, 3-year linear vesting)

- Airdrop: 8.5% (genesis distribution to existing users)

- Community Incentives: 5%

- Advisors: 1.09%

Cypher (CYPR) Backers

Cypher is supported by prominent backers, including Picus Capital, Prasanna Sankar, Balaji Srinivasan, Tribe, and Orange DAO.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest newsand updates.